Kelowna Real Estate January 2026 – Market Overview.

Welcome to my Kelowna Real Estate January 2026 Market update!

First and foremost, Happy New Year to you!

Winter has settled in, activity has cooled, and uncertainty continues to shape buyer and seller behaviour.

This past month felt particularly challenging, especially in the condo market, where higher inventory and cautious buyers are colliding. Some of this slowdown is seasonal and expected, but there’s no denying that uncertainty — from economic headlines to shifting buyer confidence — is keeping many people on pause.

At present, local buyers are driving the market. They’re very price-aware, patient, and focused on value — and I expect that trend to continue throughout the winter months.

While the broader outlook remains subdued, Kelowna’s market hasn’t stopped completely; it’s simply become more selective. In markets like this, I believe that clarity shouldn’t come from media headlines, but from understanding what’s happening on the ground, and what’s right for each individual.

Kelowna Real Estate January 2026 Latest Market Numbers

Note: The Stats in this post are taken from the Association of Interior Realtors as of January 2, 2026, and may be subject to a minor change.

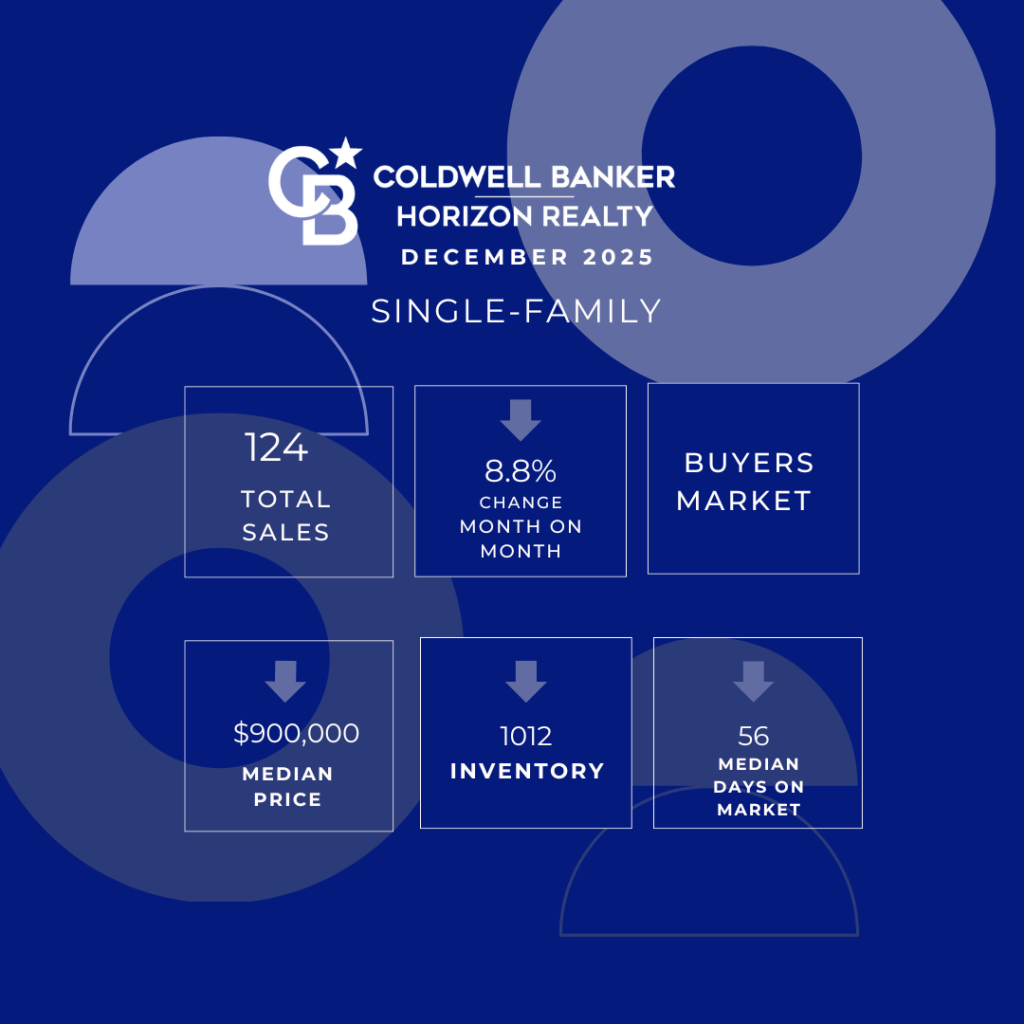

Single-Family Homes

Sales

A total of 124 single-family homes were sold in December 2025.

This represents:

- An 8.8% decrease from November 2025 (136 sales)

- A 6.9% increase compared to December 2024 (123 sales)

