Welcome to the Kelowna Real Estate Market November Report. I can’t believe I am writing in November already, but as I look out the window, we have snow on the hills!

Welcome to the Kelowna Real Estate Market November Report. I can’t believe I am writing in November already, but as I look out the window, we have snow on the hills!

October 2024 saw quite an uptick in sales compared to September. This was especially so for Single-Family Homes and Town Homes.

The most interesting item of note is that despite persistent higher inventory, Sellers are holding firm on pricing. The result is, that we have only seen modest slippage in the Median Sales prices of late.

Here’s a detailed look at October’s numbers for single-family homes, condos, and townhomes.

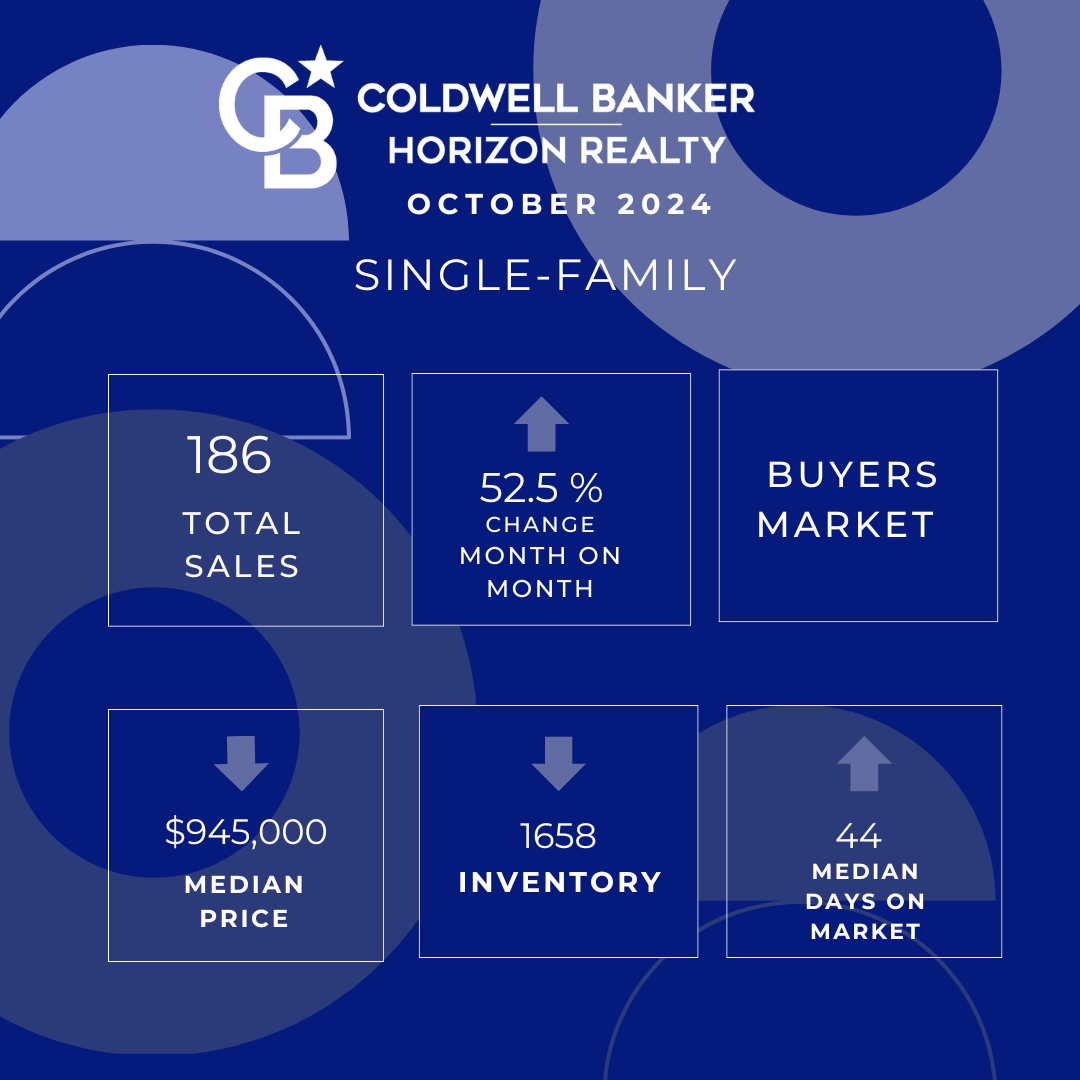

Single-Family Homes: Sales Up & Prices down modestly.

- Sales: 186 homes sold—up by 52.5% from September 2024 122 and up from 119 in October 2023.

- Median Price: $945,000, down only 1.1% from $955,000 last October and down from $957,750 last month.

- Inventory: 1,658 homes, down 12% from last month’s 1,885 units, but a significant 18.6% jump from 1,398 in October 2023.

