Kelowna Real Estate November 2025 Market in Review

In my Kelowna Real Estate November 2025 review, I had hoped to report a stronger October Market, as I felt that it had potential, but it ultimately failed to deliver any significant momentum.

Active buyers were often quite aggressive, and I also saw Buyers showing good interest in listings only to ‘stay on the fence’. Last month’s trends hint at our slow market continuing, with buyers carefully looking for great deals and the right opportunities.

We’ll take a deeper dive into buyer sentiment later in the post, to explore Buyer behaviour and what it means for the market.

Kelowna Real Estate October 2025 Stats

*NOTE: These numbers were reviewed on November 3, 2025, using the Association of Interior Stats and may be subject to minor changes should further sales be reported for October 2025.

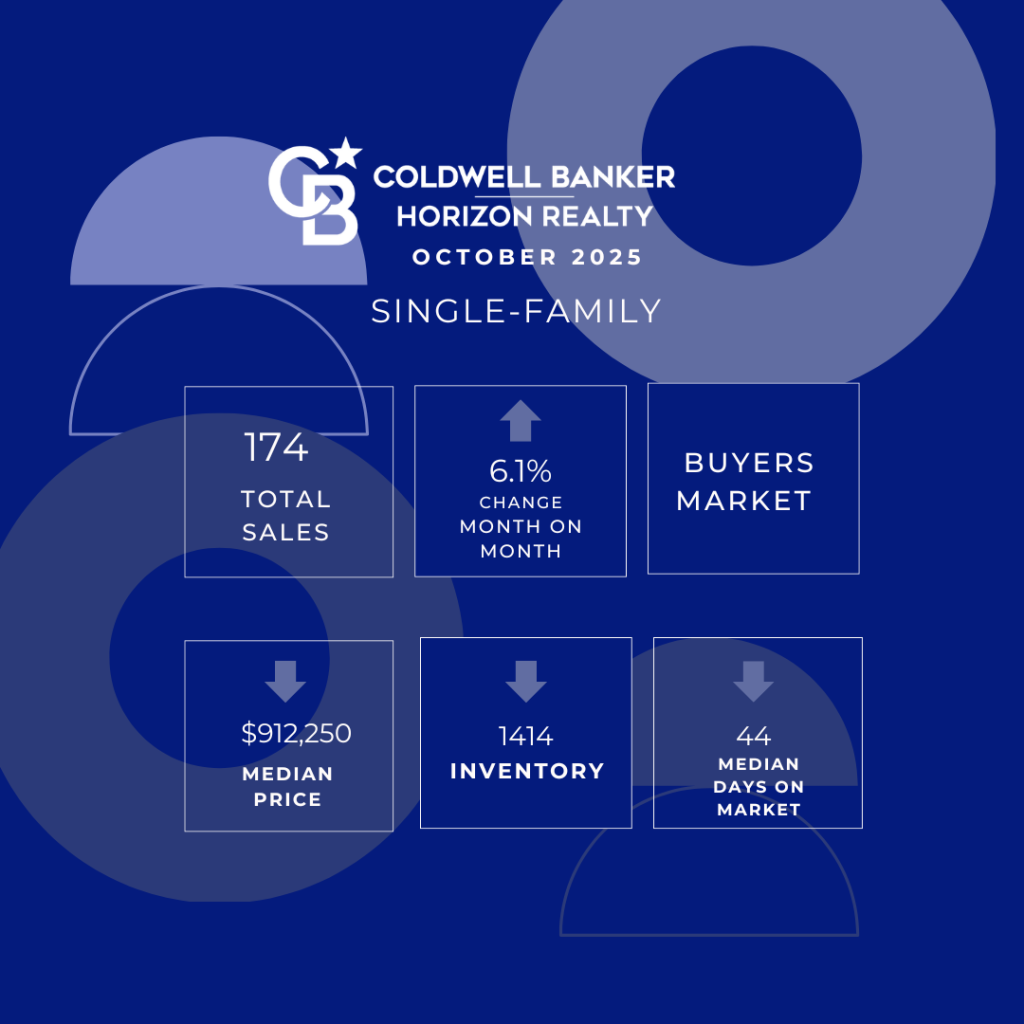

Single-Family Homes October 2025

Home Sales

- October 2025: 174 homes sold.

- Month-over-Month: Up 6.1% from 164 in September 2025.

- Year-over-Year: Down 4.4% from 182 in October 2024.

Median Price

- October 2025: $912,250

- Month-over-Month: Down 2.1% from $931,500 in September 2025.

- Year-over-Year: Down 2.4% from $935,000 in October 2024.

Inventory

- October 2025: 1,414 listings.

- Month-over-Month: Down 8.8% from 1,550 in September 2025.

- Year-over-Year: Down 6.2% from 1507 in October 2024.