Sales dipped month-over-month, continuing the typical winter decline in activity, but improved over the previous year.

Median Price

The median price decreased to $900,000 in December 2025.

- Down 3.3% from November 2025 ($931,000)

- Down 6.0% from December 2024 ($957,500)

Local Buyers dominated the market, buying the lower-priced homes, which affected the median price.

Inventory

There were 1,012 active listings in December 2025.

- Down 16.4% from November 2025 (1211)

- Down 5.4% from December 2024 (1,070)

Inventory contraction continues, to be expected at this time of year, and was down from the 2024 10-year Peak.

Days on Market

The average Days on Market decreased to 56 days.

- Down 5.1% from November (59)

- Down 21.1% from December 2024 (71)

Homes are selling faster and noticeably faster than last December.

What This Means for Single-Family Buyers and Sellers

Market Direction and Pricing

- I expect we will mainly see local Buyers this winter, so expect reasonable activity in the more affordable home market.

- Sellers should expect Buyers to continue to be aggressive with their offers.

- Expect investment purchasing to remain weak.

Inventory Matters

- For the next few months, expect choice to be limited, so don’t wait if you see something you like.

- Sellers should hope to benefit from less competition.

Timing is Improving, but…

- Buyers are still taking a long time to commit, so Sellers need to be very patient!

- Sellers should continue to focus on presentation and realistic pricing.

