Welcome to my January 2025 Kelowna Real Estate Market Report!

Happy New Year!

The Kelowna Real Estate Market kicked off 2025 with some interesting dynamics. While sales and inventory have dipped seasonally, sales are significantly higher than this time last year—a clear sign of renewed activity.

Median prices tell a mixed story: up for Single-Family Homes, steady for Townhomes, and slightly down for Condos. Buyers are still in control, but signs of a potential shift are emerging. Just this week, a well-priced home I showed received three offers within 48 hours of hitting the market.

Let’s dive into the latest numbers and explore what’s ahead for 2025!

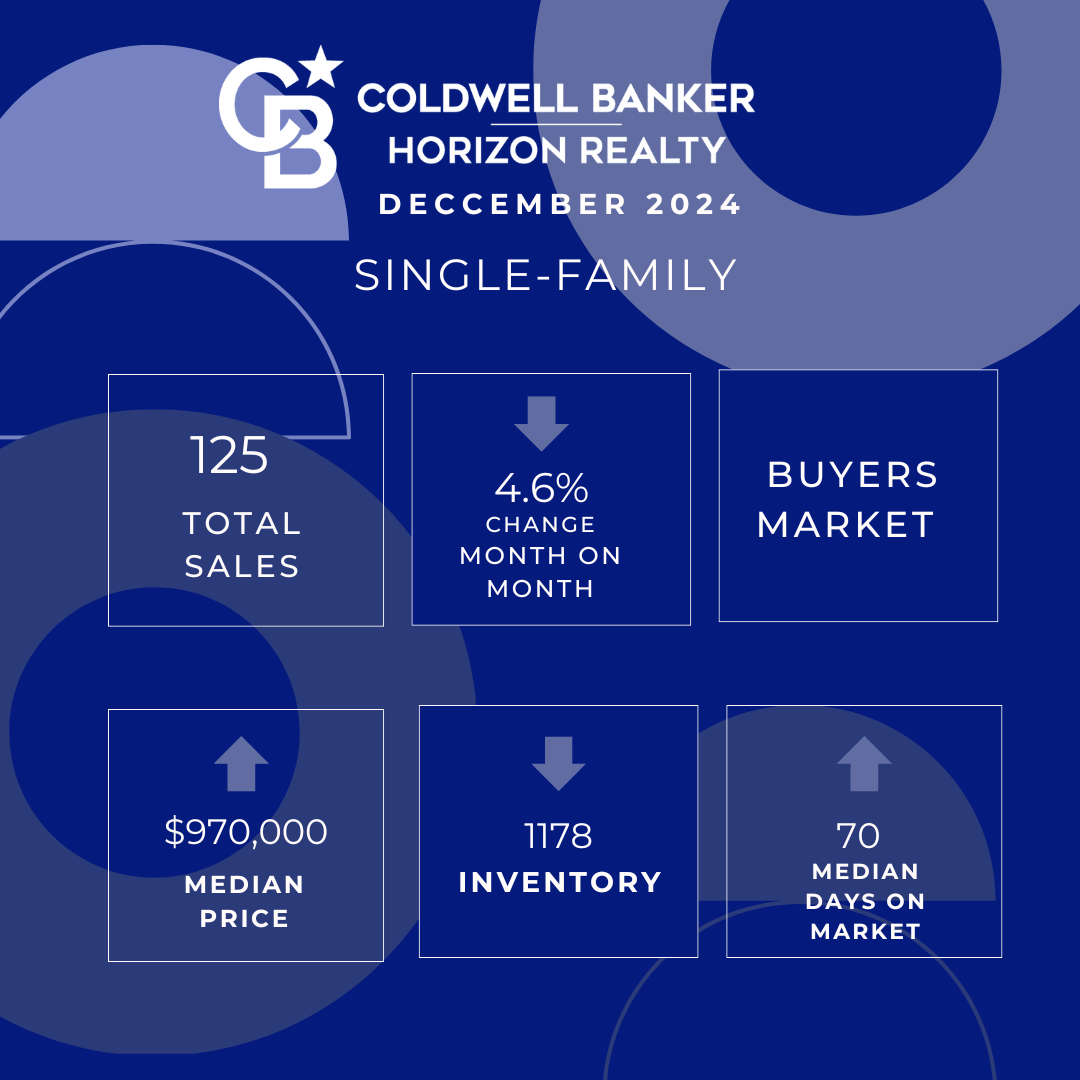

Kelowna Real Estate Market: Single-Family Homes December 2024

Home Sales

- December 2024: 125 homes sold.