Sales of single-family homes saw a big lift from last month. I merely see this as a bounce-back from the lower numbers in September, rather than the Bank of Canada interest rate making Buyers jump in. Sellers are digging in on their price, which hasn’t shifted much from last year, leaving the buyers, who were hoping for a further price drop, increasingly looking like they’re going to be out of luck.

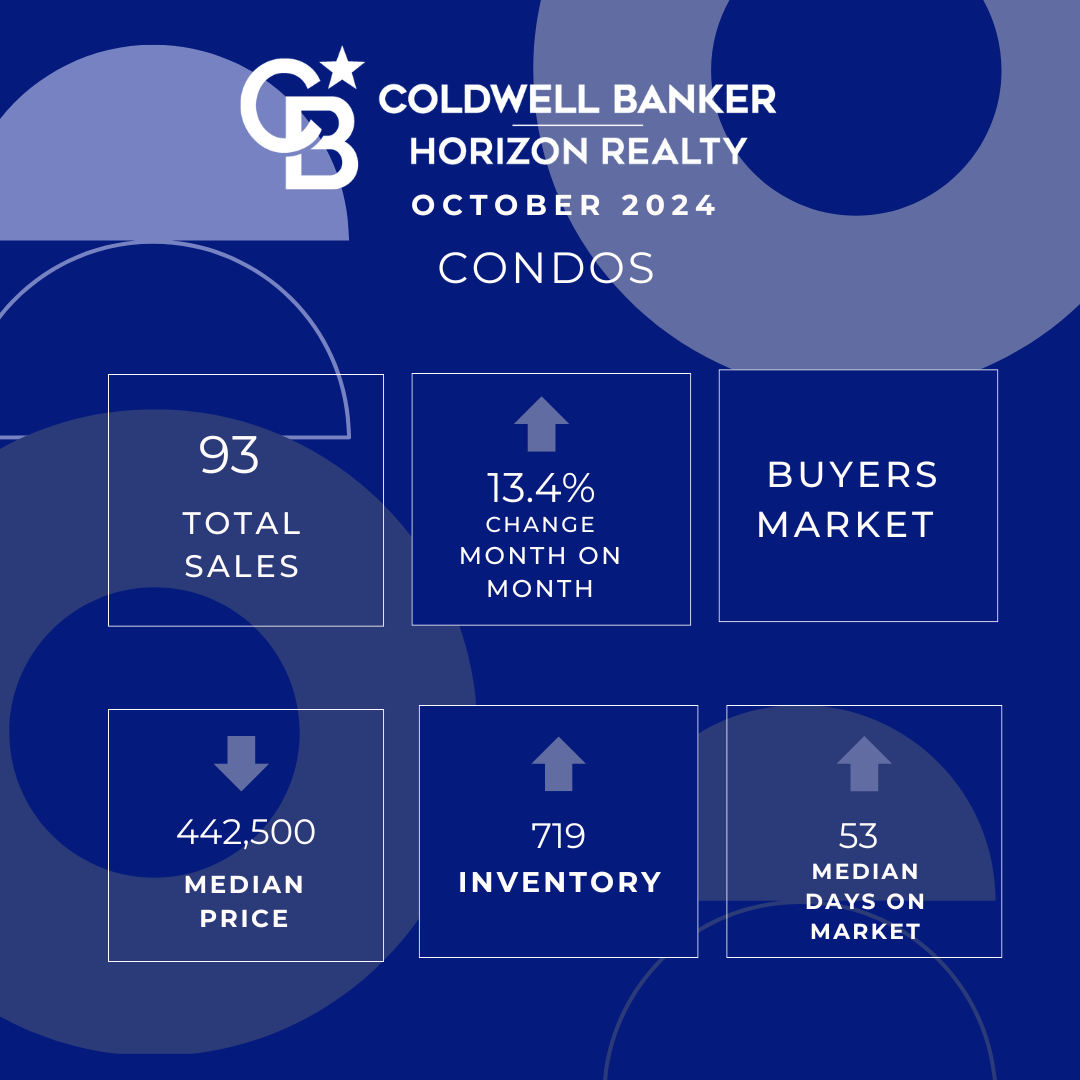

Condos: Sales Up & Prices Down.

- Sales: 93 units, up 13.4% from last month, and up 22.4% from 119 units in October 2023.

- Median Price: $442,500, a more notable 9.5% dip from $489,000 last year.

- Inventory: 719 condos, up 3.6% from 694 last month & up 28.2% from 561 in October 2023.

Condos sales did not bounce back as solidly as other sectors last month & prices have dropped more here than in other sectors. The rising days-on-market figure suggests buyers are cautiously weighing their options, but any significant price drops are becoming less likely as Sellers ‘dig-in’. There is some concern that there are a number of new projects due to be completed soon which could potentially add to inventory, especially following this years change to the short-term rental rules.