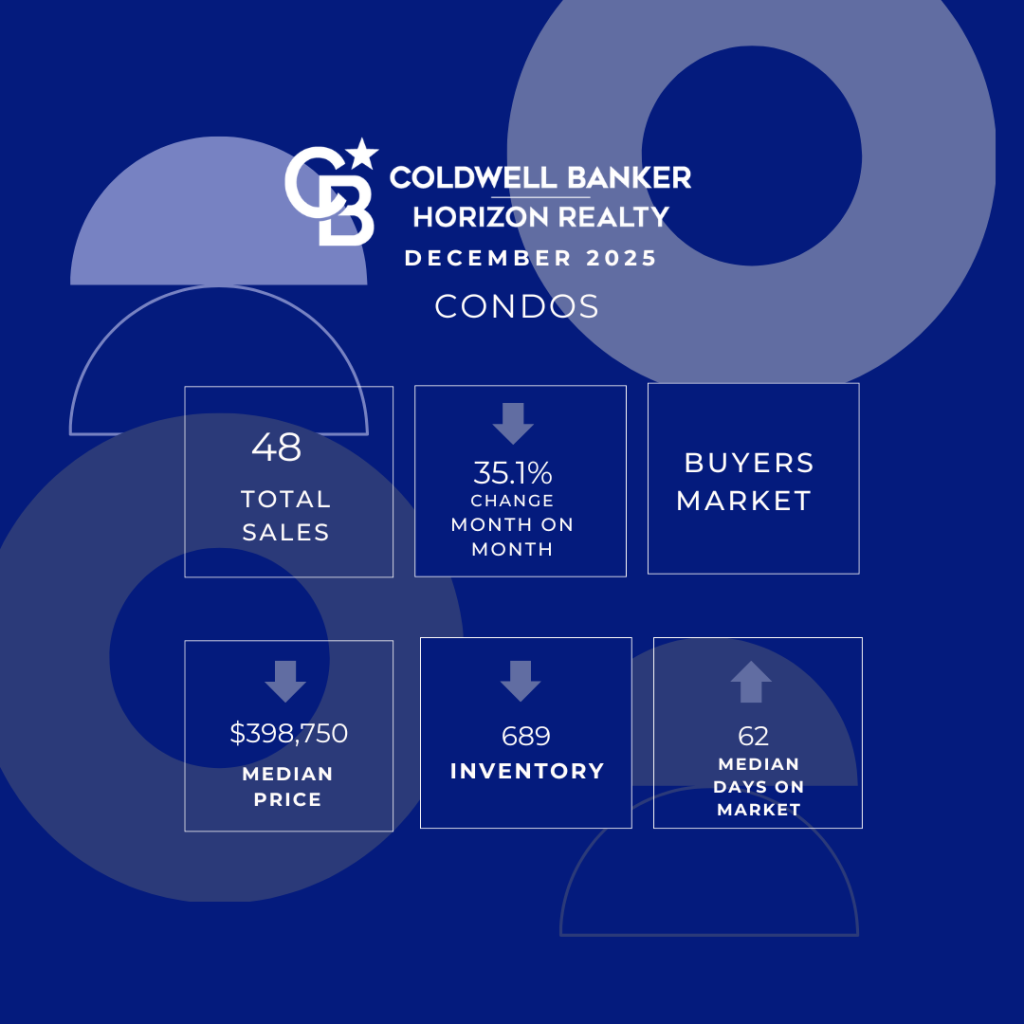

Condos

Sales

A total of 48 condos were sold in December 2025.

This represents:

-

A 35.1% decrease from November 2025 (74 sales)

-

A 30.4% decrease compared to December 2024 (69 sales)

Sales activity slowed significantly month-over-month and year-over-year, which is not good news for Condo Sellers.

Median Price

The median condo price was $398,750 in December 2025.

-

Down 4.5% from November 2025 ($417,500)

-

Down 7.7% from December 2024 ($432,000)

Prices have continued downward. Influenced by continuing higher inventory, lack of investor buyers, and other Buyers thinking that the market is going to continue to soften.

Inventory

There were 689 active condo listings in December 2025.

-

Down 7.9% from November 2025 (758 units)

-

Up 15.6% from November 2024 (596 units)

More Sellers have taken their properties off the market for Winter, but numbers remain higher than this time last year.

Days on Market

Condos spent an average of 62 days on the market in December 2025.

-

Up 5.1% from November 2025 (59 days)

-

Up 6.9% from November 2024 (58 days)

Condos are taking longer to sell, highlighting the continued challenges in this sector.

What This Means for Condo Buyers and Sellers

Market Direction & Pricing

-

Higher inventory is giving buyers plenty of choice and applying continued downward pressure on prices.

-

There’s no sugar-coating it — the condo market in Kelowna remains the most challenging segment right now. Higher inventory, fewer investor buyers, and softer rental demand have shifted the balance firmly toward buyers.

-

Well-priced condos are selling, but anything even slightly out of step with today’s market is sitting — and sitting leads to price reductions.

-

That said, challenge doesn’t mean no opportunity. For buyers with stable finances and a longer-term view, today’s conditions offer choice, negotiating power, and the ability to be selective. I’m seeing opportunities for parents purchasing for students, downsizers prioritising location over size, and buyers willing to look past short-term noise in favour of long-term livability.

-

For sellers, realism is essential. Pricing needs to reflect current demand, not past peaks. Presentation, flexibility, and patience matter more than ever. Condos that acknowledge today’s market are the ones that move; those that don’t tend to chase the market down.

