I’m pleased to report a noticeable increase in buyer inquiries across the Kelowna Real Estate Market in January 2025. A promising sign for sellers!

While this surge in interest may not immediately reflect in sales figures, I anticipate it will as we move into the full swing of the spring market. Mortgage brokers are also seeing a significant rise in pre-qualification inquiries, prompting some sellers to re-list earlier than usual.

However, this momentum hasn’t extended to the luxury market just yet. From my experience at a recent high-end open house, many buyers are still waiting to sell their current homes, and overall showing activity remains quiet.

Note: The stats below are taken from the Association of Interior Realtors numbers as of February 1, 2025, and may be subject to change.

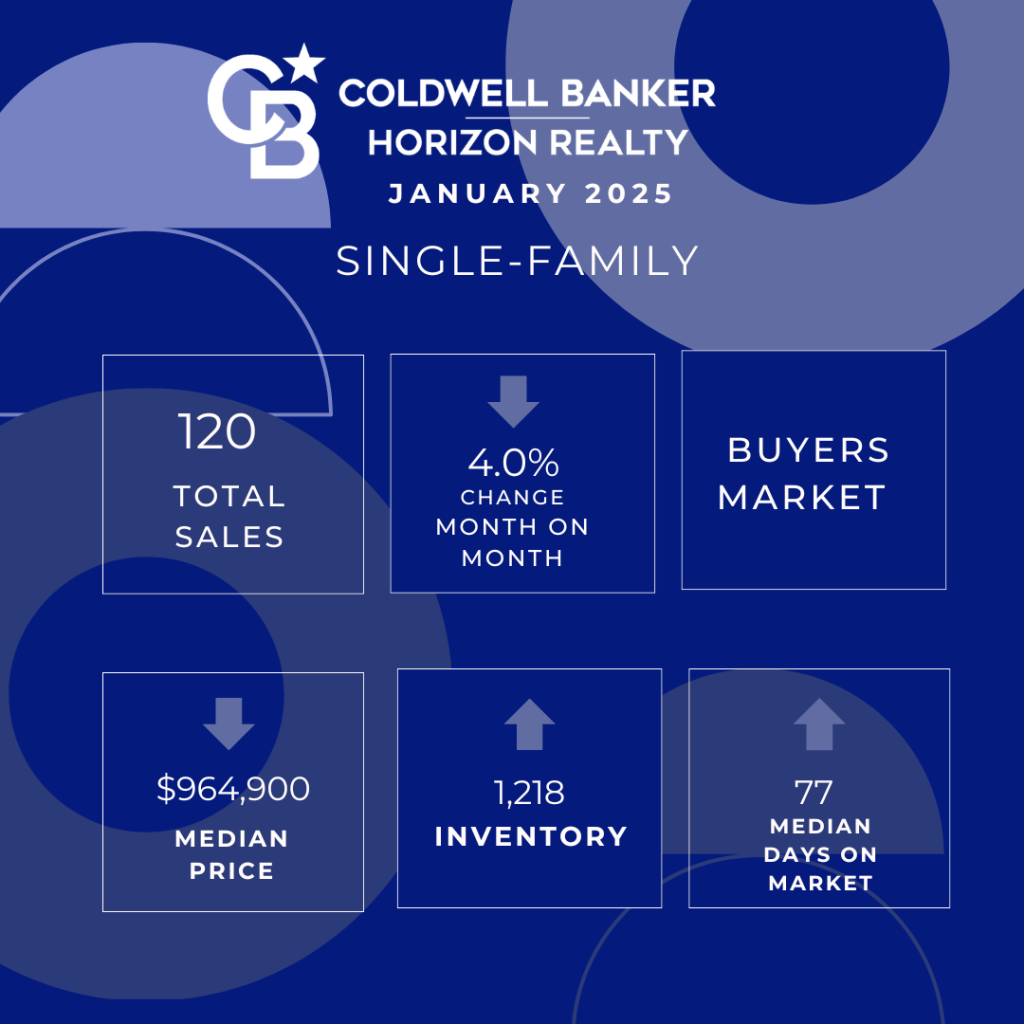

Kelowna Real Estate Market: Single-Family Homes January 2025

Home Sales

- January 2025: 120 homes sold.

- Month-over-Month: Down 4% from 125 in December 2024.

- Year-over-Year: Up 34.8% from 89 in January 2024.

Median Price

- January 2025: $964,900.

- Month-over-Month: Down 0.5% from $970,000 in December 2024.

- Year-over-Year: Up 9.0% from $885,000 in January 2024.

Inventory

- January 2025 1,218 listings.

- Month-over-Month: Up 3.5% from 1,177 in December 2024.

