Welcome to the December Kelowna Real Estate Market Report! After a strong rebound in October, November’s Single-Family Homes & Town Homes sales were more subdued, with condos standing out as the exception.

Encouragingly, all major property categories posted year-over-year gains compared to November 2023, hopefully signalling the start of some steady long-term growth.

One notable trend is the decline in inventory levels last month, suggesting some Sellers may have opted to take their properties off the market for the winter. This seasonal shift has resulted in fewer listings, particularly for single-family homes and townhomes, which could impact buyers’ options in the short term.

Let’s explore how these dynamics are shaping things!

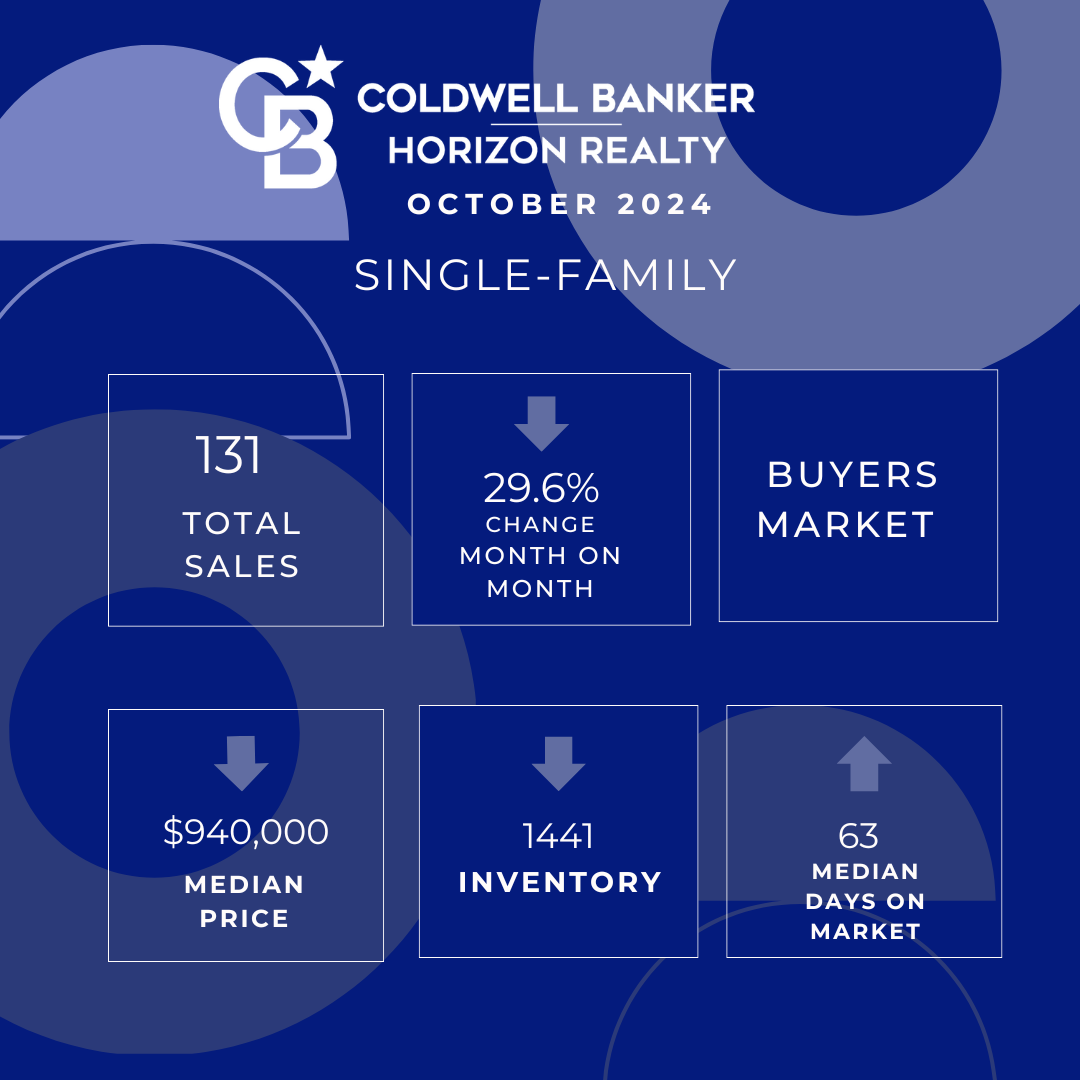

Kelowna Real Estate Market: Single-Family Homes November 2024

Sales

- November 2024: 131 homes sold.

