Welcome to the Quail Ridge and University District Q1 2025 Kelowna Real Estate Report!

Between January and March 2025, 10 residential properties were reported sold in the Quail Ridge and University District. Prices ranged from $300,000 for a compact studio penthouse at Academy Way to $1,125,000 for a 4-bedroom single-family home on Capistrano Drive. Here’s what stood out:

-

Apartments dominated the market: 7 out of 10 sales were condos, primarily along Academy Way.

-

The price sweet spot for apartments is $450,000–$590,000, mostly for 3-bedroom, 3-bathroom layouts—ideal for student rentals or shared accommodations.

-

The Townhome and detached segments saw medium price points: A townhome sold for $717,500 in Fiore Del Sol & another sold in Vint Road for$765,000 and the highest-priced sale was a single-family detached home for $1.125M in 1950 Capistrano Drive.

-

Days on Market (DOM) varied widely: from a low of 18 to a high of 139. Notably, older listings that finally sold had lingered since Fall 2024.

📉 Why the Momentum May Have Stalled

Sales made a relatively slow & steady start in early 2025, (which is normal for the University District), but the pace appeared to stall as we approached April, with the General Election pending and the threat of tariffs from South of the Border.

🏙️ Kelowna-Specific Factors:

-

High inventory levels: Particularly in Academy Way, there’s been an oversupply of similar condos, leading to buyer hesitation and longer sell times. Currently 34 condos are listed in Academy Way (as at April 9 ,2025)

-

Short-Term Rental Uncertainty: Pending provincial legislation on STRs continues to create uncertainty, especially in student-heavy and investor-attractive zones like Quail Ridge & Kelowna North. Properties like Pinnacle Pointe may still be rebuilding buyer confidence after the loss of short-term rentals, which dampened sales prices.

🌐 Wider Provincial & Economic Influences:

-

Interest Rates remain high: Despite hints at further cuts, borrowing costs are still putting pressure on some first-time buyers and investors.

-

Affordability concerns: With inflation continuing to strain household budgets, many potential buyers may be pressing pause.

-

Provincial Election on the horizon: Possible changes in housing policy—especially around STRs, development regulations, and taxes—are creating a ‘wait and see’ sentiment. My view is that is an opportunity for Investors.

-

Global uncertainty: Broader economic volatility, including global inflation and tariffs, may be influencing investment decisions even at a local level.

Reminder of Canadian Government Legislation regarding Students and how it affects UBCO.

In January 2024, the Canadian federal government introduced a two-year cap on international student study permits to address concerns about housing shortages and the integrity of the student visa system. This measure aimed to reduce the number of new study permits issued in 2024 by approximately 35% compared to the previous year, resulting in about 360,000 permits. Alumni UBC Magazine+4AP News+4Reuters+4Business in Vancouver+4The Ubyssey+4Canada.ca+4

In January 2025, the government announced a further 10% reduction for 2025, setting the cap at 437,000 study permits. This continued effort seeks to alleviate strains on housing, healthcare, and other services. AP News+3Reuters+3Canada.ca+3

For UBC Okanagan (UBCO), these federal caps have introduced uncertainties regarding international student enrollment. In March 2024, the British Columbia government allocated Provincial Attestation Letters to institutions, enabling UBC to proceed with its international enrollment planning. UBC has expressed its commitment to supporting current international students and ensuring that Canada and the university continue to welcome new international students. University Affairs+1The Ubyssey+1Reuters+2UBC Okanagan Provost’s Office+2academic.ubc.ca+2academic.ubc.ca

While these measures primarily target new applicants, current international students and those pursuing master’s and doctoral degrees are generally not affected. UBC Okanagan Provost’s Office

The evolving policies underscore the importance for prospective international students to stay informed about application requirements and for institutions like UBCO to adapt their enrollment strategies accordingly.