- Month-over-Month: Down 4.6% from 131 in November 2024.

- Year-over-Year: Up 40.4% from 89 in December 2023.

Median Price

- December 2024: $970,000.

- Month-over-Month: Up 3.2% from $940,000 in November 2024.

- Year-over-Year: Up 2.1% from $950,000 in December 2023.

Inventory

- December 2024: 1,178 listings.

- Month-over-Month: Down 17.9% from 1,662 in November 2024.

- Year-over-Year: Up from 1023 in December 2023.

Median Days on Market

- December 2024: 70 days.

- Month-over-Month: Up 11.1 from 63 days in November 2024.

- Year-over-Year: Up 32.1% from 53 days in December 2023.

Single-Family Home Takeaways: The year-over-year increase in sales suggests recovering buyer confidence compared to December 2023, but the slight month-over-month dip reflects a typical seasonal slowdown. Furthermore, these modest price improvements indicate that demand for single-family homes remains strong despite higher mortgage rates, with limited inventory driving price stability and modest growth.

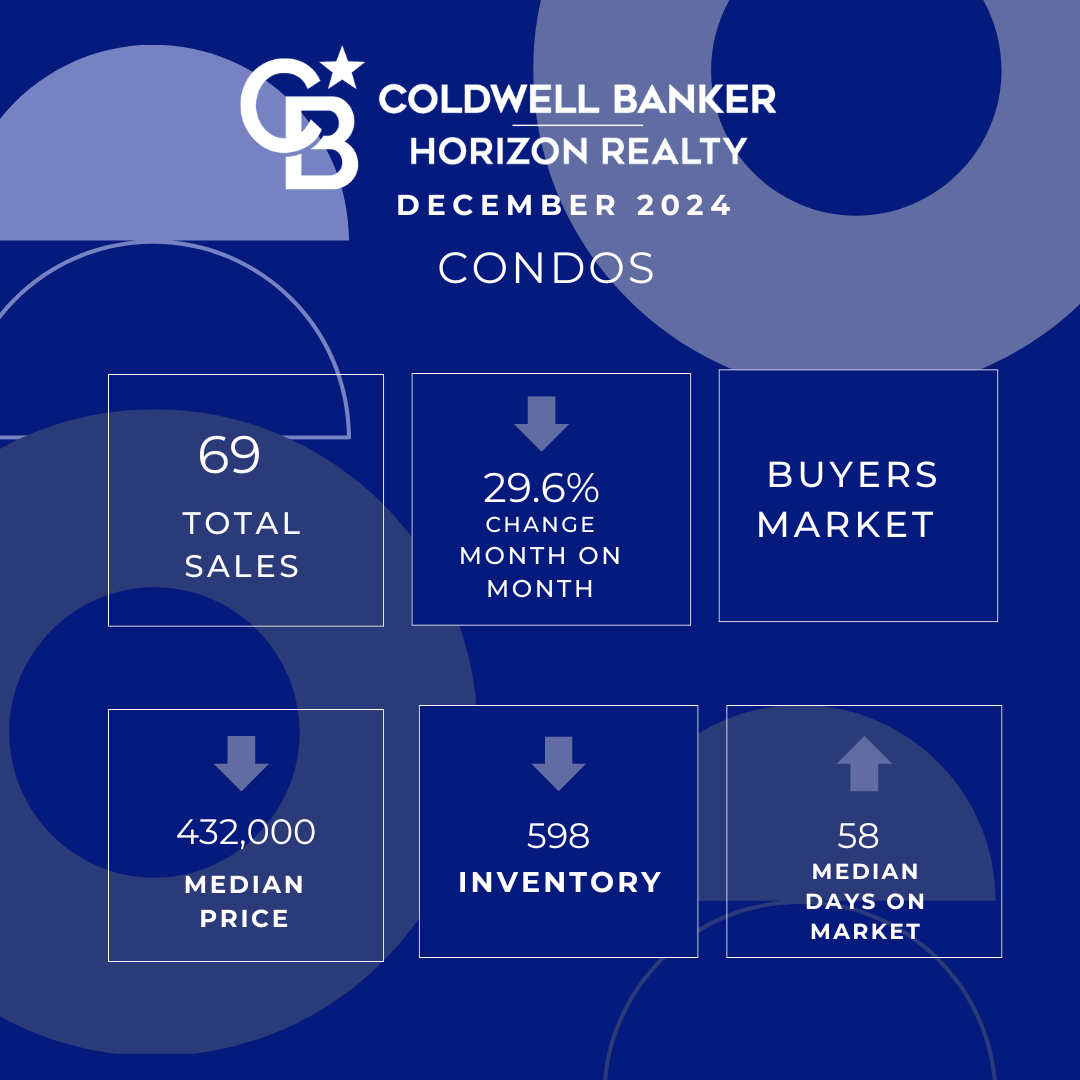

Kelowna Real Estate Market: Condos December 2024

Condo Sales:

- December 2024: 69 Condos Sold

- Month-over-Month: Down 29.6% from 98 in November 2024.

- Year-over-Year: Up 53.3% from 45 in December 2023.

Median Price:

- December 2024: $432,000.

- Month-over-Month: Down 5,6% from $457,450 in November 2024.

- Year-over-Year: Down 1.8% from $440,000 in December 2023.

Inventory:

- December 2024: 598 Listings

- Month-over-Month: Down 13.1% from 688 in November 2024.

- Year-over-Year: Up 53.3% from 498 in December 2023.

Median Days on Market:

- December 2024: 58 Days

- Month-over-Month: Up 48.7% from 39 days in November 2024.

- Year-over-Year: Up 75.8 from 33 days in December 2023.

Condo Takeaways: Condos continue to appeal to first-time buyers and investors despite cooling sales activity in December, reflecting their affordability compared to other housing types. Price corrections we continue to see in the condo market are driven by increased inventory and the impact of the short-term rental restrictions, which reduce investor demand.

