I read a news report, this week, which I thought could easily apply to the Kelowna Real Estate Market. It came from a Chief Operating Officer of the Conwest Group, a BC Residential & Commercial Building Development Company.

” In a price discovery period … sellers realize what today’s buyers are willing to pay. We believe this market is not going to last forever. There is no inventory. We will get our price. We just have to wait for it”.

I couldn’t agree more! The main unknown factor remains how high-interest rates will have to go to bring inflation into line. It is causing some Developers and an increasing number of Buyers to pause, as finance costs and affordability challenges grow.

Clearly, the market is slowing, especially as we head towards winter. However, if one of my recent Open Houses is anything to go by, there are still buyers out there. For example, we saw an uptick in Buyer’s coming from the Lower Mainland and Island, during September 2022, representing 25% of Buyers in the Central Okanagan Region.

Interestingly there were 13 Residential sales of over $2 million last month in the Kelowna & Central Okanagan Real Estate area. The highest price home sale was $8,000,000, which was a Lake Country Waterfront home, set on 5.9 acres.

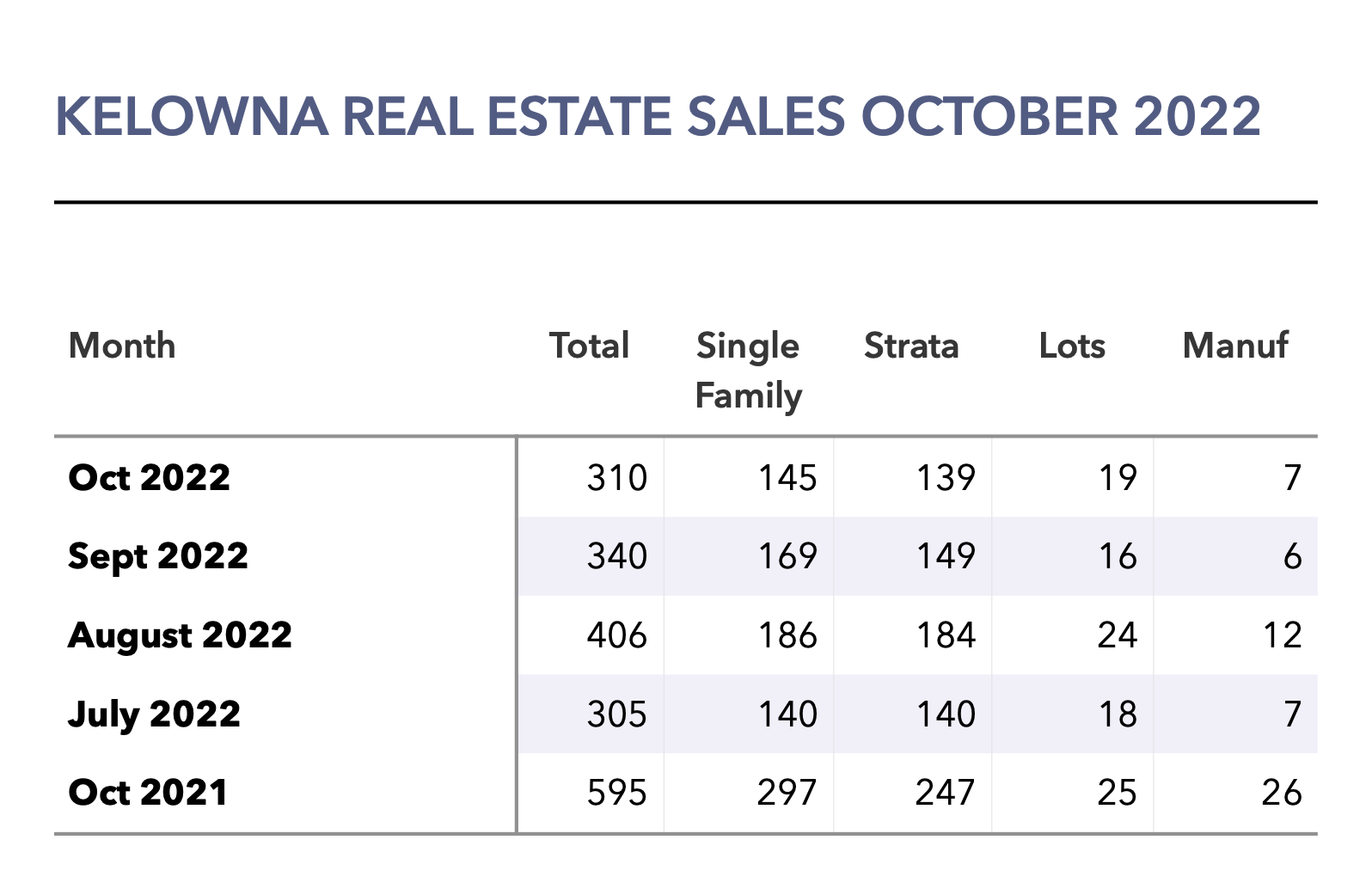

Kelowna and Central Okanagan Real Estate Sales October 2022

Compared to last month

Compared to last year

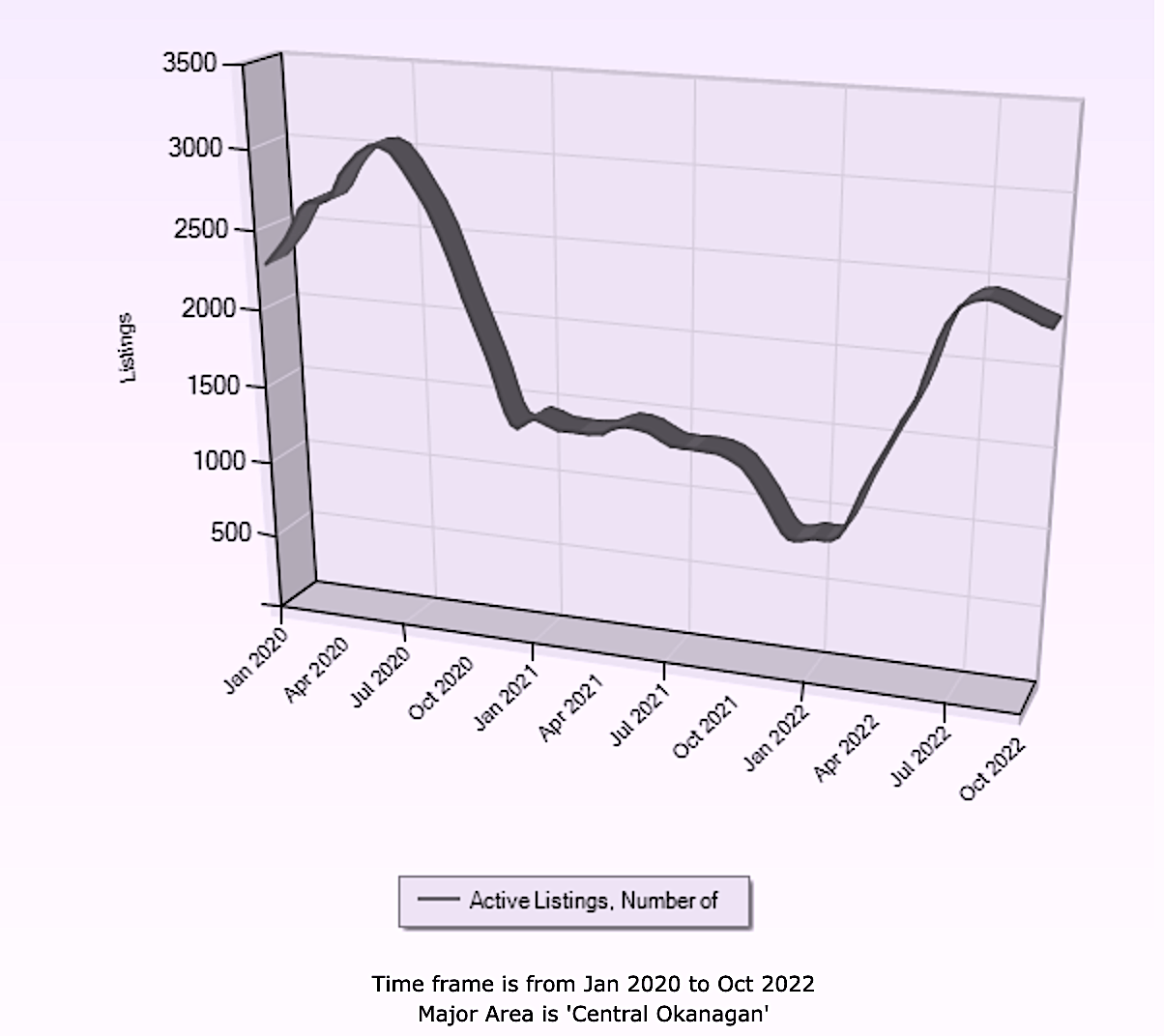

Inventory Levels Kelowna & Central Okanagan October 2022

Kelowna Real Estate – Total Listings

Single-Family Homes (Homes & Bare Land Strata) October 2022 1047 units, were down by 1.4% compared to Sept 2022 1,062 and up by 1.11% from September 2021 496.