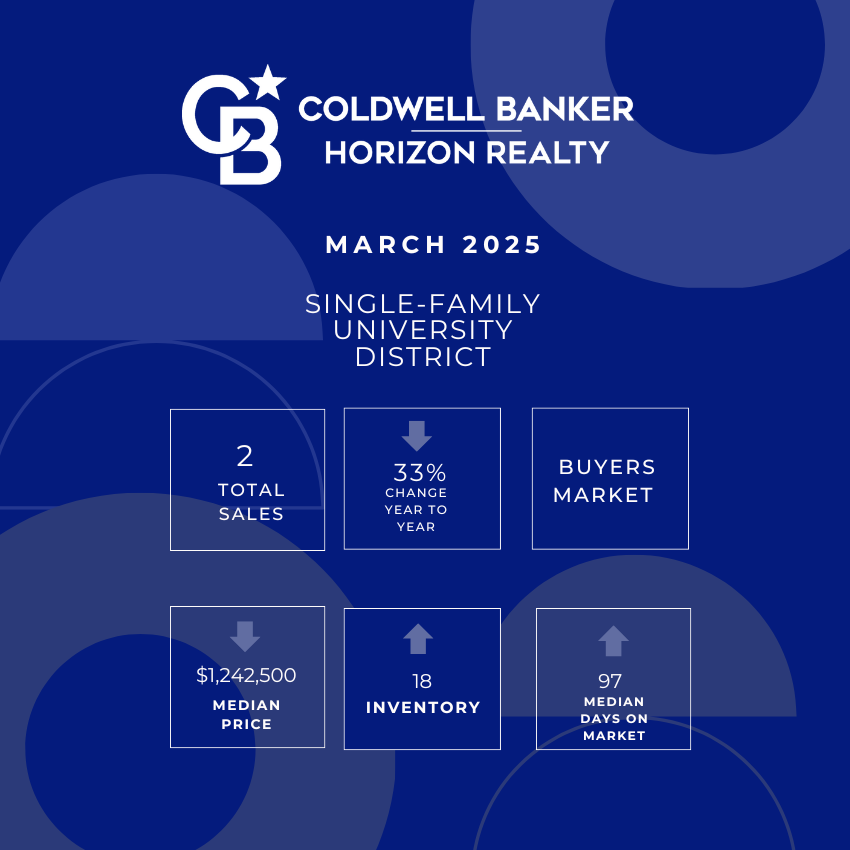

Single-Famly Homes Quail Ridge and University District Q1 2025

Sales: Total Single-Family home sales for Q1 2025 were 2, compared to 3 in 2024. Down 33%. This is not of undue concern as traditionally home sales in the University area are quiet at this time of year.

Inventory & Months of Inventory: As of March 31, 2025, there were 18 homes listed compared to 9 at the end of March 2024. Up 100%. It remains a Buyer’s Market.

Median days on the market: Q1 2025 is 97 days, compared to 54 days for 2024. I am not concerned by this number due to the University area normally being quiet during the Winter months.

Median sale prices: Year-over-year, we have seen a 5.3% upward adjustment. The median price for single-family homes in Q1 2025 was $1,242,500, up from the $1,236,00 median price recorded for 2024. I recommend caution when looking at this number as the home that sold was in 1950 Capistrano this year, whereas last year, it was a newer freestanding home in Arcadia Street, so we are not comparing ‘Apples to Apples’.

Condos Quail Ridge and University District Q1 2025

Sales: 7 sales during Q1 2025, compared to 9 sales in Q1 2024, down 22%. This area has definitely being affected by affordability issues and investor demand.

Inventory: As of March 31, 2025, there were 46 units listed compared to 37 at the same time in 2024. It remains a Buyer’s Market. This is a statistic that we will need to watch as the Academy way area has a higher level of inventory right now which may put pricing under pressure this spring.

Median days on the market: In Q1 2025, Condos took less time to sell – 57 days, compared to 75 days in 2024. This stat appears to be ‘bucking the trend’ as overall activity seems a little slow at the moment.

Median sale prices year-over-year, we saw a 14.3% downward adjustment. The median price for Condos in Q1 2025 was $450,000, down from $525,000 median price in 2024. Prices are definitely lower, however, this can be affected by whether people have been buying two or three bedroom units.

Townhomes Quail Ridge and University District Q1 2025

Sales: 1 sales in Q1 2025, compared to 5 sales in 2023, down 80%. This is not unexpected given that last year more units were selling in the new Quail Landing project and also in Academy Ridge.

Inventory: As of March 31, 2025, there were 23 units listed compared to 13 at the same time in 2024. It remains a Buyer’s Market. Inventory is more elevated as there are more units for sale in Academy Ridge and Quail Landing at the moment.

Median days on the market: Q1 2025 was 18 days, a decline from 35 days in 2024.

Median sale prices year-over-year, we’ve seen a 14.2% upward adjustment. The median price for Townhomes in Q1 2025 was $765,000, up from the $669,900 median price in 2024. These numbers should be viewed with a note of caution, as there are a variety of different Townhomes that are selling the University District now. For instance, if one of the cheaper Townhomes sells, say in Bella Sera or Academy Ridge, this can skew the numbers.

✍️ Trish’s Takeaway: Quail Ridge and University District Q1 2025

For Sellers in this market, pricing sharply and preparing homes thoroughly is critical. Now is not the time for over-pricing.

For Buyers, this might be a brief window of opportunity before spring activity ramps up, as it remains a Buyers market.

If you would like to chat about the next steps or obtain a Market Evaluation of your home please contact me, as I have 20 years of experience as a specialist, in buying and selling properties in the Quail Ridge and University area.

Trish Cenci

Tel: 250-864-1707

Useful Links

My Website : http://www.trishcenci.com

Current Quail Ridge Listings

Current UBCO Listings

Quail Ridge Residents Association Link

Okanagan Golf Club Link

University of BC Okanagan Link

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link