The Quail Ridge and University District Real Estate Market faced a challenging year in 2024, reflecting broader trends across Kelowna.

Let’s take a closer look at some of the unique factors that shaped the market in this area last year.

Key issues which directly affected the Quail Ridge & University Real Estate Market in 2024.

- Provincial Government’s Short-Term Rental Changes Spring 2024: Affected the value of Pinnacle Pointe Condos as Owners could no longer take advantage of lucrative summer Air BnB style rentals.

- Higher interest rates affected the number of Parents purchasing University Condos and Townhomes – which especially affected the values of Academy Way Condos.

- Localised fire damage at Pinnacle Pointe from 2022: the completion of repair work, following the 2022 fire in some units in the 1875 Country Club Drive building, was not completed until the summer 2024, which hampered sales.

- Recent changes in Canadian government policies regarding International Student Visas: This impacted the number of international students attending UBC’s Okanagan campus in Kelowna. In September 2024, the federal government announced a reduction in the cap on international study permits, decreasing from 485,000 to 437,000 for the 2025/26 academic year. This policy shift contributed to a significant decline in international student enrollment at UBC Okanagan. As of September 26, 2024, the campus reported being 25% to 30% short of its conservative enrollment targets. International enrollment fell by almost half from its peak over the past two years Local Media Report . This affected rental demand.

- Speculation Tax continued to affect the number of Buyers traditionally attracted to the Quail Ridge Golf Course Community for vacation / second homes.

