Kelowna Real Estate May 2025: Why Waiting Might Cost You More Than You Think

Welcome to my Kelowna Real Estate May 2025 Market Report!

As we move through Spring 2025, I’m seeing a clear divide in the Kelowna real estate market so far. Many buyers are actively viewing homes but then hesitating, understandably cautious given the current wave of economic uncertainty in the media headlines.

At the same time, I’ve been involved in and heard of multiple-offer situations, showing that demand has been quietly building.

The facts – Inventory is up, interest rates have edged down, and prices are emerging from a subdued 2024. For Buyers, this means more choice and negotiating power than we’ve seen in years. So, why wait?

Markets can shift quickly. There’s plenty of pent-up demand, so we could see a rapid turnaround once confidence returns.

In this post, we’ll look through last month’s numbers & then I’ll walk you through what’s happening beneath the surface. We’ll look at what’s holding some buyers back and what savvy buyers stand to gain right now by acting before the window begins to close.

Kelowna Real Estate May 2025 Stats Report

*NOTE: These numbers were reviewed on May 1, 2025, using Association of Interior Stats and may be subject to minor changes, should further sales be reported for April 2025.

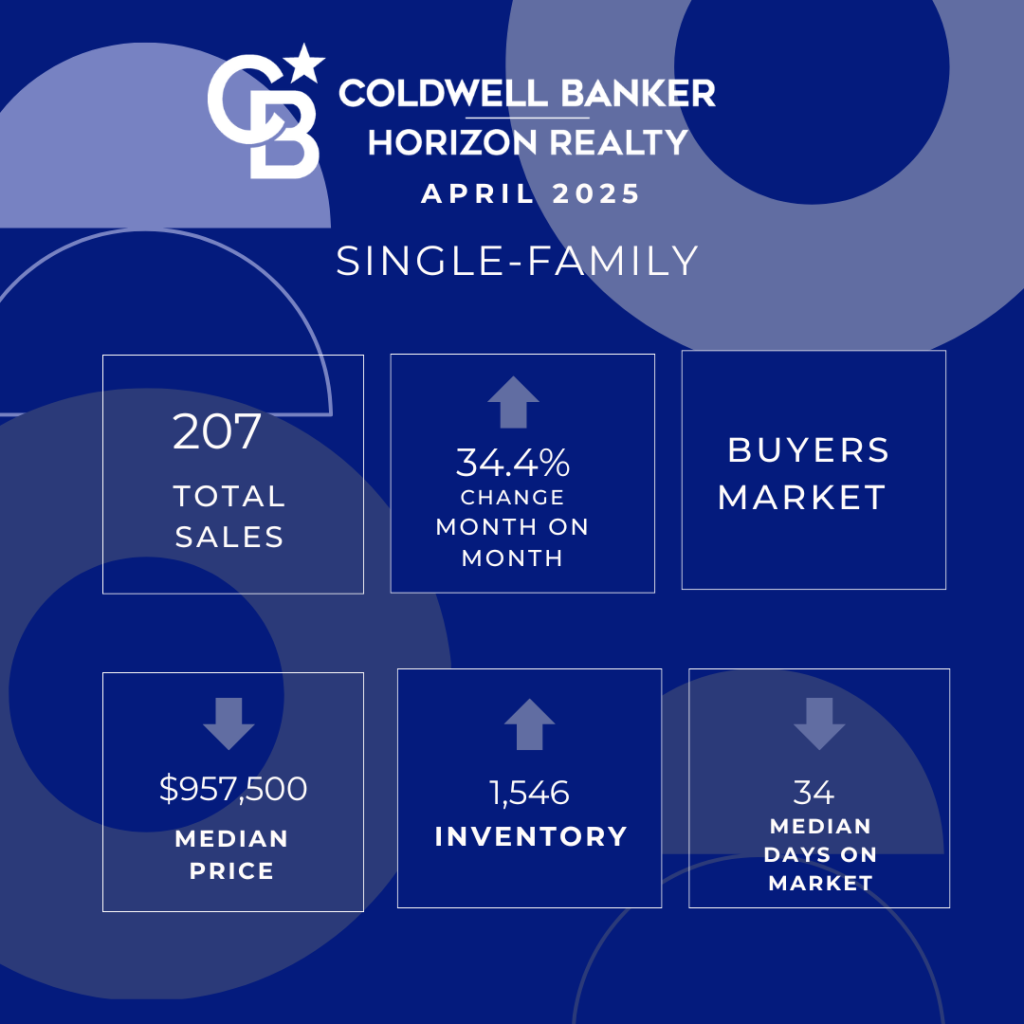

Single-Family Homes April 2025

Home Sales

- April 2025: 207 homes sold.

