Kelowna Real Estate Market June 2025

Welcome to my Kelowna Real Estate Market June 2025 Report.

In this post, we’ll look through last month’s numbers & factors currently affecting Kelowna Buyers and Sellers.

Kelowna Real Estate June 2025 Stats Report

*NOTE: These numbers were reviewed on June 2, 2025, using Association of Interior Stats and may be subject to minor changes, should further sales be reported for May 2025.

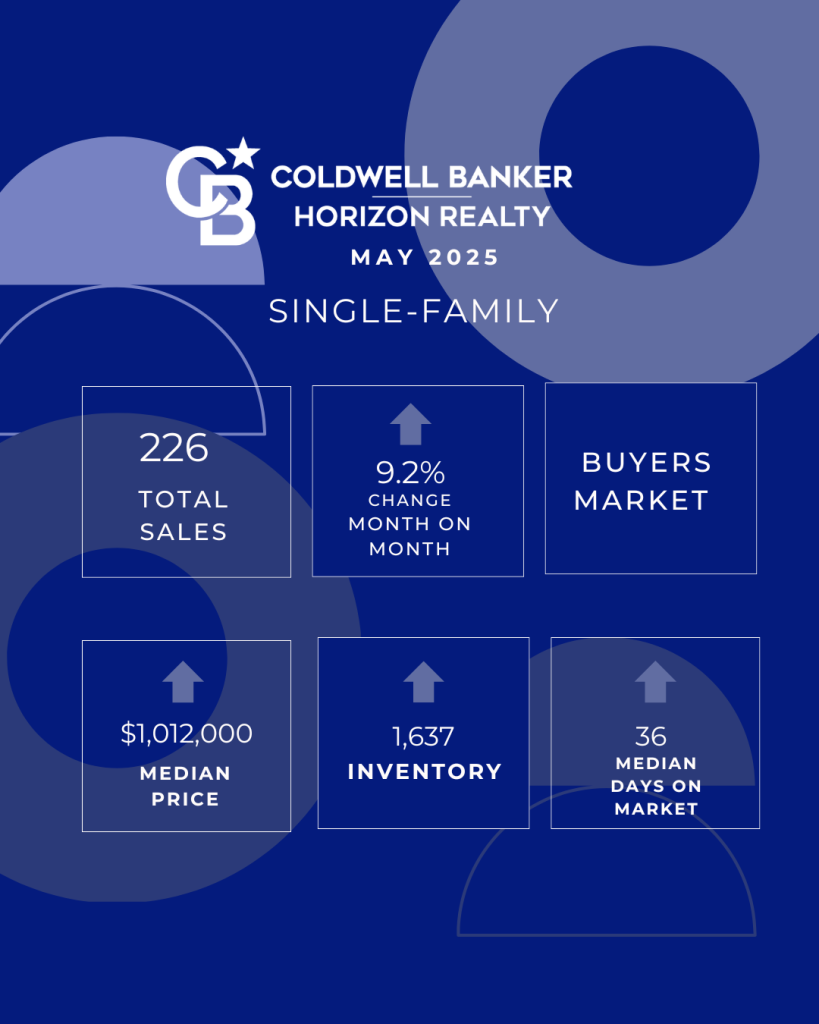

Single-Family Homes May 2025

Home Sales

- May 2025: 226 homes sold.

- Month-over-Month: Up 9.2% from 207 in April 2025.

- Year-over-Year: Up 17.7% from 192 in May 2024.

Median Price

- May 2025: $1,012,000.

- Month-over-Month: Up 5.7% from $957,500 in April 2025.

- Year-over-Year: Up 2.0% from $992,500 in May 2024.

Inventory

- May 2025: 1,637 listings.

- Month-over-Month: Up 4.9% from 1,560 in April 2025.

- Year-over-Year: Up 1.7% from 1,609 in May 2024.

Median Days on Market

- May 2025: 36 days.

- Month-over-Month: Up 5.9% from 34 days in April 2025.

- Year-over-Year: Down 2.7%% from 37 days in May 2024.

Single-Family Home Takeaways:

- Steady Increase in Sales Activity

While activity has picked up, it’s more of a gradual improvement than a dramatic shift, which is normal for this time of year. - Modest Price Growth

This is likely due to some higher-priced homes selling rather than upward price pressure. - Inventory Trending Upward

Inventory numbers remain at a 10-year high. - Days on Market Remains Balanced

Properties are still moving.

Note: The numbers in this post relate to single-family homes only.

