It is no surprise that it has remained a Buyer’s Market across all major segments of the Kelowna Real Estate Market!

As we moved through August 2024, the Kelowna Real Estate market continued to lean heavily towards a buyer’s market, offering opportunities for those looking to purchase a home. However, for many Sellers, it has been a challenging month as inventory levels climb and prices continue to soften across multiple property types.

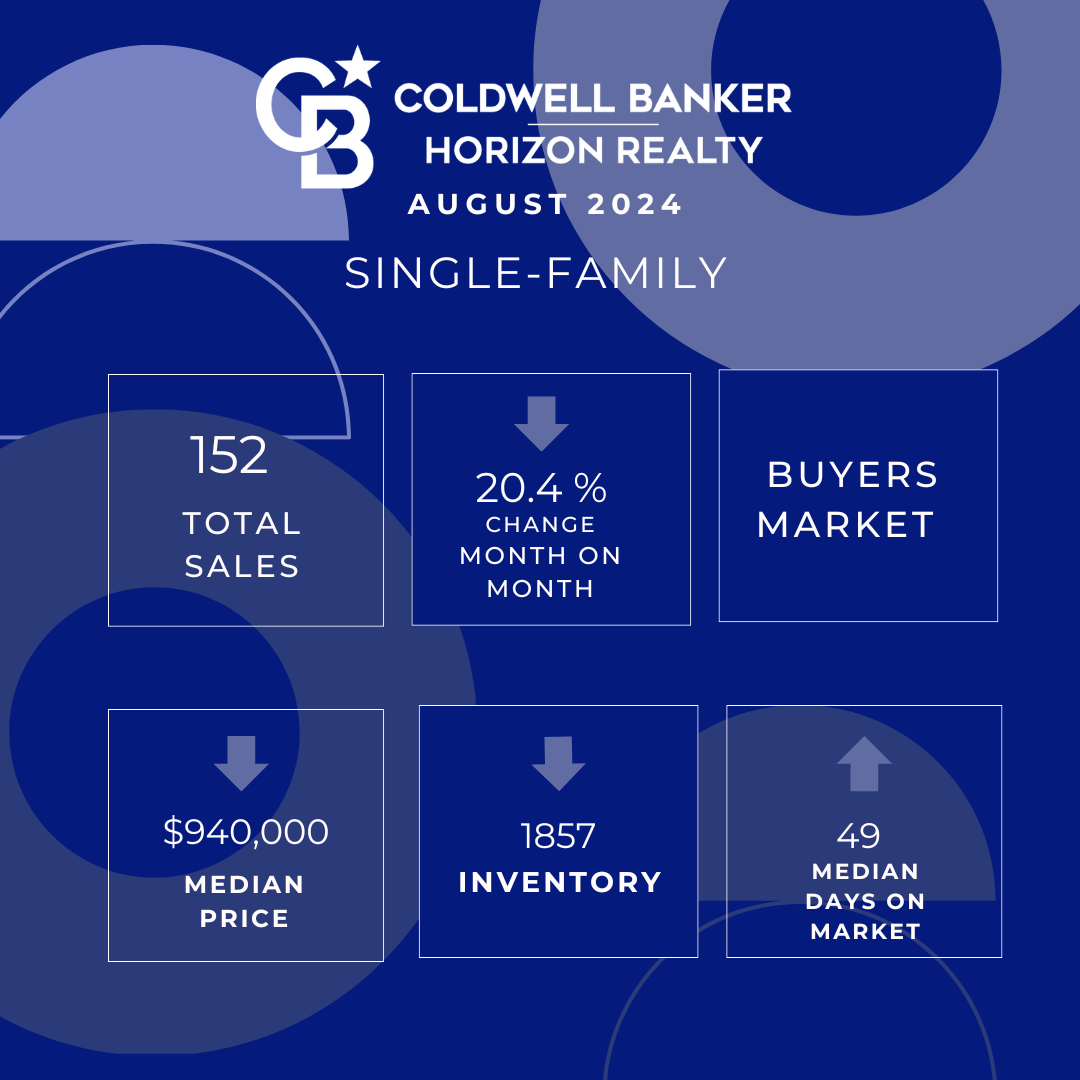

Single-Family Homes: Cooling Off

In the single-family home segment, we saw 152 total sales, a significant 20.4% drop month-over-month. The median price now sits at $940,000, marking a downward trend as buyers gain more leverage. Potentially good news is that inventory is falling, with 1,857 homes currently available, with homes staying on the market longer (an average of 49 days.)

The takeaway here is clear: it’s a buyer’s market. With more options to choose from and price adjustments occurring. Those looking to purchase a single-family home have a greater chance of securing a deal. However, sellers will need to be patient and price their homes competitively to attract serious offers.