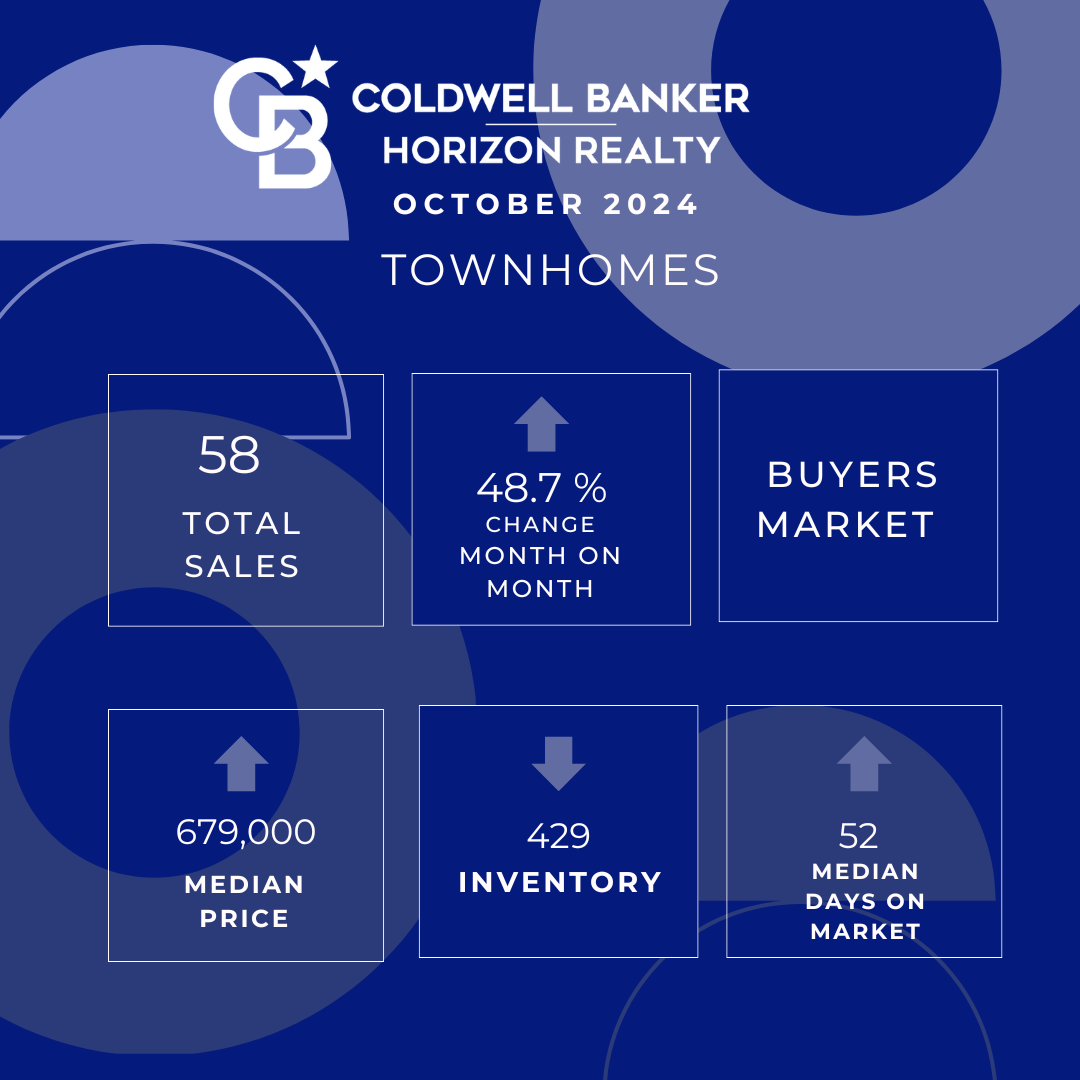

Townhomes: Sales & Prices Up

- Sales: 58 units, a strong 48.7% bounce-back from last month & 31.8% increase over last year’s 44.

- Median Price: $679,000, down just 3.5% from October 2023’s $702,450. and up from $662,500 last month.

- Inventory: 429 units, a substantial 30.4% increase from last year’s 329 units, but down from 449 last month.

Townhomes also saw a sizable increase in sales from last month, with median prices staying largely stable, suggesting Sellers in this segment, too, are committed to holding firm. With properties in this price range, more in line with most Buyers’ affordability budgets, those eyeing further declines may need to rethink, as October’s numbers point to a more stabilised market.

Other Real Estate Links

BC Real Estate Association October 2024 report

Trish’s Real Estate Listings

This month’s Photo – October Sunset over Lake Okanagan looking towards the Bridge.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link