If you plan to sell your home in Kelowna, keeping an eye on key stats & economic info can give you a clearer picture of Real Estate Market trends.

If you’re not ready to call your Agent yet, but want to understand whether the market is shifting here are the key numbers to watch:

Key Stats & Economic Info – Real Estate Statistics to Watch

- Inventory Levels

- What to Watch: The number of homes for sale, including condos and townhomes.

- Why It Matters: Rising inventory can indicate a shift towards a buyer’s market while decreasing inventory suggests a seller’s market.

- Where to Find: In my monthly Kelowna Real Estate Market update Trish Cenci Blog or the Association of Interior Realtors Market Stats

- Current Stats: For Sale, as of December 31, 2024, 1,178 homes (Down 17.9% from November) 598 Condos (Down 13.1% from November) & 329 Townhomes (Down 15.6% from November).

- What does this mean? Reduced inventory is common in Kelowna this time of year as some Sellers take a break from the Market during the Winter Months. It is also normal for inventory to rise in the Spring. If this does not correspond with an increasing number of Buyers, then the market may become oversupplied, which will potentially put downward pressure on prices.

- Days on Market (DOM)

- What to Watch: How long properties stay on the market before selling.

- Why It Matters: A longer DOM can signal a slowing market, while a shorter DOM suggests a hotter market.

- Where to Find: Trish’s Blog or Association of Interior Realtors local MLS® Reports.

- Current Stat: December 2024 DOM is Homes 70 days( up from 63 days in November), Condos 58 days (up from 39 Days in November) & Townhomes 55 days (up from 53 Days in November).

- What does this tell us – All types of property are taking longer to sell, in Kelowna, which is normal at this time of year. If these numbers start to fall, it is a sign that there is improving demand in the market

- Median Sale Price

- What to Watch: Trends in home prices.

- Why It Matters: Consistent increases or decreases in prices can signal changes in market conditions.

- Where to Find: Trish’s Blog or AOIR Stats

- Current Stats: The median sale prices as of December 31, 2024 – Homes $970,000 (up 3.2% from November 2024), Condos $432,000 ( Down 5.6% from November 2024) Townhomes $645,000 (up 0.01% from November 2024).

- What this tells us – demand is improving especially for affordable Family Homes, Condos remain more subdued and Townhomes are steady. It is affected by the demand for a particular type of property against the current inventory.

- Sales -to-Active Listings

- What to Watch: The percentage of listed homes that sold in a given month.

- Why It Matters: It measured the tightness of the Market. A ratio below 15% is a Buyer’s Market, 15%-20% is a balanced market and over 20% is a Seller’s Market.

- Where to Find: BC Real Estate Association Monthly Stats update

- Current Stat: The current sale-to-list price ratio is 9.7% up from 8.7% in December 2023.

- What this tells us – that it remains a Buyer’s market, but the market has improved very slightly.