Condos Oct 2022 464 units, down by 6.6% compared to September 2022 497, and up 94.1% on Oct 2021 239.

Townhomes Oct 2022 320 units numbers were down by 7.7% compared to Sept 2022 297 and up 133.6% from Oct 2021 137.

Kelowna Median Real Estate Prices October 2022

Single Family Homes & Bare Land Strata

The Median Residential Home sale price in our area for October 2022 was $922,500. September 2022 $955,000 August 2022 $952,500 October 2021 $941,000 March 2022 (peak) $1,150,500.

The median price has now fallen below its 2021 levels, and is down 19.8% since March 2022 peak.

Condos

The Median Condo sale price for October 2022 was $470,000.

September 2022 $471500 August 2022 $488,500 October 2021 $439,900 – March 2022 (Peak) $520,000.

The median price was slightly down compared to last month, still above 2021 levels & down 9.6% from the March 2022 peak.

Townhomes

The Median Townhome price for October 2022 was $666,150.

September 2022 $700,000 August $697,950 October 2021 $667,00 – Peak was March $786,000.

The median price is currently was down by 4.8% last month & down 15.2% since March 2022.

This represents quite a sizeable fall in median Townhome prices, which could be a signal that the interest rate rises are affecting affordability, forcing Buyers to negotiate harder with Sellers looking to get a sale.

Kelowna Real Estate Market – My thoughts this month

1. Interest Rates – The Bank of Canada increased interest rates by a further 0.5% last month, taking the overnight rate to 3.75%. While there are signs that inflation levels are starting to reduce, it is not likely to be enough to rule out another interest rate rise before the end of the year. This will continue to affect affordability for some buyers & it will therefore continue to affect Real Estate sales numbers.