- Year-over-Year: Up 21.6% from 1,002 in January 2024.

Median Days on Market

- January 2025: 77 days.

- Month-over-Month: Up 10% from 70 days in December 2024.

- Year-over-Year: Up 24.2% from 62 days in January 2024.

Single-Family Home Takeaways: Year-over-year sales have risen significantly, highlighting increased market activity compared to this time last year. However, month-over-month sales dipped again, reflecting the typical ‘winter lull.’ Median sale prices edged down slightly from December 2024 but showed solid improvement compared to January last year.

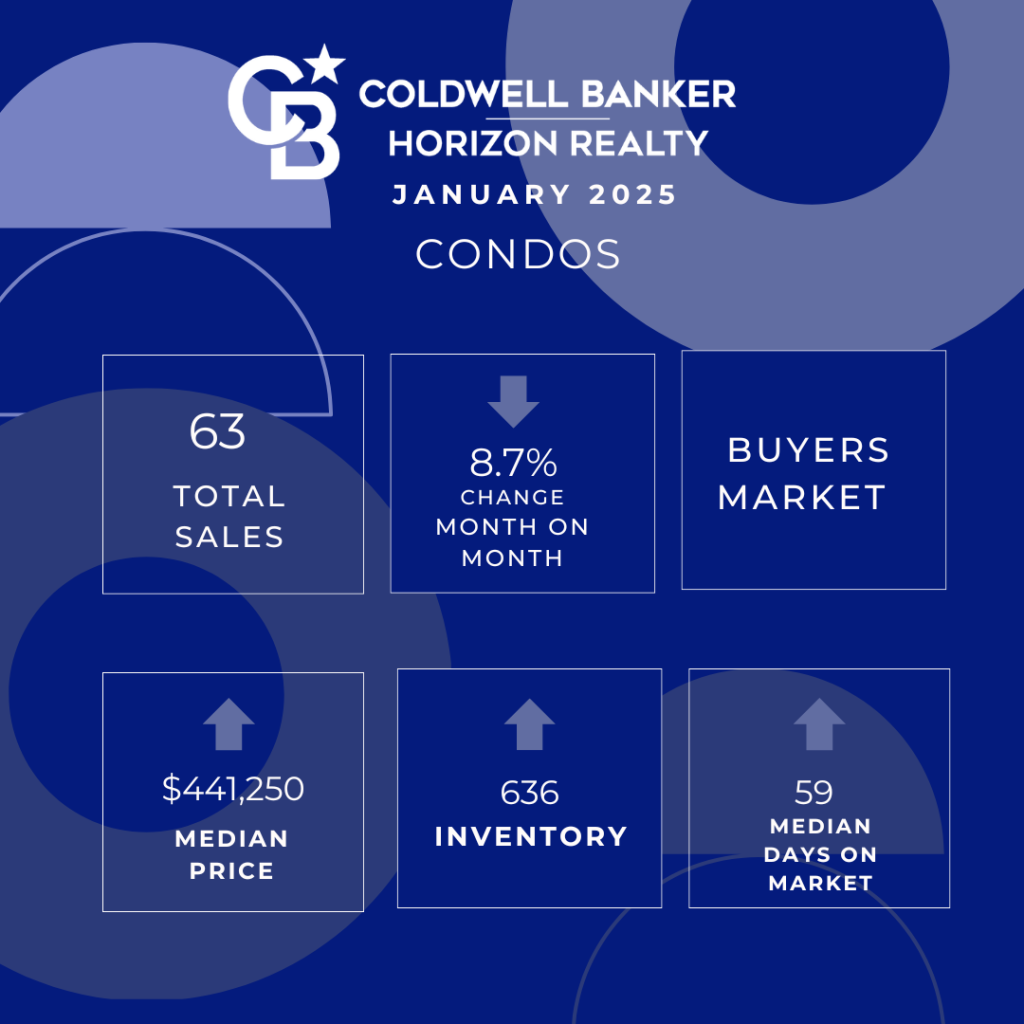

Kelowna Real Estate Market: Condos January 2025

Condo Sales:

- January 2025: 63 Condos Sold

- Month-over-Month: Down 8.7% from 69 in December 2024.

- Year-over-Year: Up 10.5% from 57 in January 2024.

Median Price:

- January 2025: $441,250.

- Month-over-Month: Up 2.1% from $432,000 in December 2024.

- Year-over-Year: Down 4.1% from $460,000 in January 2024.

Inventory:

- January 2025: 636 Listings

- Month-over-Month: Up 6.7% from 596 in December 2024.

- Year-over-Year: Up 26.2% from 504in January 2024.