- Month-over-Month: Up 34.4% from 154 in March 2025.

- Year-over-Year: Up 8.4% from 191 in April 2024.

Median Price

- April 2025: $957,500.

- Month-over-Month: Down 6.8% from $1,027,500 in March 2025.

- Year-over-Year: Down 0.3% from $960,000 in April 2024.

Inventory

- April 2025: 1,546 listings.

- Month-over-Month: Up 5.5% from 1,466 in March 2025.

- Year-over-Year: Up 6.7% from 1,449 in April 2024.

Median Days on Market

- April 2025: 34 days.

- Month-over-Month: Down 8.1% from 37 days in March 2025.

- Year-over-Year: Down 2.9%% from 35 days in April 2024.

Single-Family Home Takeaways:

📈 Sales Activity is Gaining Momentum

-

A clear sign that buyers are returning to the market this spring, perhaps encouraged by stabilised rates or pent-up demand from a slower winter.

💰 Prices Show Signs of Softening

-

Despite stronger sales, sellers are adjusting expectations, possibly due to growing inventory or more cautious buyer sentiment.

🏡 Inventory is Building

-

A continued rise in supply is giving buyers more options and negotiating power, putting slight downward pressure on prices.

⏱ Homes Are Selling a Little Faster

-

A sign of improving buyer activity, even if pricing isn’t at peak levels.

While it’s encouraging to see activity picking up this spring, the slight dip in prices combined with rising inventory suggests we remain in a Buyers Market. Sellers need to be pricing strategically, and buyers have more room to shop around, especially if they’re move-in ready. This could be a great window for upsizers or downsizers to make a move before more listings flood the summer market.

Note: The numbers in this post relate to single-family homes only.