Median Days on Market

- October 2025: 44 days.

- Month-over-Month: Down 4.3 % from 46 days in September 2025.

- Year-over-Year: Up 2.3% from 43 days in October 2024.

Single-Family Home Takeaways October 2025:

- Sales activity improved slightly from September but remained below last year’s levels.

- Prices softened modestly, reflecting continued buyer caution.

- Inventory declined, suggesting the usual seasonal pullback in new listings.

- Homes sold a little faster than last month, showing steady buyer engagement despite cooler conditions.

- Overall, the market remained a Buyer’s Market, with mild downward price pressure.

Note: The numbers in this post relate to single-family homes only.

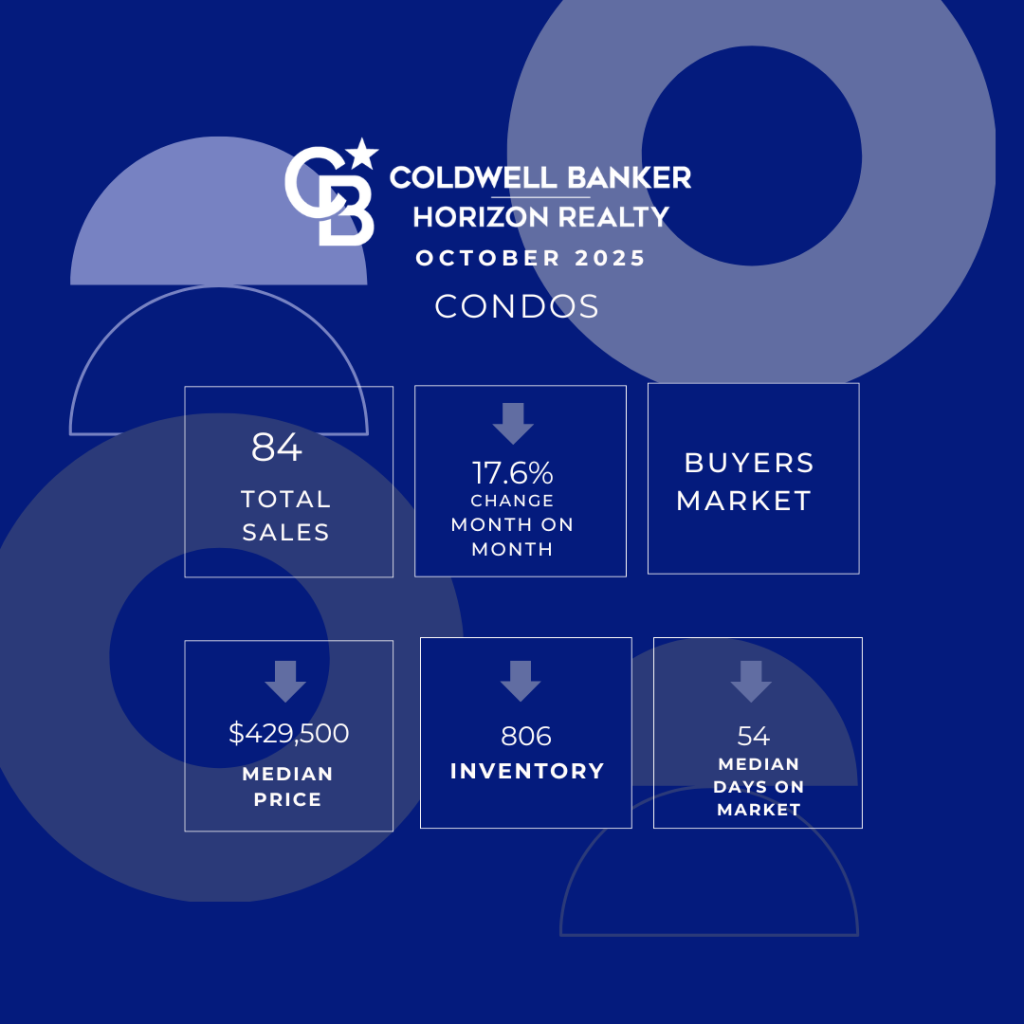

Condos October 2025

Condo Sales:

- October 2025: 84 Condos Sold

- Month-over-Month: Down 17.6%% from 102 in September 2025.

- Year-over-Year: Down 9.7% compared to 93 in October 2024.

Median Price:

- October 2025: $429,500

- Month-over-Month: Down 1.5% from $436,250 in September 2025.

- Year-over-Year: Down 2.9% from $442,500 in October 2024.

Inventory:

- October 2025: 806 Listings

- Month-over-Month: Down 3.9% from 839 in September 2025.

- Year-over-Year: Up 12.4% from 717 in October 2024.

Median Days on Market:

- October 2025: 54 Days

- Month-over-Month: Down 12.9% from 62 days in September 2025.

