Kelowna Real Estate Market July 2025

Welcome to my Kelowna Real Estate Market July 2025 Report.

Showings have remained sluggish during June, leaving many Sellers riding a roller-coaster of hope and repricing stress.

Buyers, meanwhile, are leaning in by being aggressive with offers, intent on saving every last dollar.

Inventory continues its upward climb, and with it, Seller anxiety. Uncertainty with International Tariffs and concerns over how far the market may correct hang over the market, and the path for Bank of Canada interest rate is also not clear.

As a result, the Kelowna Housing Market is struggling to find its footing.

Kelowna Real Estate July 2025 Stats Report

*NOTE: These numbers were reviewed on July 5, 2025, using Association of Interior Stats and may be subject to minor changes, should further sales be reported for June 2025.

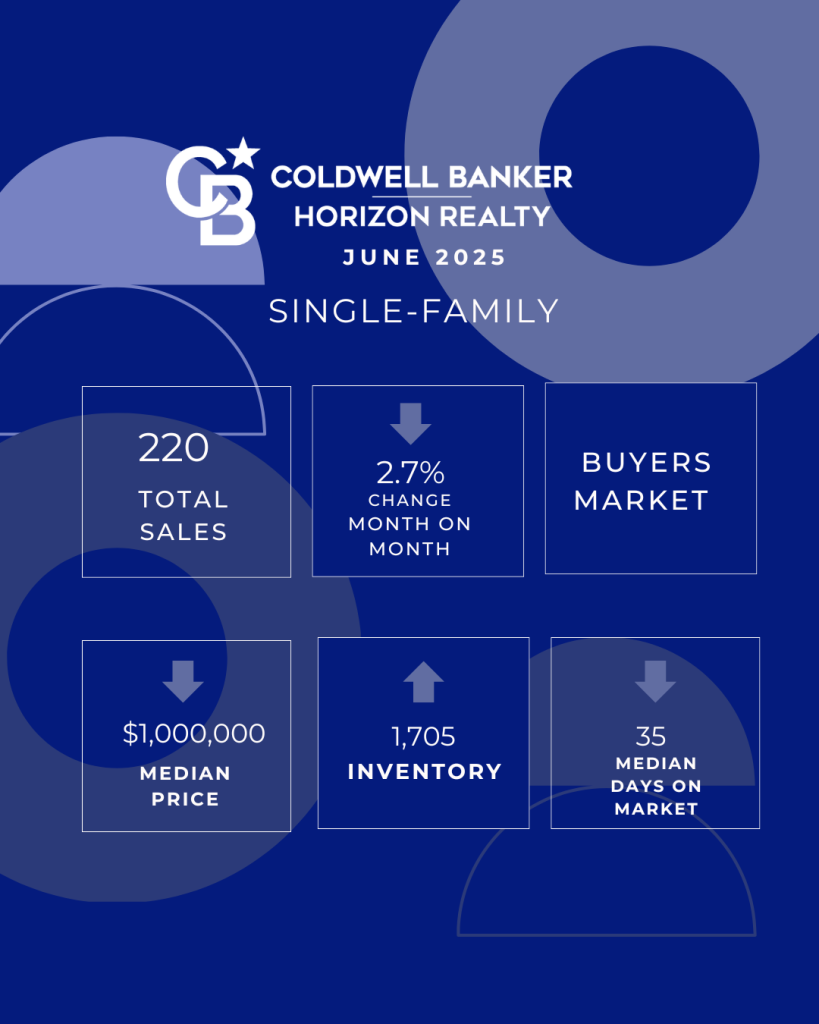

Single-Family Homes June 2025

Home Sales

- June 2025: 220 homes sold.

- Month-over-Month: Down 2.7% from 226 in May 2025.

- Year-over-Year: Up 15.1% from 191 in June 2024.

Median Price

- June 2025: $1,000,000.

- Month-over-Month: Down 1.2% from $1,012,500 in May 2025.

- Year-over-Year: Up 1.4% from $986,000 in June 2024.

Inventory

- June 2025: 1,705 listings.

- Month-over-Month: Up 4.5% from 1,631 in May 2025.

- Year-over-Year: Down 1.8% from 1,7037 in June 2024.

Median Days on Market

- June 2025: 35 days.

- Month-over-Month: Down 2.7% from 36 days in May 2025.

- Year-over-Year: Down 5.4%% from 37 days in June 2024.

Single-Family Home Takeaways June 2025:

- Sales up slightly, but Buyer hesitancy lingers – home sales are up modestly year on year, but Buyers remain cautious, many holding back due to ongoing uncertainty around interest rates, and international tariffs.