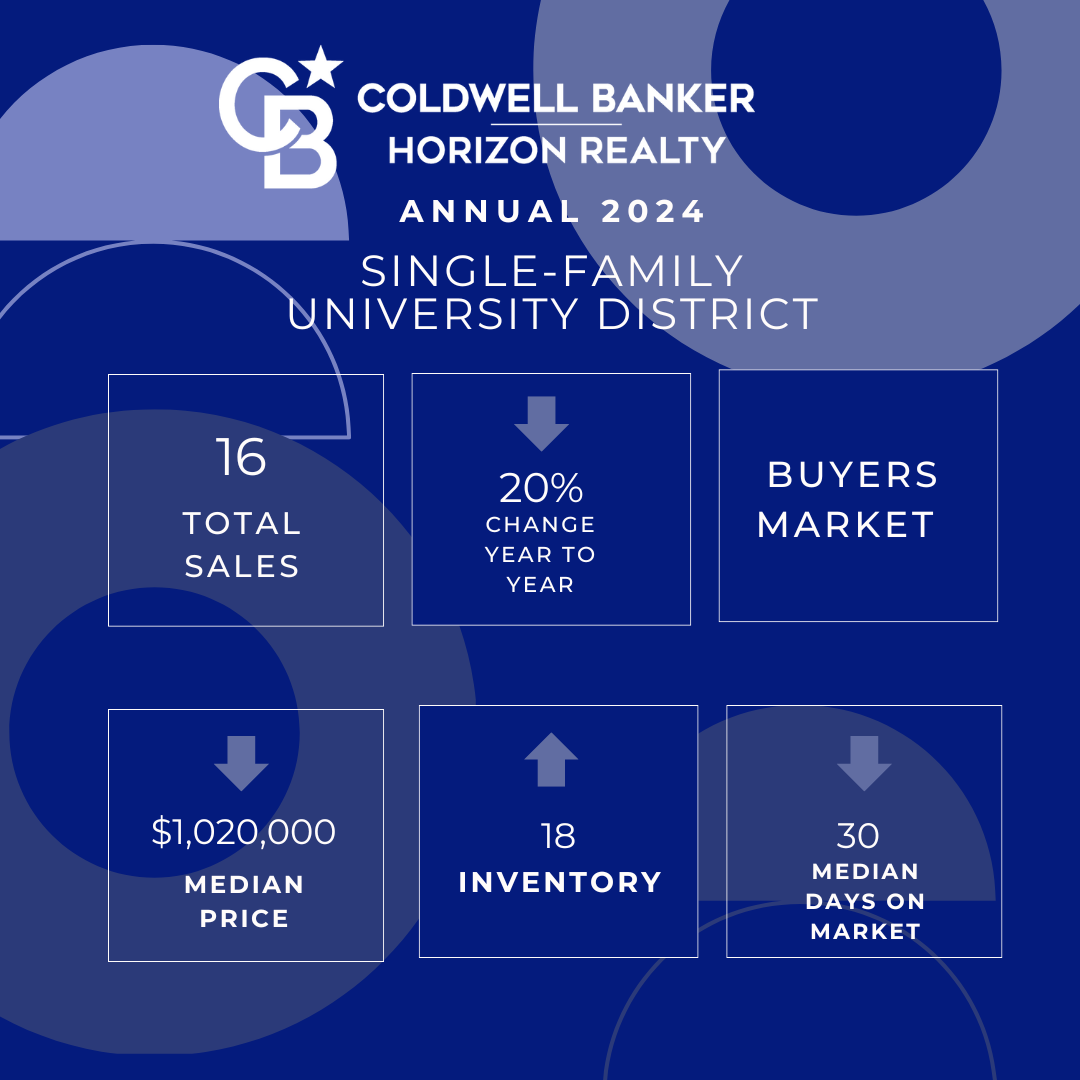

Single-Famly Homes Quail Ridge and University District

Sales: Total Single-Family home sales for 2024 were 16, compared to 20 in 2023. Down 20%.

Inventory & Months of Inventory: As of December 31, 2024, there were 18 homes listed compared to 7 at the end of December 2023. Up 257%. It remains a Buyer’s Market.

Median days on the market: 2024 is 30 days, compared to 38 days for 2023. This is a welcome improvement.

Median sale prices: Year-over-year, we have seen an 11% downward adjustment. The median price for single-family homes in 2024 was $1,020,000, down from the $1,146,550 median price recorded for 2023.