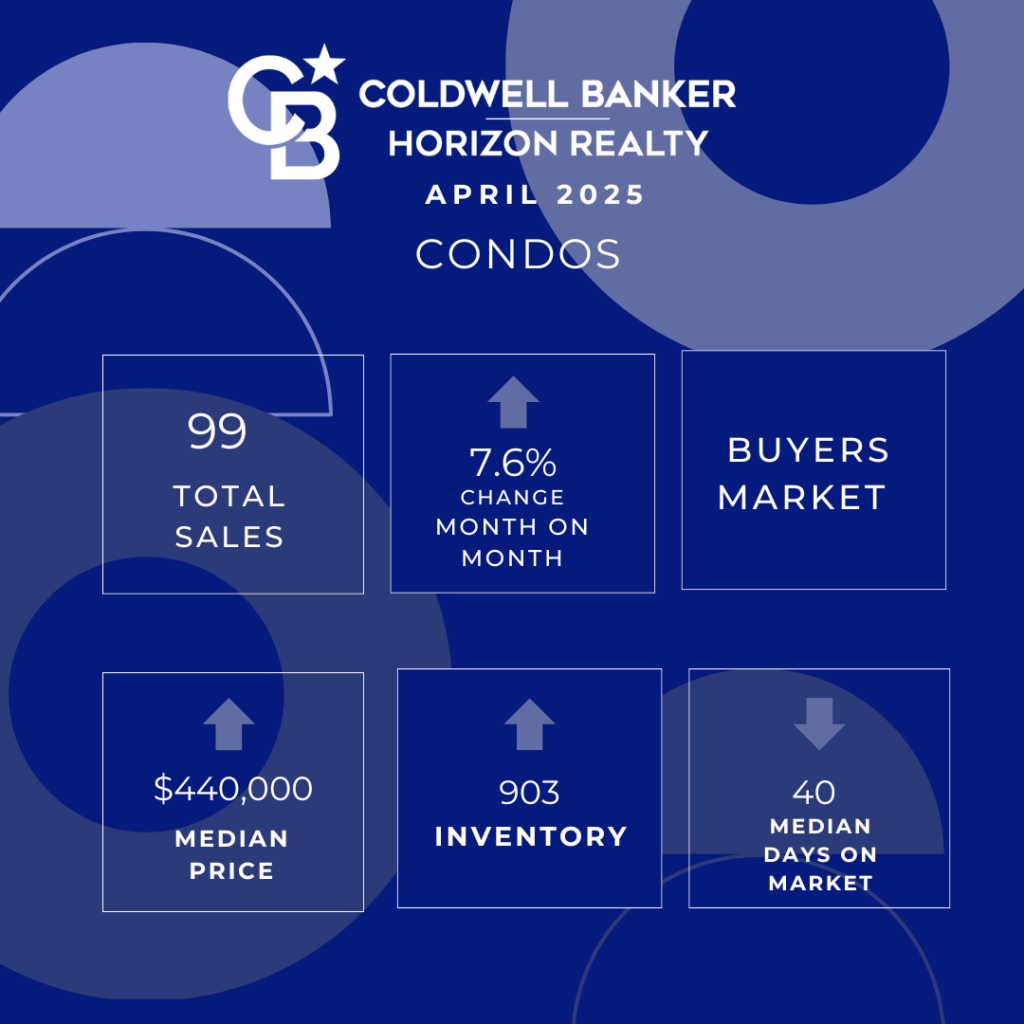

Condos April 2025

Condo Sales:

- April 2025: 99 Condos Sold

- Month-over-Month: Up 7.6% from 92 in March 2025.

- Year-over-Year: Down 10% from 110 in April 2024.

Median Price:

- April 2025: $440,000.

- Month-over-Month: Up 6.3% from $414,000 in March 2025.

- Year-over-Year: Down 7.4% from $475,000 in April 2024.

Inventory:

- April 2025: 903 Listings

- Month-over-Month: Up 11.2% from 812 in March 2025.

- Year-over-Year: Up 24.9% from 723 in April 2024.

Median Days on Market:

- April 2025: 40 Days

- Month-over-Month: Down 4.8%% from 42 days in March 2025.

- Year-over-Year: Up 5.3% 38 days in April 2024.

Condo Takeaways:

📊 Sales Still Lagging Behind Last Year

-

Shows modest spring activity, but the market hasn’t fully rebounded from last year’s higher numbers, likely due to oversupply or shifting buyer priorities.

💵 Prices Bounce Back Month-to-Month

-

Some short-term strength, but overall prices remain well below 2024 levels, pointing to longer-term softening.

📦 Inventory Surge Continues

-

A major influx of listings gives buyers more leverage and signals potential challenges for sellers needing quicker sales.

⏳ Condo Sales Taking Longer

-

Slightly quicker than March but slower than last year – an indicator that condos are lingering longer, possibly due to increased supply or cautious buyers.

While we’re seeing some price recovery month-over-month, the sharp rise in inventory and slower YoY sales says condo sellers need to be extra strategic. Whether it’s rental restrictions, investor pullback, or affordability limits, the market is offering opportunities – but only for those pricing competitively and marketing to the right audience.