Kelowna Real Estate Market: Townhomes December 2024

Townhome Sales:

- December 2024: 40 Townhomes Sold.

- Month-over-Month: Down 20% from 50 in November 2024.

- Year-over-Year: Up 37.93% from 29 in December 2023.

Median Price:

- December 2024: $645,000

- Month-over-Month: Up 0.01% from $639,950 in November 2024.

- Year-over-Year: Down 0.01% from $650,000 in December 2023.

Inventory:

- December 2024: 329 Listings.

- Month-over-Month: Down 15.6% from 390 in November 2024.

- Year-over-Year: Up 9.3% from 301 in December 2023.

Median Days on Market:

- December 2024: 55 Days

- Month-over-Month: Up 3.8% from 53 days in November 2024.

- Year-over-Year: Up 22.2% from 45 days in December 2023.

Townhome Takeaways: Similar to single-family homes, year-over-year growth reflects stronger buyer demand compared to December 2023. Prices appear to have plateaued for now, with buyers appreciating their affordability compared to single-family homes.

Factors set to influence trends and opportunities Kelowna Real Estate in the coming months

1. Expansion of BC’s Speculation and Vacancy Tax

Effective January 2025, British Columbia has expanded the Speculation and Vacancy Tax to 13 new communities, including several in the Okanagan region. Residential property owners in these areas will need to declare for the first time in January 2025.

The affected communities include:

- Vernon

- Coldstream

- Penticton

- Summerland

- Lake Country

- Peachland

- Salmon Arm

This policy aims to deter property speculation and increase housing availability for residents by taxing vacant homes, encouraging their conversion into rental properties. This will have some affect on the number of Second Home / Vacation Home Buyers in these areas.

2. Mortgage Rate Forecast and Bank of Canada Rate Trends

The mortgage market in Canada is showing signs of relief for borrowers, with a clear downward trend in rates projected throughout 2025. This is a promising development for homebuyers, particularly in Kelowna, where affordability remains a key concern.