- Prices are holding, but Buyers are being aggressive – while the median price remains stable, there’s consistent pressure from buyers negotiating harder, many coming up well under the asking price, especially where properties have been on the market a while.

- Inventory is still climbing – listings rose again in June, giving buyers more leverage. Though slightly down from last year, supply remains on the higher side, adding to the competitive atmosphere for Sellers.

- Steady days on market numbers may be masked by re-listings – the median days on market has remained relatively stable. However, there is evidence of some sellers re-listing at lower prices, which could be distorting these numbers and giving a false sense of speed.

- Buyers market conditions persist – with the increase in listings and sales, struggling, the market remains in the buyers’ favour. Sellers need to continue to be sharp with pricing and presentation to compete, especially with growing options and savvy Buyer tactics.

Note: The numbers in this post relate to single-family homes only.

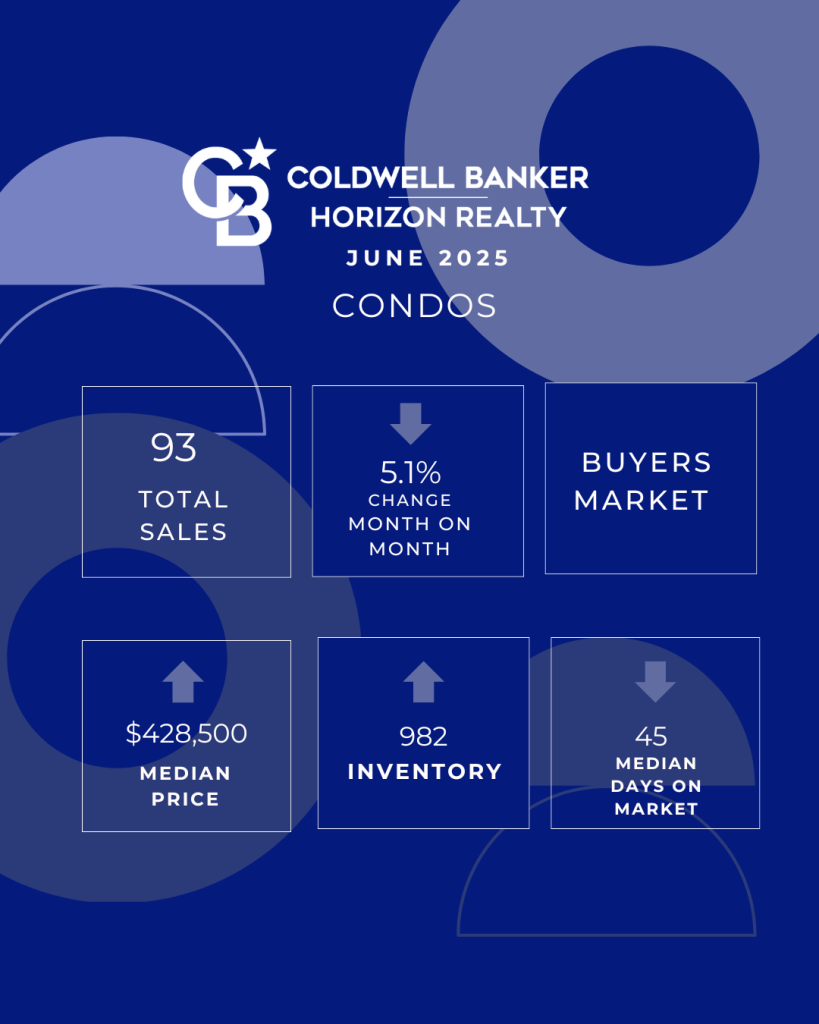

Condos June 2025

Condo Sales:

- June 2025: 93 Condos Sold

- Month-over-Month: Down 5.1% from 98 in May 2025.

- Year-over-Year: Held steady compared to 98 in June 2024.

Median Price:

- June 2025: $428,500.

- Month-over-Month: Down 3.6% from $461,000 in May 2025.

- Year-over-Year: Down 3.1% from $442,000 in June 2024.

Inventory:

- June 2025: 982 Listings

- Month-over-Month: Up 3.8% from 946 in May 2025.

- Year-over-Year: Up 22.8% from 800 in June 2024.

Median Days on Market:

- June 2025: 45 Days

- Month-over-Month: Down 11.7% from 51 days in May 2025.

- Year-over-Year: Down 11.7% 51 days in June 2024.