Median Days on Market:

- January 2025: 59 Days

- Month-over-Month: Up 1.7% from 58 days in December 2024.

- Year-over-Year: The same at 59 days in January 2024.

Condo Takeaways: Sales in January 2025 saw a typical winter slowdown month-over-month, but were still higher than last year, indicating stronger buyer interest compared to early 2024. The median price rose from December, suggesting short-term stability, though it remains lower year-over-year, likely due to increased inventory, the effects of the new short-term rental rules and affordability concerns. Active listings continued to climb, up from last month and last year, giving buyers more choices and potentially keeping prices in check. Meanwhile, the median days on the market held steady, showing no major shift in how long condos take to sell.

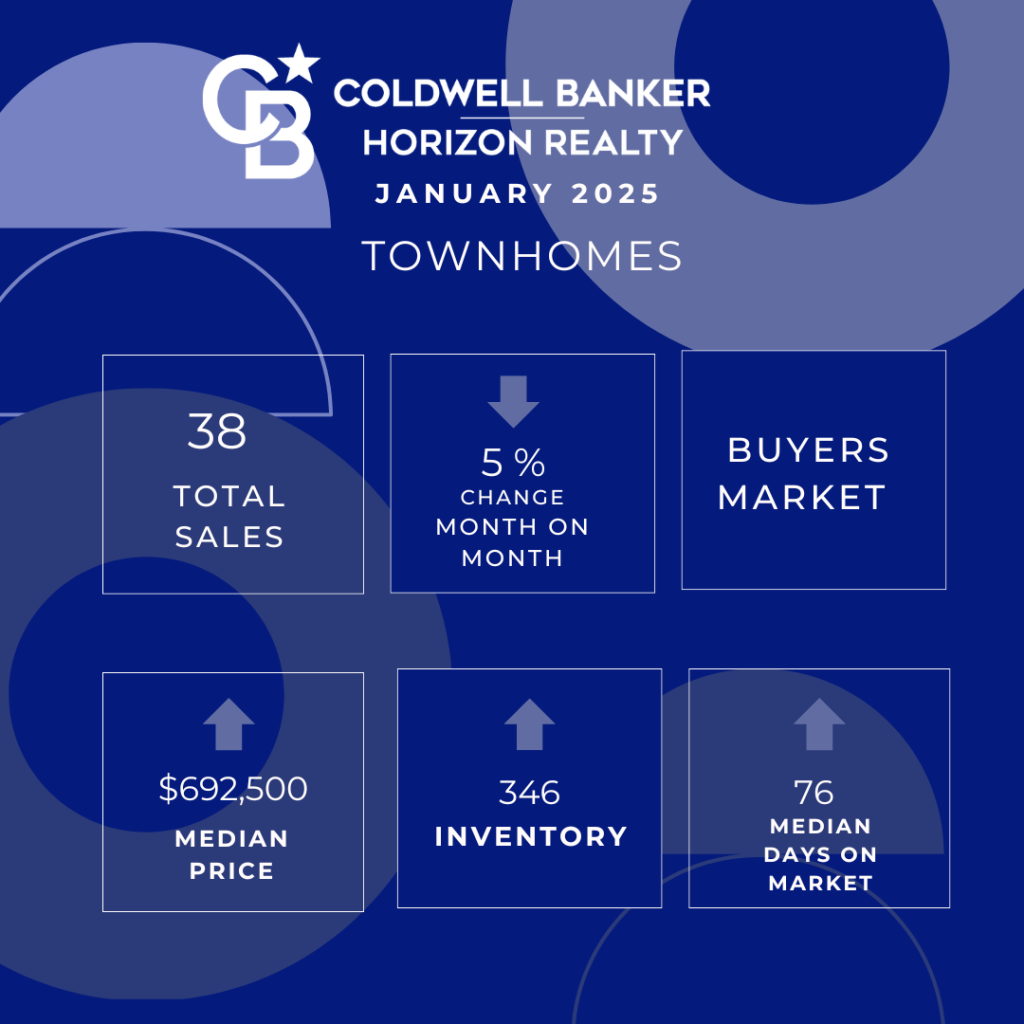

Kelowna Real Estate Market: Townhomes January 2025

Townhome Sales:

- January 2025: 38 Townhomes Sold.

- Month-over-Month: Down 5% from 40 in December 2024.

- Year-over-Year: Up 35.7% from 28 in January 2024.

Median Price:

- January 2025: $692,500.

- Month-over-Month: Up 7.4% from $645,000 in December 2024.

- Year-over-Year: Up 5.9% from $654,000 in January 2024.

Inventory:

- January 2025: 346 Listings.