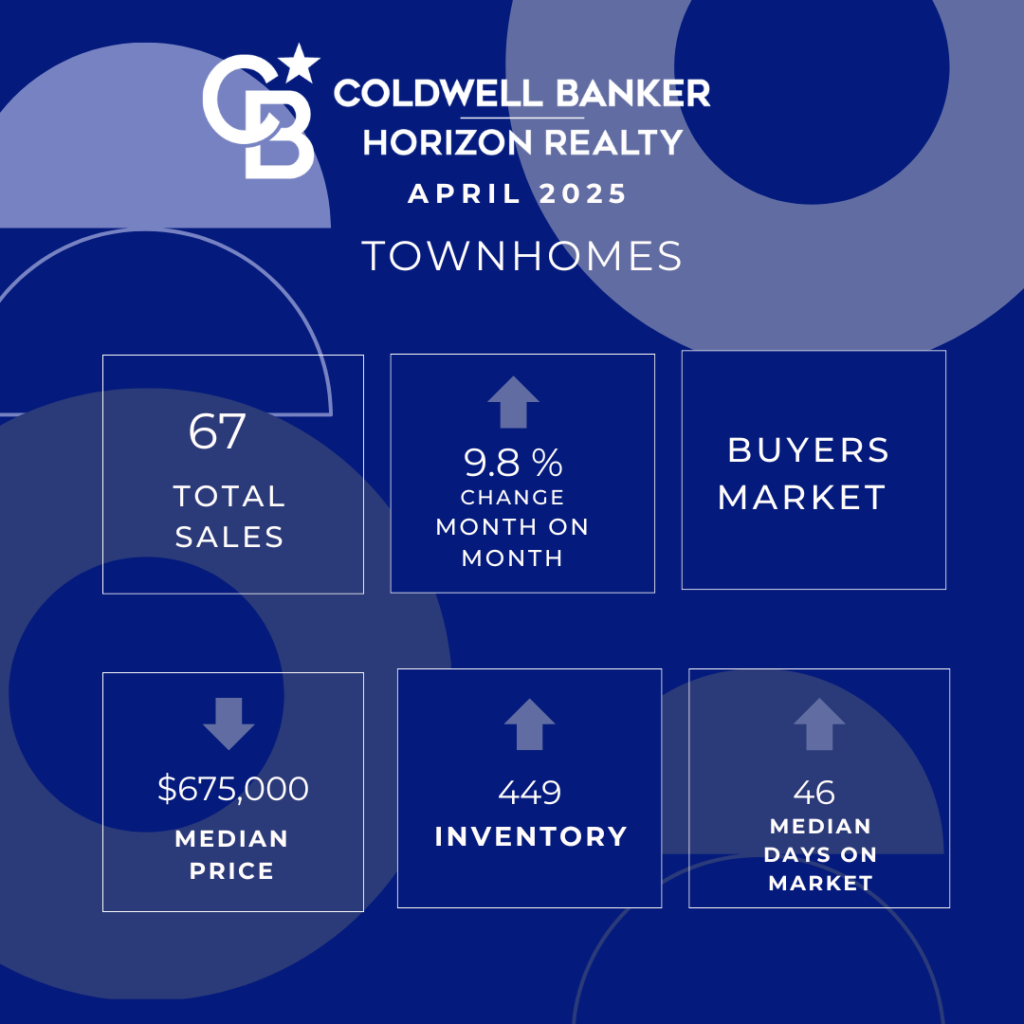

Townhomes April 2025

Townhome Sales:

- April 2025: 67 Townhomes Sold.

- Month-over-Month: Up 9.8% from 61 in March 2025.

- Year-over-Year: Down 5.6% from 71 in April 2024.

Median Price:

- April 2025: $675,000.

- Month-over-Month: Down 6.3% from $720,000 in March 2025.

- Year-over-Year: Down 0.3% from $677,000 in April 2024.

Inventory:

- April 2025: 449 Listings.

- Month-over-Month: Up 4.4% from 430 in March 2025.

- Year-over-Year: Up 15.7% from 388 in April 2024.

Median Days on Market:

- April 2025: 46 Days

- Month-over-Month: Up 48.4% from 31 days in March 2025.

- Year-over-Year: Up 17.9% from 39 days in April 2024.

Townhome Takeaways:

🏘️ Sales Improving Month-to-Month, But Below Last Year

-

Spring activity is picking up, but not at the pace we saw in 2024.

💲 Prices Have Softened

-

A fairly stable year-over-year number, but the recent drop suggests sellers may be adjusting to meet buyer affordability.

📈 Inventory Climbing

-

Increased selection is giving buyers more breathing room, which may continue to affect pricing if demand doesn’t catch up.

🕰️ Homes Taking Much Longer to Sell

-

A clear sign that buyers are taking their time, and that townhome listings may need stronger value propositions to move.