13 Sold in Quail Ridge and 3 Sold in the University Heights area, and 5 of these sales had suites.

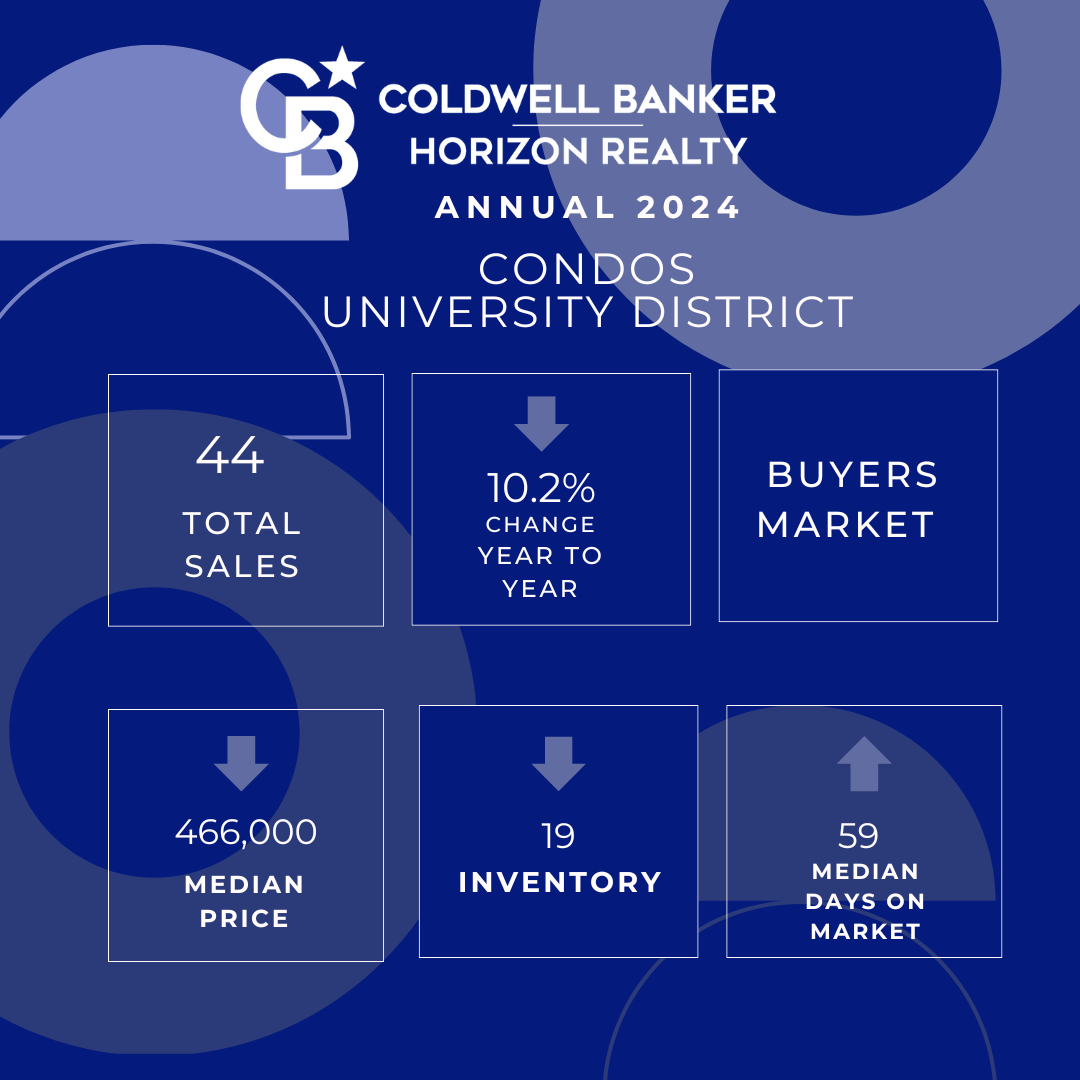

Condos Quail Ridge and University District September 2024

Sales: 44 sales during 2024, compared to 49 sales in 2023, down 10.2%

Sales: 44 sales during 2024, compared to 49 sales in 2023, down 10.2%

Inventory: As of December 31, 2024, there were 19 units listed compared to 21 at the same time in 2023. Listings peaked in June at 60, which was a 10-year high. It remains a Buyer’s Market.

Median days on the market: In 2024 Condos took longer to sell – 59 days, compared to 38 days in 2023.

Median sale prices year-over-year, we saw a 2.9% downward adjustment. The median price for Condos in 2024 was $466,000, down from the $480,000 median price in 2023.