- Month-over-Month: Up 4.8% from 330 in December 2024.

- Year-over-Year: Up 12.3% from 308 in January 2024.

Median Days on Market:

- January 2025: 76 Days

- Month-over-Month: Up 38.2% from 55 days in December 2024.

- Year-over-Year: Up 28.8% from 59 days in January 2024.

Townhome Takeaways: Sales in January 2025 saw a slight decline from December, reflecting seasonal trends, but were still higher than last year, signalling stronger demand. The median price jumped month-over-month and year-over-year, suggesting steady price growth as prices tend to be in the ‘more affordable’ category for local Buyers. Inventory continued to rise, from last month and from January 2024, providing buyers with more options. However, homes are taking longer to sell, with the median days on the market increasing from December 2024 and compared to last year. While demand is improving, rising inventory and longer selling times could impact pricing trends in the coming months.

Current Influences on the Kelowna Real Estate Market

1. BC Speculation and Vacancy Tax Expansion

The Speculation and Vacancy Tax now applies to 13 additional communities, including several in the Okanagan. Affected homeowners will need to declare for the first time in January 2025. More info: here

Newly impacted areas in the Okanagan:

- Vernon

- Coldstream

- Penticton

- Summerland

- Lake Country

- Peachland

- Salmon Arm

This could discourage some out-of-town buyers, but I’m also seeing previously hesitant buyers moving forward with purchases before potential future tax changes.

2. Interest Rates

This week, the Bank of Canada lowered its target overnight rate to 3%, with the Bank Rate at 3.25%—welcome news, particularly for first-time buyers looking to enter the market.

3. BC Real Estate Association Q1 2025 Housing Forecast

BCREA Chief Economist Brendon Ogmundson provided an optimistic outlook but also flagged potential risks:

“While we are entering 2025 with a high level of optimism and expectations for increased activity, the potential for punishing tariffs on BC exports to the United States presents significant uncertainty for the outlook.”

For the Okanagan, the forecast predicts:

- 5.3% increase in sales

- 2.2% increase in prices

Read the full report here

4. Inventory Levels & Housing Demand

I expect inventory levels to stay elevated in the near term. However, I’m also seeing hearing of multiple offers on more affordable homes, particularly those with suites, as buyers look for rental income potential.

5. Short-Term Rental Regulations & Condo Market Impact

Kelowna’s short-term rental restrictions continue to impact the condo market. Investor interest slowed last year due to affordability concerns and uncertainty around the new rules, leading to higher inventory and price adjustments. However, with these shifts now largely factored into the market, 2025 is likely to see renewed interest—especially in areas like UBCO, where condos are becoming a more attractive option for both investors and parents buying for students again.

6. The Impact of New Trade Tariffs by the US Government.

The recent announcement of up to 25% tariffs on Canadian imports by the U.S. government is poised to have several implications for the Kelowna Real Estate Market:

- Economic Impact on Key Sectors: Kelowna’s economy is significantly supported by industries such as agriculture and manufacturing, which are now subject to these tariffs. The increased costs for these sectors could lead to reduced profitability, potential layoffs, and decreased consumer spending, thereby affecting the local housing market.

- Construction Costs and Housing Prices: The tariffs are expected to raise the cost of imported building materials. This increase may result in higher construction expenses, potentially slowing down new housing projects and leading to elevated property prices due to constrained supply.

- Interest Rate Fluctuations: Economic uncertainties stemming from the tariffs could influence the Bank of Canada’s monetary policy. Depending on the broader economic impact, there might be adjustments in interest rates, which would directly affect mortgage rates and, consequently, housing affordability in Kelowna.

- Investor Sentiment: The tariffs introduce a layer of economic uncertainty that could make investors more cautious. This hesitancy might lead to a slowdown in real estate investments, affecting both commercial and residential property markets in the region.

In summary, while the full extent of the tariffs’ impact will unfold over the coming weeks, it is prudent for Buyers & Sellers in the Kelowna Real Estate Market to monitor these developments closely. Staying informed and adaptable will be key to navigating the potential challenges ahead.

Other Kelowna Real Estate Articles & Reports you may have missed last month

- The Importance of Schools in Real Estate Purchases – Kelowna Guide: Link

- Key Stats and Economic Info Kelowna Real Estate Sellers Should Watch: Link

- Impact of a Federal Election on Kelowna’s Real Estate Market: Link

- Quail Ridge and University District Annual Report 2024: Link

- Central Okanagan 2024 Market Overview Link

Contact Trish

As always, if you have any questions about your specific home or buying needs, please feel free to contact me as I’m happy to help!

This month’s photo: View of Lake Okanagan from Lake Country

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link