BC Real Estate Association Mortgage Rate Forecast Table (2024-2025)

| Term | 2024 Q1 | 2024 Q2 | 2024 Q3 | 2024 Q4 | 2025 Q1F | 2025 Q2F | 2025 Q3F | 2025 Q4F |

| Variable Rate | 6.60% | 6.35% | 5.64% | 4.95% | 4.70% | 4.45% | 4.45% | 4.45% |

| Five-Year Qualifying Rate | 7.25% | 7.10% | 6.71% | 6.70% | 6.70% | 6.85% | 6.85% | 6.85% |

| Five-Year Average Discounted Rate | 5.25% | 5.10% | 4.71% | 4.70% | 4.60% | 4.60% | 4.60% | 4.60% |

Key Takeaways for Kelowna Buyers and Sellers:

- Decreasing Variable Rates: Variable mortgage rates are forecasted to continue to drop from 6.60% in Q1 2024 to 4.45% by mid-2025. This trend is expected to welcome boost to the purchasing power for homebuyers.

- Stability in Discounted Rates: The five-year average discounted rate is expected to stabilize at 4.60% by Q1 2025, providing more predictability for those considering fixed-rate options.

- Bank of Canada Stability: While the Bank of Canada is unlikely to adjust its overnight rate in the next six months, inflation stabilization and GDP growth trends will heavily influence longer-term decisions.

Positive Implications for Kelowna Real Estate:

- Increased Market Activity: Lower borrowing costs will likely encourage buyers sidelined by higher rates in 2024 to re-enter the market.

- Demand for Affordable Housing: As rates drop, properties with income suites will remain particularly attractive, enabling buyers to offset higher monthly costs through rental income.

- Improved Affordability: These rate reductions provide a better environment for first-time buyers and upgraders alike.

I am therefore cautiously optimistic about Kelowna’s Real Estate Market, with declining rates offering some much-needed momentum for a recovery towards a Balanced Market in 2025, especially for Single-Family Homes.

A word of caution-: At this stage, we do not know what the implications of the upcoming change in Government in the US will have on our Economy, (e.g. the threat of Trade Tariffs), plus there is pressure on the current Canadian Government to call an election, which could add to the uncertainty.

3. BC Real Estate Association Projections 2025

The BCREA’s Q4 2024 Housing Forecast indicates that the Central Okanagan Real Estate market is set for gradual improvement in 2025. The average sale price is expected to grow by 1.5% overall with sales up 6.7%.

BCREA Q4 Housing Forecast 2024

4. Inventory Levels and Housing Demand

High inventory levels and cautious buyer sentiment are expected to temper growth in 2025, more so for Condos. I expect affordable housing, particularly Homes with suites, will be in high demand as buyers seek additional income opportunities to offset mortgage costs. The availability of such properties may influence market dynamics, with well-priced, income-generating homes attracting significant interest.

5. Impact of Short-Term Rental Regulations on Condo Sales

Ongoing restrictions on short-term rentals continue to impact the condo market in Kelowna. Investors seeking short-term rental income may be deterred, leading to a potential decrease in demand for condominiums. Conversely, these regulations could make condos more accessible to long-term residents, potentially stabilizing prices and increasing owner-occupancy rates. I anticipate condo sales in the areas surrounding the University will rebound, as last year’s price drop (especially on Academy Way) has significantly boosted their appeal as investment opportunities.

6. Increase in Insured Mortgage Price Cap

Effective December 15, 2024, the federal government has raised the price cap for insured mortgages from $1 million to $1.5 million. Details

Implications for Kelowna’s Real Estate Market:

- Enhanced Purchasing Power: This adjustment enables buyers to purchase higher-priced homes with a lower down payment, potentially increasing demand in Kelowna’s mid to upper-market segments.

- Market Activity Boost: The increased cap may attract more buyers into the market, stimulating sales and contributing to market growth.

- Affordability Considerations: While this change offers greater flexibility, buyers should remain mindful of overall affordability and long-term financial planning.

Other Kelowna Real Estate Articles you may have missed last month

- 10 Home Upgrades to Make Your Property More Attractive to Buyers Link

- New BC Flipping Tax from January 2025 – What You Need To Know Link

- Understanding Home Buyer Costs- A Complete Guide Link

Well, that’s all for this month.

As always, if you have any questions about your specific home or buying needs, please feel free to contact me as I’m happy to help!

This month’s photo: Winter Walk by Kalamalka Lake, December 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link