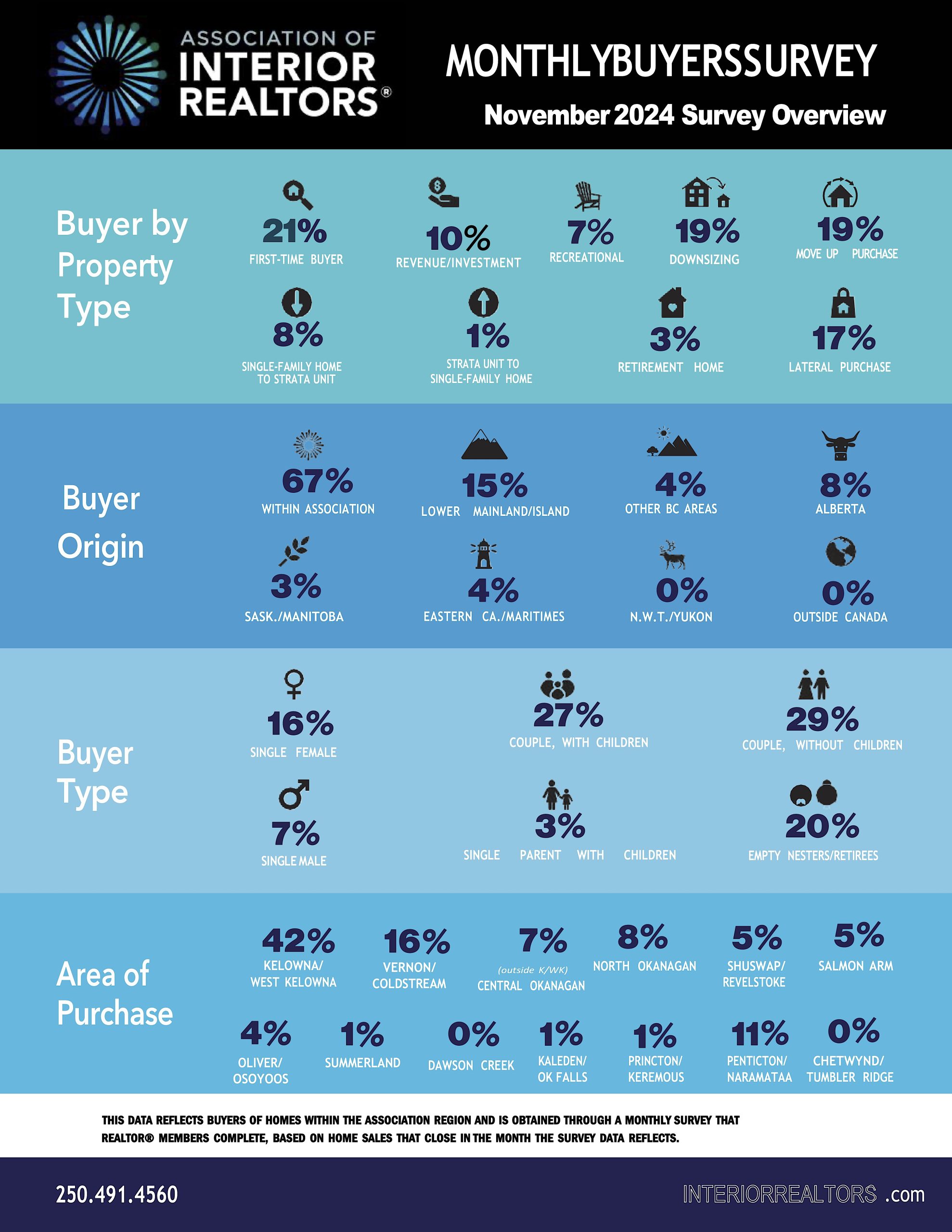

- Buyers Survey Results

- What to Watch: Buyers Survey Results from the Central Okanagan.

- Why It Matters: Provides a guide to Sellers of how many Buyers may be looking for their type of property.

- Where to Find: Association of Interior Realtors via your Realtor®.

- Current Stat: See the infographic below.

- What it tells us – What types of Buyers are currently busy in the market, which locations are they Buying in and where are they moving from.