- Year-over-Year: Down 1.9% 53 days in October 2024.

Condos Key Takeaways – October 2025

- Condo sales slowed notably from September and remained below last year’s pace.

- Prices edged down both month-over-month and year-over-year, reflecting continued price sensitivity.

- Inventory remained higher compared to last year, keeping competition strong among sellers.

- Properties sold slightly faster than in September, suggesting motivated buyers are still active.

- Overall, the condo market showed signs of continued headwinds from elevated supply, weak investor demand and affordability concerns.

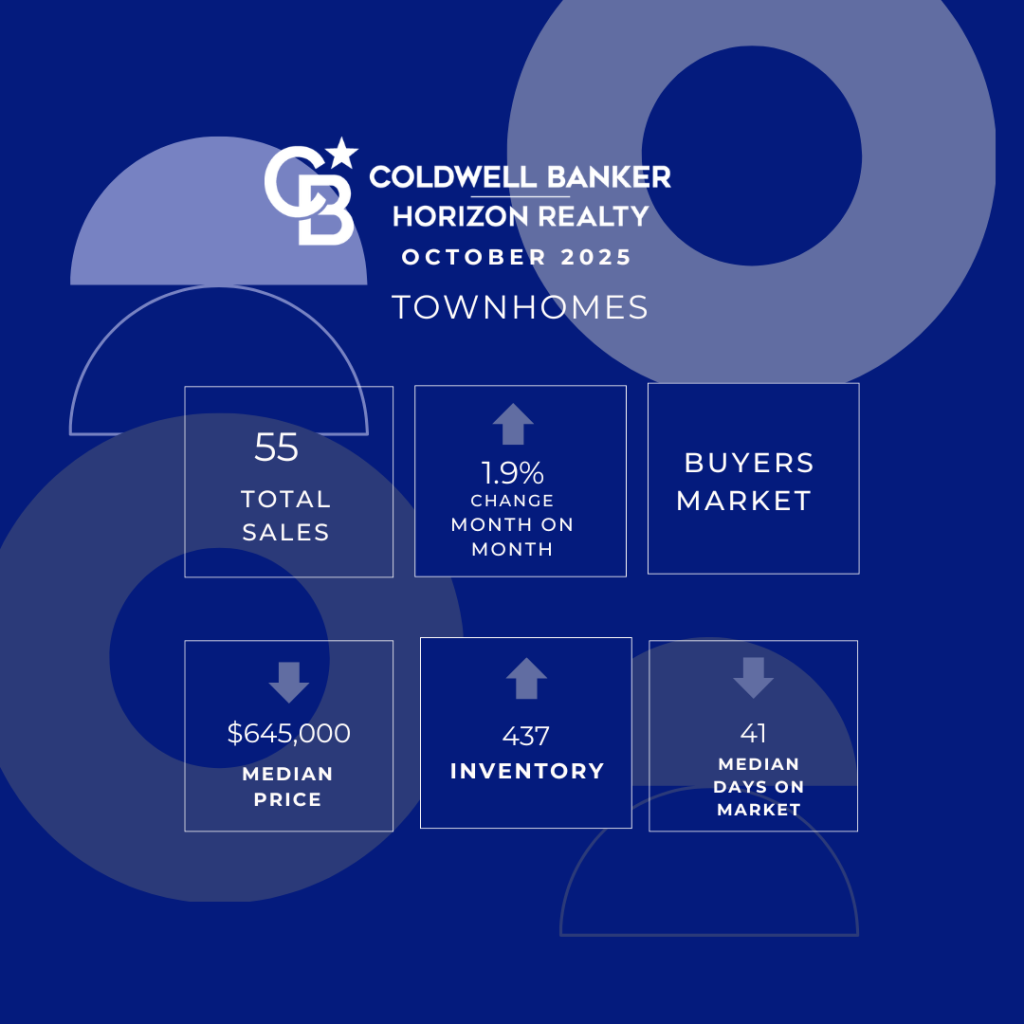

Townhomes October 2025

Townhome Sales:

- October 2025: 55 Townhomes Sold.

- Month-over-Month: Up 1.9% from 54 in September 2025.

- Year-over-Year: Down 5.2% from 58 in October 2024.

Median Price:

- October 2025: $645,000

- Month-over-Month: Down 12.1% $733,750 in September 2025.

- Year-over-Year: Down 5.0% from $679,000 in October 2024.

Inventory:

- October 2025: 437 Listings.

- Month-over-Month: Up 0.2% from 436 in September 2025.

- Year-over-Year: Up 1.2% from 432 in October 2024.

Median Days on Market:

- October 2025: 41 Days

- Month-over-Month: Down 14.6% from 48 days in September 2025.

- Year-over-Year: Down 21.2% from 52 days in October 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link