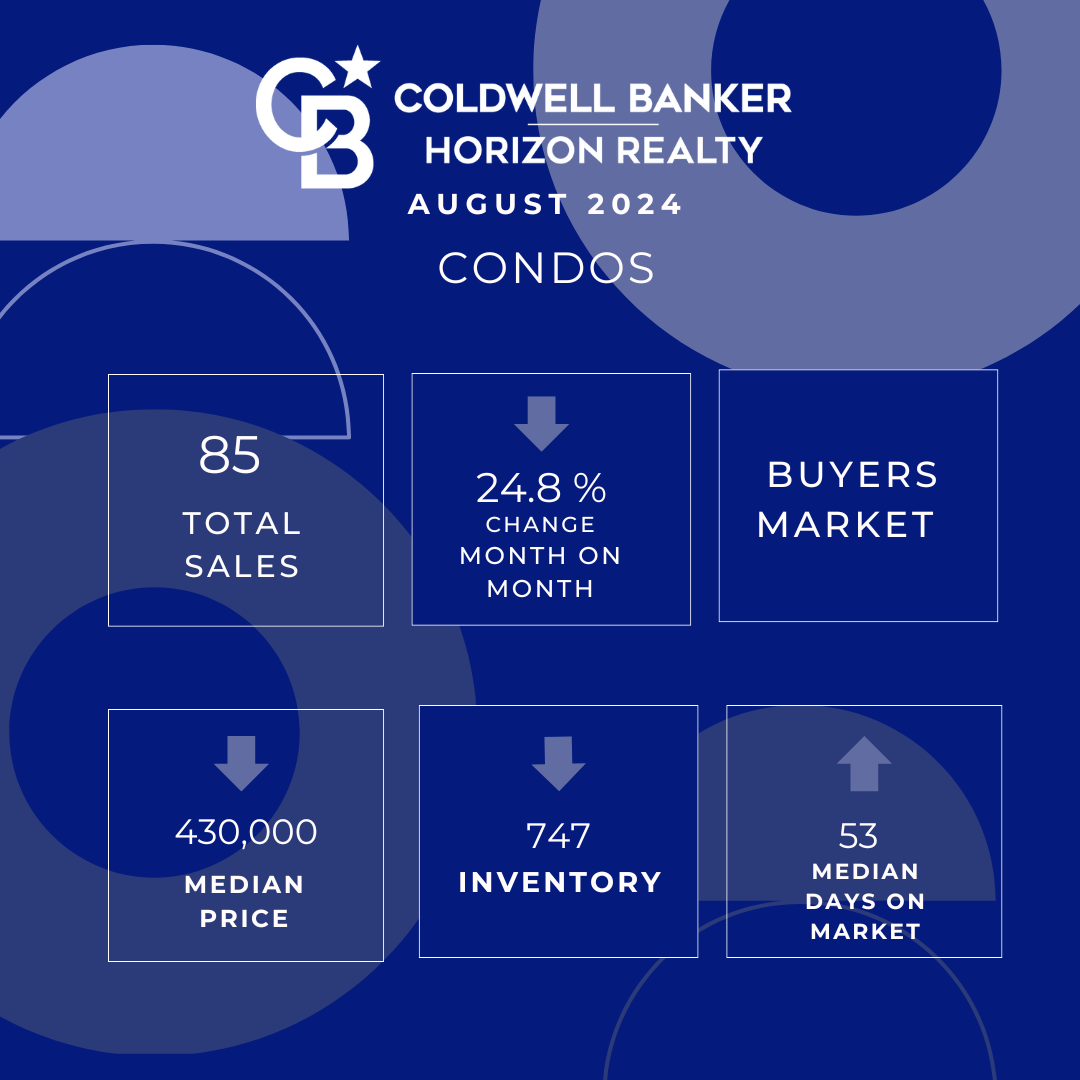

Condos: Prices Ease, Inventory Falls

The condo market is showing similar signs of softness. Total sales dropped by 24.8% month-over-month, leaving us with only 85 sales in August. The median price fell slightly to $430,000, and with 747 condos on the market, buyers have more negotiating power. The median days on market for condos has also increased to 53 days, reflecting the slower pace of sales.

This is another sector where buyers have the upper hand, with Sellers needing to adjust their expectations and strategies accordingly.