-

The hope is that short-term rentals are expected to return on a limited scale in Kelowna next year, which should result in a modest increase in demand. Pricing in this sector has been badly affected, so there are some deals to be had.

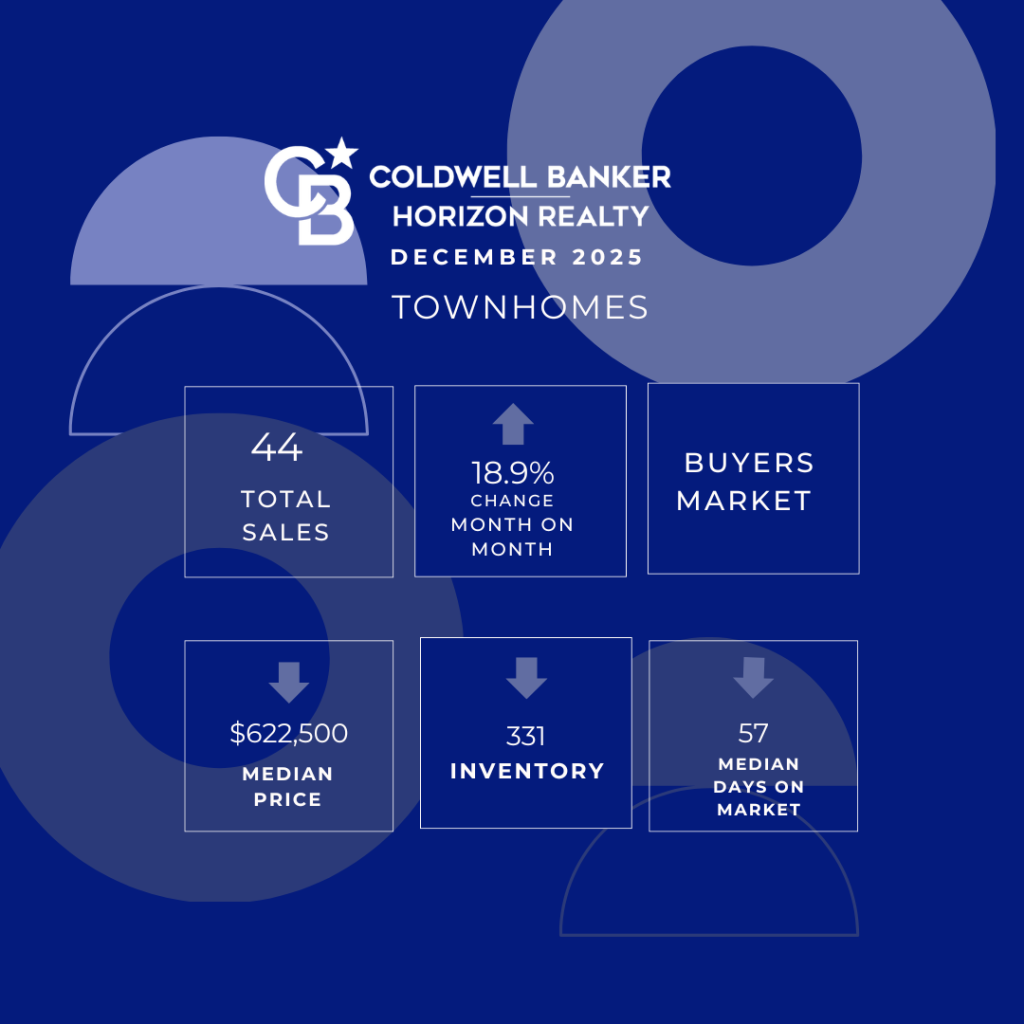

Town Homes

Sales

A total of 44 townhomes sold in December 2025.

-

Up 18.9% from November 2025 (37 sales)

-

Up 10% from December 2025 (40 sales)

Sales bounced back after a sharp dip last month.

Median Price

The median townhome price was $622,500 in December 2025.