2. Impact of a tight rental market – with more Buyers being ruled out of the Market through affordability concerns the rental market will remain tight. This may encourage some investors back into the Real Estate Market.

3. Kelowna Real Estate Inventory – numbers seemed to have levelled out, rather than continuing to rise, as they have in some BC communities. This is likely to be better news for Sellers, as our market may then stay balanced rather than becoming a Buyers’ market resulting in less pressure on prices.

For Buyers – continue to get pre-approved for Mortgages before you start looking. Rising interest rates are affecting qualification levels.

For Sellers – expect to have less showings at this time of year. Make sure your home is ready for winter, and take care of any maintenance & decoration issues. First impressions are important and your home needs to show at its best.

ACCESS TO ADDITIONAL ECONOMIC REPORTS & INFORMATION

Okanagan Real Estate Quarterly Market Review October 2022 Okanagan Market Review 1:4ly Real Estate Report October 2022

BCREA Canadian Economic Growth Report October 2022 Bc Real Estate Economic Growth Report October 2022

BCREA Bank of Canada Interest Rate Announcement October 2022 Bank of Canada Interest Rate Announcement details October 2022

Kelowna and Centrale Okanagan Real Estate Buyers Survey Results September 2022 Kelowna Real Estate Buyers Survey Report September 2022

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link