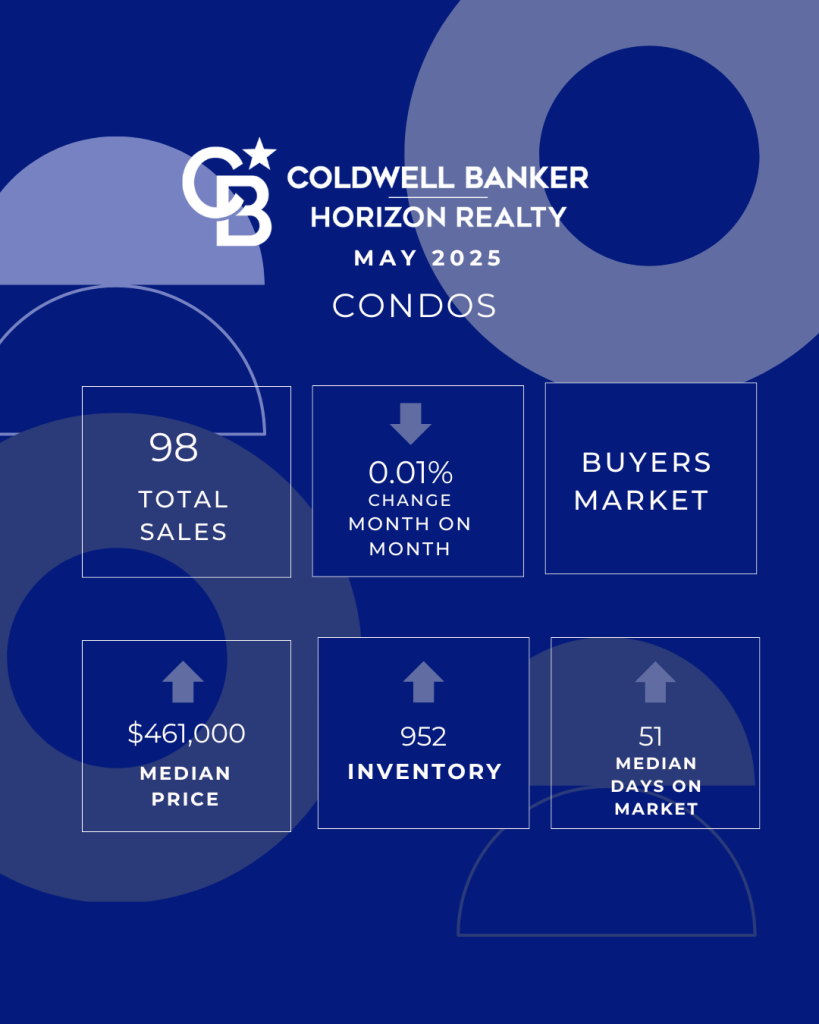

Condos May 2025

Condo Sales:

- May 2025: 98 Condos Sold

- Month-over-Month: Down 0.01% from 99 in April 2025.

- Year-over-Year: Down 21% from 124 in May 2024.

Median Price:

- May 2025: $461,000.

- Month-over-Month: Up 4.8% from $440,000 in April 2025.

- Year-over-Year: Up 2.6% from $449,500 in May 2024.

Inventory:

- May 2025: 952 Listings

- Month-over-Month: Up 5.2% from 905 in April 2025.

- Year-over-Year: Up 23% from 774 in May 2024.

Median Days on Market:

- May 2025: 51 Days

- Month-over-Month: Up 27.5% from 40 days in April 2025.

- Year-over-Year: Up 18.6% 43 days in May 2024.

Condo Takeaways:

-

Sales Holding Steady, but Well Below Last Year

Indicates that while current activity has stabilised, we’re still seeing more cautious buyers compared to last spring. -

Prices Edge Up Despite Softer Sales

Interesting to see prices up slightly despite higher inventory. -

Inventory Continues to Build

Condo supply remains high, giving buyers more options and possibly more negotiating power. This is especially so for ‘investor-oriented’ buildings. -

Longer Time to Sell

This is a key signal that while buyers are active, they’re taking more time—and in some cases, possibly waiting for price adjustments or more attractive financing conditions.