- Month-over-Month: Down 29.6% from 186 in October 2024.

- Year-over-Year: Up 12% from 117 in November 2023.

Median Price

- November 2024: $940,000.

- Month-over-Month: Down 0.5% from $945,000 in October 2024.

- Year-over-Year: Down 1.8% from $957,500 in November 2023.

Inventory

- November 2024: 1,441 listings.

- Month-over-Month: Down 13.3% from 1,662 in October 2024.

- Year-over-Year: Up 13.6% from 1,268 in November 2023.

Median Days on Market

- November 2024: 63 days.

- Month-over-Month: Up 43.2% from 44 days in October 2024.

- Year-over-Year: Up 34% from 47 days in November 2023.

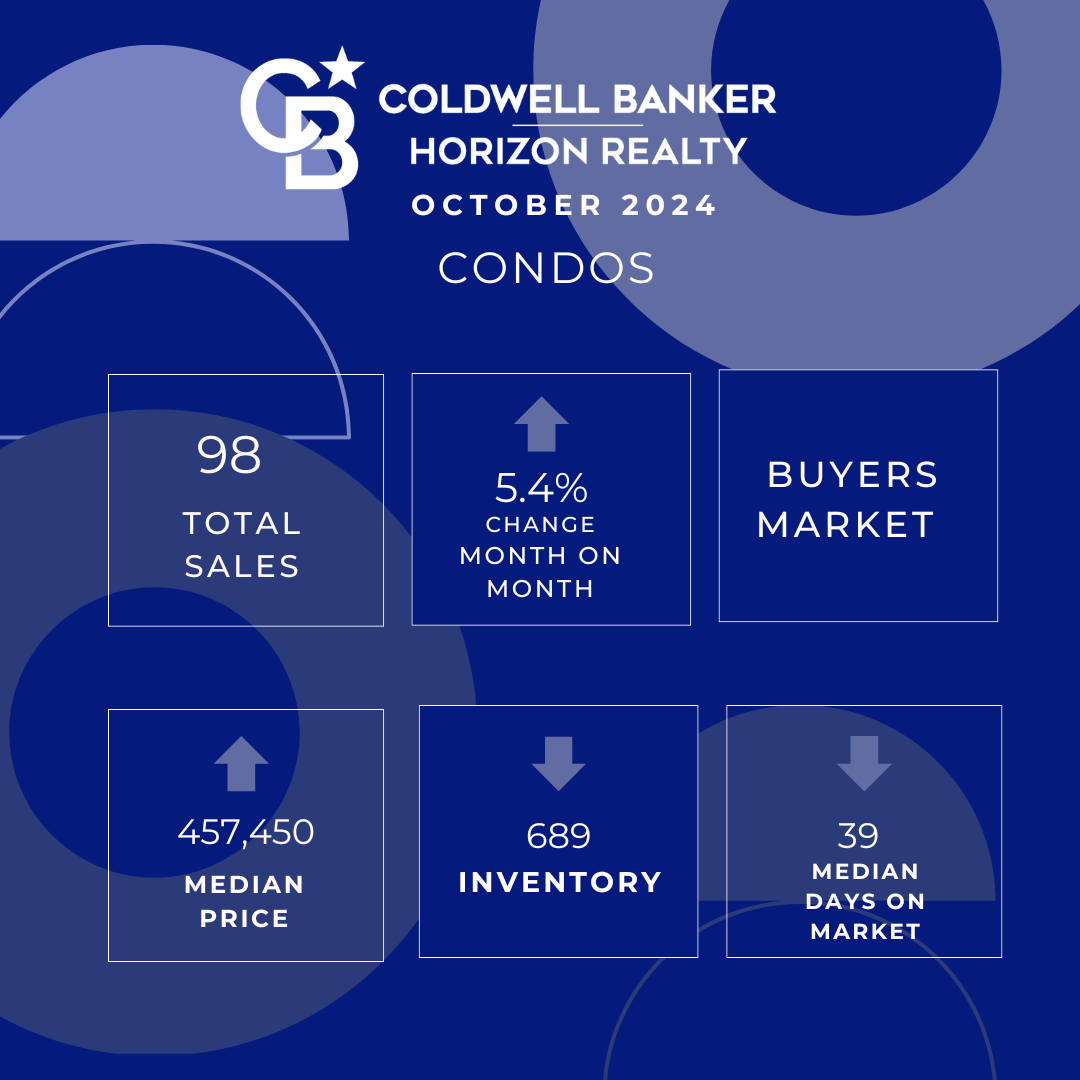

Kelowna Real Estate Market: Condos November 2024

Sales:

- November 2024: 98 Condos Sold

- Month-over-Month: Up 5.4% from 93 in October 2024.

- Year-over-Year: Up 58.1% from 62 in November 2023.

Median Price:

- November 2024: $457,450

- Month-over-Month: Up 3.4% from $442,500 in October 2024.

- Year-over-Year: Up 10% from $416,000 in November 2023.

Inventory:

- November 2024: 689 Listings

- Month-over-Month: Down 3.8% from 716 in October 2024.

- Year-over-Year: Up 17.4% from 587 in November 2023.

Median Days on Market:

- November 2024: 39 Days

- Month-over-Month: Down 26.4% from 53 days in October 2024.

- Year-over-Year: Up 8.3% from 36 days in November 2023.

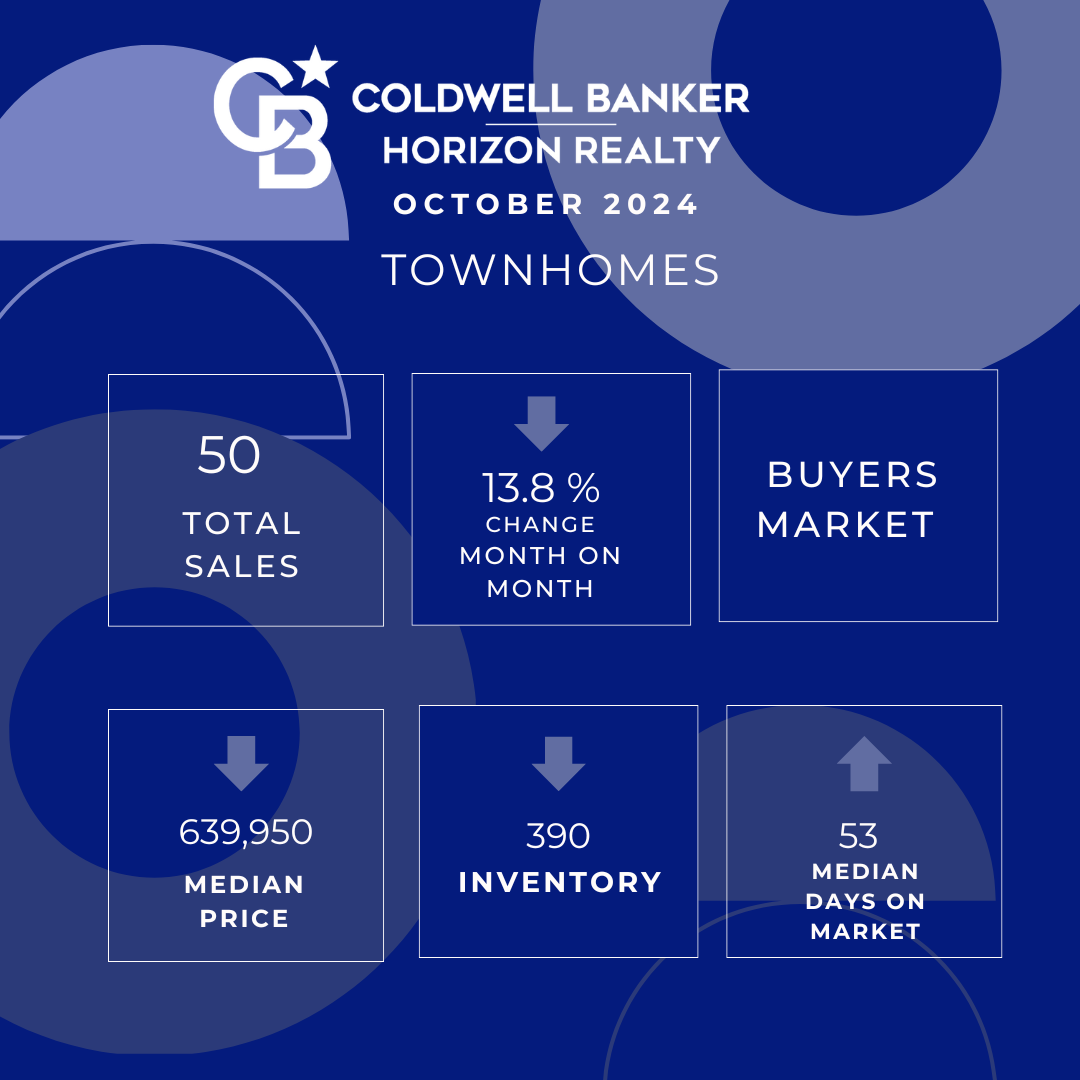

Kelowna Real Estate Market: Townhomes November 2024

Sales:

- November 2024: 50 Townhomes Sold.

- Month-over-Month: Down 13.8% from 58 in October 2024.

- Year-over-Year: Up 47.1% from 34 in November 2023.

Median Price:

- November 2024: $639,950

- Month-over-Month: Down 5.8% from $679,000 in October 2024.

- Year-over-Year: Down 3.0% from $660,000 in November 2023.

Inventory:

- November 2024: 390 Listings.

- Month-over-Month: Down 9.3% from 430 in October 2024.

- Year-over-Year: Up 16.4% from 335 in November 2023.

Median Days on Market:

- November 2024: 53 Days

- Month-over-Month: Up 1.9% from 52 days in October 2024.

- Year-over-Year: Up 20.5% from 44 days in November 2023.

Kelowna Real Estate Market: What are these numbers telling us?

1. Shifting Buyer Preferences

Affordability continues to be a challenge, forcing some Kelowna buyers to rethink their real estate goals. With rising home prices and interest rates straining budgets, the dream of owning a Single-Family home is now being replaced with more attainable options like Condos or Townhomes. This seems to be bourne out in this month’s numbers:

- Condo Sales Growth: Sales were up 5.4% month-over-month and 58.1% year-over-year, with the median price rising 10% over last year. This suggests a growing demand for more affordable options amid high interest rates and inflation.

- Townhome Popularity: Sales rose 47.1% year-over-year, indicating continued interest in properties that balance affordability with space, though the median price declined 3% as buyers likely became more price-sensitive.