We’re seeing more supply than demand in the townhome segment, with price resistance showing up in both longer days on market and monthly price declines. For families or downsizers looking for more space without detached-home pricing, this could be a sweet spot—but sellers need to stage, price, and market strategically to stand out.

🔍 So What’s Holding Buyers Back?

1. Global Trade Tensions and Economic Anxiety

Trade instability involving Canada, the U.S., and China is shaking economic confidence across B.C. Fears around tariffs and global growth are sidelining buyers, now waiting for clarity before committing to a major purchase.

2. Volatile Interest Rate Outlook

Mortgage rates have dropped, and some buyers are hoping they will drop further to ease their affordability concerns. But beware, the Bank of Canada is now cautious about cutting further due to potential inflation from trade issues. If bond yields rise, so too might fixed mortgage rates, making “today’s rate” potentially the best we’ll see for a while.

3. Lingering Buyer Hesitation

Despite improved borrowing conditions, many buyers remain on the fence, unsure whether now is truly the right time. This cautious mindset, caused by tariffs, job uncertainty, & affordability, may mean missing out on a market that actually favours buyers more than we’ve seen in years.

4. Fear of Recession

BCREA warns that B.C.’s economy is facing near-zero growth this year, with a risk of recession. This environment naturally fuels uncertainty, but for experienced investors, it can also signal opportunity before recovery takes hold.

5. Concerns About Home Price Direction

With increased supply, buyers worry that prices might fall further. However, prices in the Okanagan are forecast to rise 1.4% in 2025, then jump 2.6% in 2026. The real danger? Waiting too long and being priced out when momentum returns.

🌟 The Real Opportunity: Why Smart Buyers Are Moving Now

1. Lock in Today’s Lower Rates Before They Rise

We’re currently sitting below 4% on five-year fixed high ratio mortgages, down from over 6% in late 2023. If Buyers wait and rates reverse direction, the results will be:

-

Raising monthly costs for first-time buyers, thus weakening affordability again.

-

Refinancing will be more expensive.

-

A slowdown down investor momentum

2. Unmatched Selection and Negotiation Power

Kelowna’s inventory is at its highest level in over a decade, offering unprecedented choice, especially in the condo and townhome markets. You can take your time, negotiate, and include subjects—luxuries that often disappear in a seller’s market.

3. Prices Are Stable—But Won’t Stay That Way

BCREA forecasts modest price growth in 2025, but stronger gains in 2026 as confidence and demand rebound. For buyers, this is your quiet window—a chance to buy before prices ramp up again.

4. Stack Government Incentives to Maximise Value

Tools like the FHSA (First Home Savings Account), federal first-time buyer supports, and BC’s housing affordability plans can be leveraged right now. These incentives won’t last forever and may change with elections or shifting fiscal priorities.

5. Kelowna’s Growth Story Is Just Getting Started

With new infrastructure & development, such as the expansion at Kelowna International Airport, the new Transit Centre near UBCO, the new Parkinson Recreation Centre, UBCO’s downtown expansion, and population growth, Kelowna continues to attract talent, retirees, and remote workers. Those who buy in now are positioning themselves for strong long-term equity gains, especially in areas like the University District and Glenmore.

💬 Final Thoughts: Time in the Market Beats Timing the Market

If you’re feeling uncertain, you’re not alone—but sometimes, the best opportunities arise when others are hesitating. With interest rates still attractive, plenty of listings to choose from, and room to negotiate, this could be the moment to make a smart, strategic move.

I’ve helped many clients navigate through market shifts like this before—and timing truly matters. Whether you’re buying your first home, upsizing, or investing in a second property, I’m here to provide honest advice, local insights, and a clear plan tailored to your goals.

📞 Let’s Chat

- Ready to take the next step?

- Call or text Trish at 250-864-1707

- Contact Trish Cenci PREC* by email: here.

Let’s make your next move a confident one!

Other Links:

BC Real Estate Housing Forecast April 2025: Full Details

This month’s Photo: Sunset at Rotary Beach, Kelowna, April 2025.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link