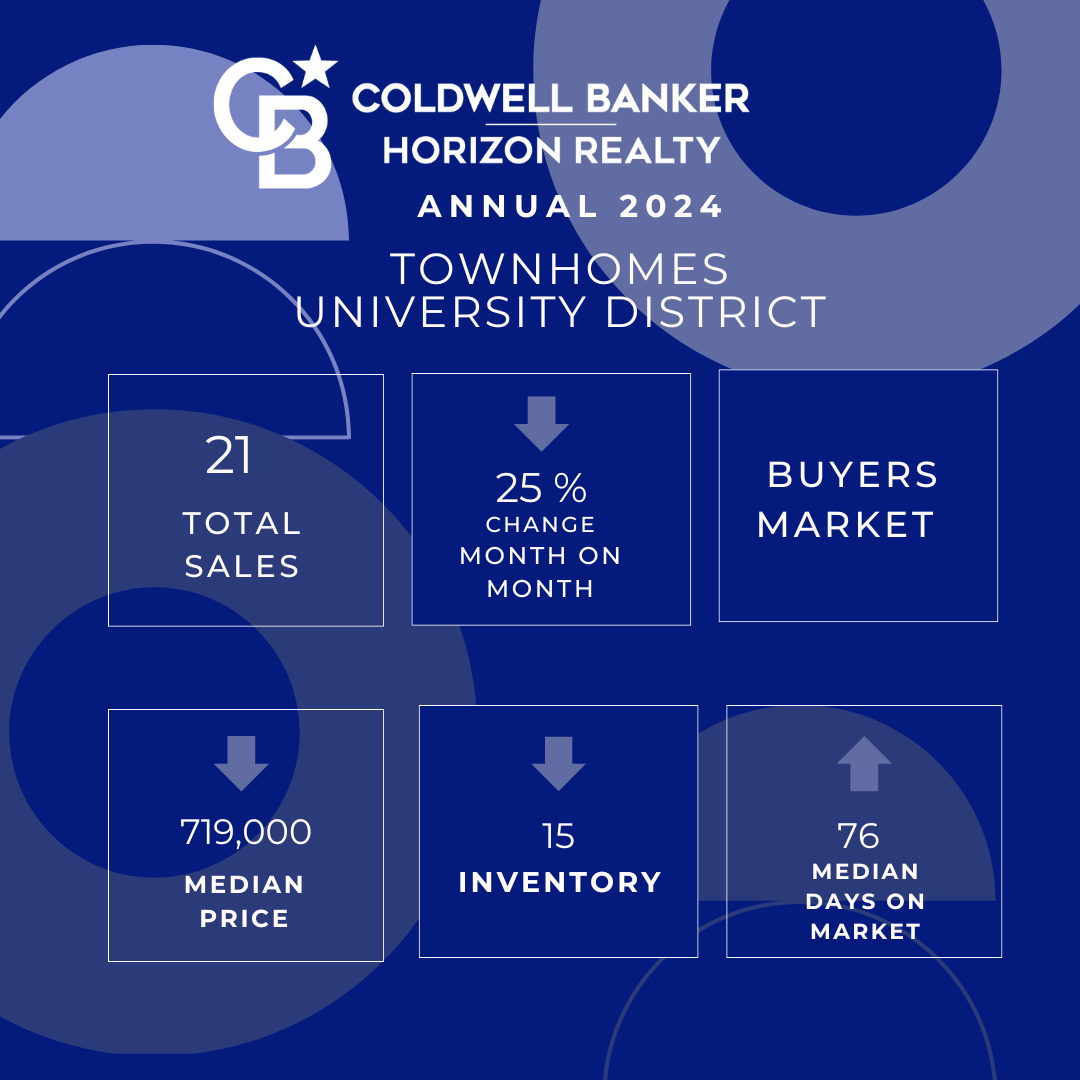

Townhomes Quail Ridge and University District 2024

Sales: 21 sales in 2024, compared to 28 sales in 2023, down 25%.

Inventory: As of December 31, 2024, there were 15 units listed compared to 17 at the same time in 2023, so broadly similar. It remains a Buyer’s Market.

Median days on the market: 2024 was 76 days, a decline from 67 days in 2023.

Median sale prices year-over-year, we’ve seen a 2% downward adjustment. The median price for Townhomes in 2024 was $719,000, down from the $734,000 median price in 2023.

Quail Ridge and University District Real Estate Market Outlook for 2025

Since early November, only 7 sales have been recorded in the area, indicating that the University District is settling into its typical winter slowdown in activity.

Advice for Buyers and Sellers

Sellers: Now is an excellent time to prepare ready for the spring market. See my recent post 10 Home Upgrades to Attract Buyers

Tackle those renovations, redecoration projects, and any minor fixes you’ve been putting off to ensure your property is ready to stand out when the market heats up again, as competition will remain strong.

Buyers: Affordability is improving and there are signs that the Spring market will be busier this year. While it doesn’t look like prices will rise too sharply I do expect there to be strong demand for more affordable homes. So if you see the right one, make sure you’re pre-approved for financing and don’t wait!

If you would like to chat about the next steps or obtain a Market Evaluation of your home please contact me, as I have over 19 years of experience as a specialist, in buying and selling properties in the Quail Ridge and University area.

Trish Cenci

Tel: 250-864-1707

Useful Links

My Website : http://www.trishcenci.com

Current Quail Ridge Listings

Current UBCO Listings

Quail Ridge Residents Association Link

Okanagan Golf Club Link

University of BC Okanagan Link

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link