Condos Key Takeaways – June 2025

- Sales Soft, Market Activity Slowing Further

Condo sales dipped slightly from May and are down modestly from last year, indicating continued hesitancy among buyers—especially investors and first-timers grappling with affordability and policy uncertainty. - Prices Under Pressure

Both month-over-month and year-over-year median prices declined, suggesting that buyers are pushing back hard and sellers are adjusting expectations. Aggressive pricing is becoming more common to attract attention. - Inventory Continues to Climb Sharply

Listings rose again in June and are now significantly higher than last year. The surge is adding to buyer choice—and seller competition. - Days on Market Down, But May Not Reflect Real Urgency

Median time on market dropped, but this likely reflects some strategic relistings and price reductions rather than a surge in buyer urgency. Many units still sit unless sharply priced. - Firm Buyer’s Market

High inventory, declining prices, and measured buyer interest confirm this remains a buyer’s market. Sellers need to lead with value, especially in oversupplied areas like Academy Way and central urban cores.

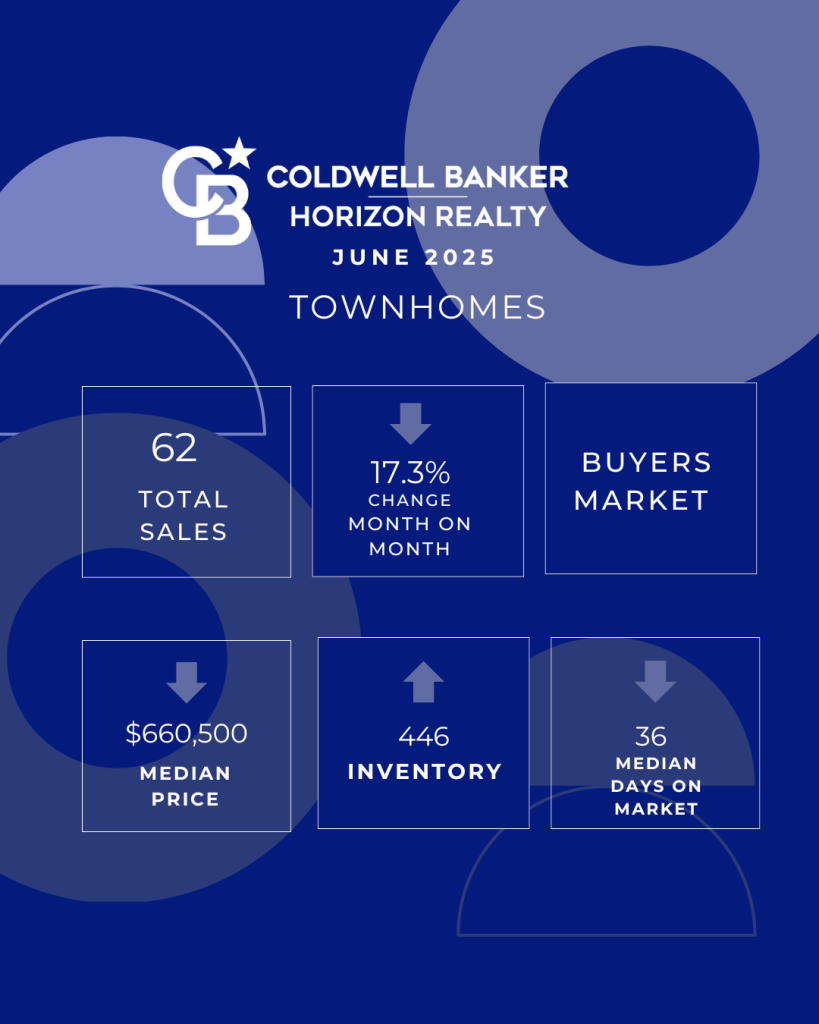

Townhomes June 2025

Townhome Sales:

- June 2025: 62 Townhomes Sold.

- Month-over-Month: Down 17.7% from 75 in May 2025.

- Year-over-Year: Up 6.9% from 58 in June 2024.

Median Price:

- June 2025: $660,500.

- Month-over-Month: Down 3.6% from $685,000 in May 2025.

- Year-over-Year: Down 7.0 % from $710,500 in June 2024.

Inventory:

- June 2025: 446 Listings.

- Month-over-Month: Up 0.6% from 443 in May 2025.

- Year-over-Year: Down 2.6% from 458 in June 2024.

Median Days on Market:

- June 2025: 36 Days

- Month-over-Month: Down 28% from 50 days in May 2025.

- Year-over-Year: Up 5.9% from 34 days in June 2024.

Townhome Takeaways:

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link