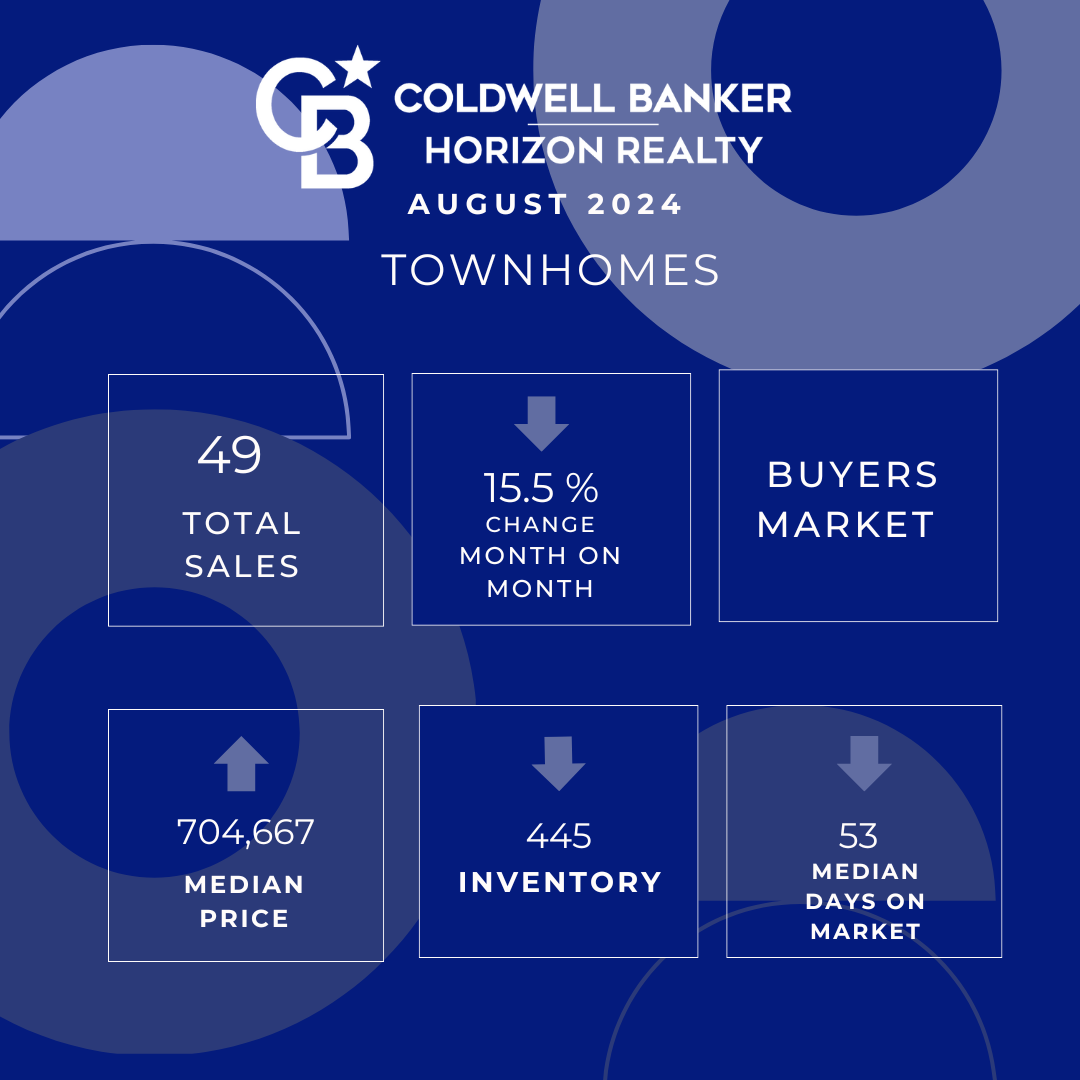

Townhomes: Moderate Decline

Townhomes fared slightly better, but the trend still leans towards a buyer’s market. Total sales dropped by 15.5%, with only 49 sales in August. The median price now sits at $704,667, while inventory has fallen to 445 townhomes. These properties are spending slightly longer on the market (an average of 35 days).

While the townhome market isn’t facing as sharp a downturn as other segments, mainly due to them being more affordable, Sellers still need to be mindful of the competitive landscape.

The Impact of the Latest Bank of Canada Rate Drop

In an effort to support the economy, the Bank of Canada recently announced a 0.25% drop in the interest rate. While this move brings a touch of optimism to the Kelowna Real Estate market, it’s unlikely to be the catalyst that pushes most buyers off the fence.

For those who have been closely watching mortgage rates, this slight decrease may provide some relief, especially for first-time homebuyers who are navigating affordability concerns. However, with housing prices still elevated and economic uncertainty lingering, many buyers will continue to wait for more significant changes before making a move.

Room for Optimism, but Caution Remains

Despite the dip in rates, it’s important for both buyers and sellers to remain realistic. This small drop isn’t enough to radically change the current market dynamics. For sellers, patience and strategic pricing will be key, while buyers can continue to explore the growing inventory and negotiate better deals.

What’s Next?

As we head into the fall, all eyes will be on the market’s response to economic conditions and potential further rate adjustments. Whether you’re buying or selling, it’s crucial to stay informed and adapt your strategy to the shifting landscape.

If you’re ready to make your next move in the Kelowna real estate market, or if you simply want to chat about your options, feel free to call me at 📞 250-864-1707 or visit my website at 🌐 www.trishcenci.com. I’m here to guide you through every step of the process, ensuring you make the best decision for your future.

Interesting Articles

BC Real Estate Association Q3 Housing Forecast 2024

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link