-

Down 5.0% from November 2025 ($655,000)

-

Down 3.5% from December 2024 ($645,000)

Prices were lower after a modest boost last month.

Inventory

There were 331 active townhome listings in December 2025.

-

Down 16.6% from November 2025 (397 units)

-

Held Steady compared to December 2024 (330 units)

Inventory has reduced as some Sellers hold back during this quieter winter period.

Days on Market

Townhomes spent an average of 57 days on the market in December 2025.

-

Down 9.5% from November 2025 (63 days)

-

Up 3.6% from December 2024 ( 55 Days)

There was a modest reduction in time on the market last month, but Townhomes were still taking nearly 2 months to sell.

What This Means for Townhome Buyers and Sellers

Market Direction & Pricing

-

The dip in Townhome sales last month has not materialised into a continuing trend.

-

Prices are holding steady, as demand remains in this more affordable sector.

-

Inventory is down, representing fewer potential choices for now.

Timing

-

Buyers currently have fewer choices, but it’s the same as last year.

-

Longer days on market mean Sellers will need to have patience!

Kelowna Real Estate January 2026: My Thoughts.

1. Uncertainty Isn’t Going Away — So Waiting for “Clarity” May Cost You

Trade issues, job shifts and policy changes have been part of the Kelowna conversation for some time now. My honest view? This level of uncertainty is likely to continue. If you’re waiting for the media to declare the “perfect time,” you may be waiting a long while. The better approach in 2026 is to focus on your affordability, your timeline and your lifestyle goals — and move forward when those align.

2. Buyers: Why Wait? Choice and Leverage Are on Your Side

Kelowna buyers currently have something they haven’t had in years: options. More listings mean less pressure, more negotiating room, and time to be selective. If you find a home that fits your needs and your budget works today, waiting for certainty could mean missing the right property altogether.

3. Sellers: Pricing to the Market Is Non-Negotiable

2026 is not shaping up to be a “test the market” year in Kelowna. Homes that sell are priced correctly from day one. Buyers are informed, cautious, and quick to dismiss properties that feel overpriced — even slightly. Strategic pricing isn’t leaving money on the table; it’s how you protect it.

4. Condition Matters More Than Ever

In a more balanced market, buyers notice everything. Roof age, furnace, windows, and overall upkeep matter. Homes that are well maintained stand out quickly. Those that aren’t tend to sit — and sitting leads to price reductions. In 2026, preparation is a seller’s advantage.

5. Condos Remain the Most Challenged Segment

Kelowna’s condo market continues to feel the effects of higher inventory and softer demand. This is especially noticeable in areas tied closely to student and investor activity. Buyers have choice, and investors are cautious. Pricing and realistic expectations are critical in this segment.

6. Investment Properties Require Patience and a Long View

Rental vacancy in Kelowna remains elevated, keeping rental returns modest. This is putting pressure on investor-owned condos in particular. Short-term rental opportunities are expected to return, which could provide some upside — but this won’t instantly fix the fundamentals. Investors need to be selective and prepared for longer holding periods.

7. UBCO and College-Area Demand Has Shifted

Reduced foreign student numbers continue to affect demand near UBCO and Okanagan College. This doesn’t mean these areas lack opportunity — but it does mean pricing, rental expectations, and exit strategies need to be realistic. Not every condo near campus performs the way it once did.

8. Serious Buyers Still Appear in “Quiet” Markets

One thing I’ve learned over the years in Kelowna: winter and uncertain markets often attract the most serious buyers. These are people making thoughtful, long-term decisions — not emotional ones. If you’re prepared and positioned well, 2026 can absolutely work in your favour.

This month’s photo:

New Year’s Eve Fireworks Downtown Kelowna, December 2025.

Kelowna Real Estate January 2026

- Ready to make your next move?

- Call or text Trish at 250-864-1707

- Contact Trish Cenci PREC* by email: here.

Let’s help make your Kelowna Real Estate dreams become a reality!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link