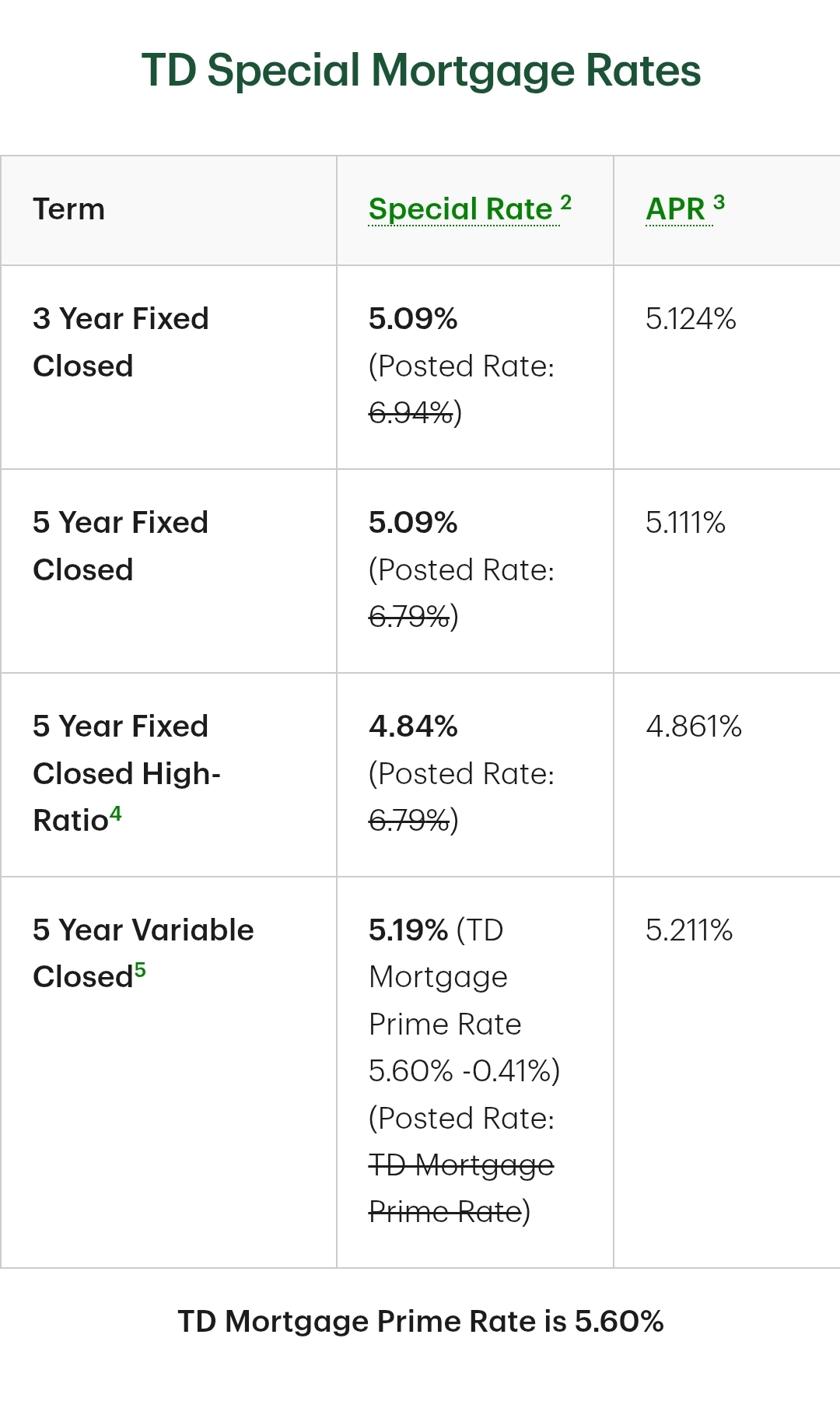

- Interest Rates

- What to Watch: Changes in mortgage rates.

- Why It Matters: Rising rates can reduce buyer affordability, potentially slowing the market.

- Where to Find: TD Bank Mortgage Rates or local mortgage brokers.

- Current Stat: See below – current mortgage interest rate with TD Bank as at January 15, 2025.

- What it tells us – Interest rates have started to fall, which should ease affordability for some Buyers, and therefore create increased demand.

Key Economic Indicators to Watch

- Unemployment Rate

- Why It Matters: High unemployment can reduce buyer confidence and purchasing power.

- Where to Watch: Government of Canada Employment Stats, BC Unemployment & Key Economic Indictors.

- Current Stat: The current unemployment rate in BC is 6%. Kelowna December 2024 – 5.3%.

- Consumer Confidence Index

- Why It Matters: Reflects consumer optimism about the economy, which can influence their willingness to buy homes.

- Where to Watch: Conference Board of Canada or local business publications.

- Current Stat: The current Consumer Confidence Index as of December 2024 is 60.0 (2014=100).

- Inflation Rate

- Why It Matters: Higher inflation reduces overall affordability, impacting housing demand.

- Where to Watch: Stats Can Consumer Price Index Portal

- Current Stat: The current Consumer Price Index number as of November 2024 is 1.9%.

- Interest Rates

- Why It Matters: Directly affects mortgage rates and buyer affordability.

- Where to Watch: Bank of Canada Policy Rate announcements and updates.

- Current Stat: The current Bank of Canada’s overnight lending rate is 3.25%.

- GDP Growth

- Why It Matters: Reflects the overall economic health and growth, influencing housing demand.

- Where to Watch: BC Real Estate Association Nowcast

- Current Stat: For the first 11 months of the year, the Nowcast estimate of BC’s real GDP growth is 1.5 per cent.

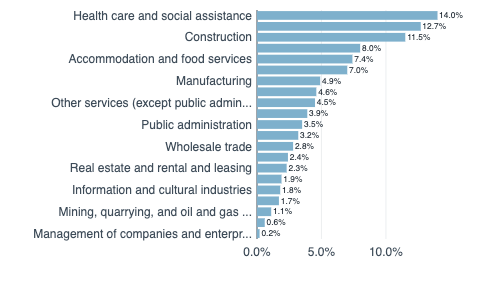

- Local Industry Performance

- Why It Matters: Sectors like tourism, tech, and the wine industry are crucial to Kelowna’s economy and housing market.

- Where to Watch: Kelowna Chamber of Commerce, Kelowna Tourism Industry Reports, or the Central Okanagan Economic Development Commission Key Central Okanagan Economic Indicators

- Current Stat: Breakdown of Employment in the Central Okanagan by Sector -:

Key Stats and Economic Info Current % Employment Central Okanagan by Sector 2024

By keeping an eye on these real estate and economic indicators, you can better anticipate market trends and make informed decisions when selling your home in Kelowna. Understanding these numbers helps you stay ahead of the curve and adapt your strategy to current market conditions.

Remember, if this is all too much for you, you can always contact your Agent for help! :

If you’re getting ready to sell and would like help? Please feel free to call me, Trish Cenci, Tel 250 864 1707 or email me here

Disclaimer: The information provided in this blog post is for informational purposes only and should not be considered financial or legal advice. For specific advice regarding your real estate situation, please consult with a professional real estate agent, financial advisor, or legal expert.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link