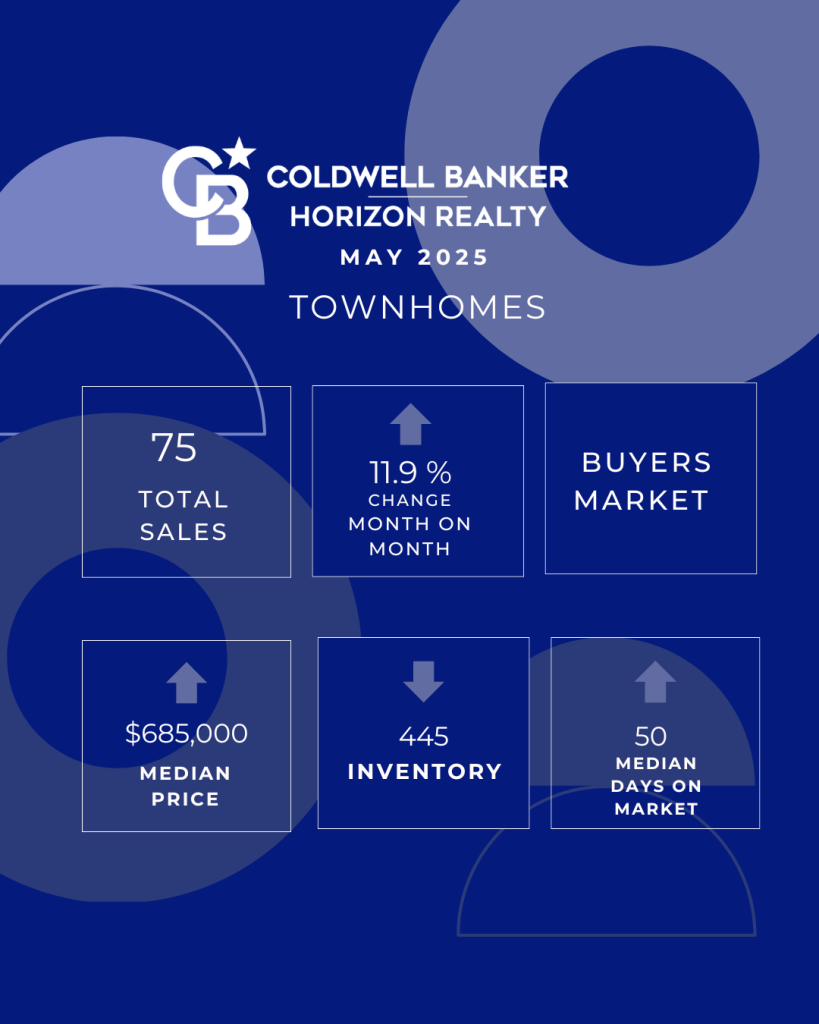

Townhomes May 2025

Townhome Sales:

- May 2025: 75 Townhomes Sold.

- Month-over-Month: Up 11.9% from 67 in April 2025.

- Year-over-Year: Down 7.4% from 81 in May 2024.

Median Price:

- May 2025: $685,000.

- Month-over-Month: Up 1.5% from $675,000 in April 2025.

- Year-over-Year: Up 1.5% from $675,000 in May 2024.

Inventory:

- May 2025: 445 Listings.

- Month-over-Month: Down 0.1% from 450 in April 2025.

- Year-over-Year: Up 5.7% from 421 in May 2024.

Median Days on Market:

- May 2025: 50 Days

- Month-over-Month: Up 8.7% from 46 days in April 2025.

- Year-over-Year: Up 47.1% from 34 days in May 2024.

Townhome Takeaways:

Kelowna Real Estate Market June 2025: Policy and Taxation Updates Impacting Buyers

GST Rebate for First-Time Buyers

Effective May 27, 2025, the federal government introduced a 100% GST rebate on newly built homes priced up to $1 million for first-time buyers. Homes priced between $1 million and $1.5 million are eligible for a partial rebate. This initiative is particularly beneficial for those considering new constructions in areas like Westbank Centre, The Ponds, or North Glenmore.

Property Transfer Tax (PTT) – Administrative Updates

While PTT rates remain unchanged, new administrative requirements have been implemented:

-

Enhanced Documentation: Buyers with temporary Social Insurance Numbers (SINs) must provide additional documentation.

-

Ownership Structures: Transactions involving trusts, co-ownerships, or purchases on reserve lands now require more detailed reporting.

In areas like UBCO and Quail Ridge, where families often co-purchase condos for students, these updates mean additional paperwork, especially if a temporary SIN, trust structure, or non-resident ownership is involved.

Bank of Canada Interest Rate Outlook – June 2025

The Bank of Canada’s upcoming interest rate decision, on June 4, 2025, is under scrutiny, and rates could swing either way. Currently, the benchmark rate stands at 2.75%.

The following analyses suggest that the Bank of Canada may opt to hold its interest rate steady in June to address persistent inflation while monitoring economic conditions.

Economic Indicators

-

-

Persistent Inflation: Core inflation in Canada rose to 3.15% in April, exceeding the Bank’s 2% target, indicating ongoing inflationary pressures.

-

Economic Growth Concerns: RBC Capital Markets economists highlight that Canada’s economy faces challenges, including weak productivity and rising labour costs, which could influence the Bank’s decision-making. MarketWatch+3MarketWatch+3rbccm.com+3

-

Market Expectations: Analysts at Scotiabank note that elevated core inflation has reduced expectations for a rate cut at the Bank of Canada’s June meeting, with the benchmark interest rate likely to remain at 2.75%. Reuters

-

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link