2. Slowing Single-Family Home Market

- Sales for single-family homes declined 29.6% month-over-month, potentially highlighting affordability pressures. An alternative possibility is the recent fall in inventory (quite normal in Kelowna) is making finding the right home a little trickier.

- The median price drop of 1.8% year-over-year reflects continued softer demand for homes in the higher price bracket.

3. Longer Time to Sell

- Days on Market have increased for single-family homes (63 days, up 43.2% from last month) and townhomes (53 days, up 20.5% year-over-year), showing that properties are taking longer to sell in these segments.

- Condos, however, bucked the trend with a 26.4% month-over-month reduction in days on market, highlighting stronger interest in this segment.

4. Lower Inventory Levels

- Inventory down month-on-month for all segments:

- Condos: -3.8%.

- Townhomes: -9.3%.

- Single-Family Homes: -13.3%.

This suggests some Sellers are holding out for the spring market or that buyers are hesitant to commit in the current climate.

Overall Market Trends

- The condo market appears to be the most resilient, driven by affordability and quicker turnover.

- The townhome segment reflects steady interest but increasing price sensitivity.

- Single-family homes are facing more significant challenges, with affordability concerns and a slower pace of sales likely to continue in the short term.

Why December 2024 Matters for Kelowna Real Estate

1. Bank of Canada Rate Announcement: The next interest rate decision on December 11th, 2024 could impact borrowing costs, shaping buyer affordability and seller strategies heading into 2025.

Announcement dates and future dates: here

2. New Mortgage Rules: Guaranteed mortgages commencing December 15, 2024, will make it easier for buyers to qualify, especially first-time buyers facing affordability challenges.

– Increasing the $1 million price cap for insured mortgages to $1.5 million

– Expanding eligibility for 30-year mortgage amortizations to all first-time homebuyers and to all buyers of new builds.

More Details: here

3. Market Sentiment Shift: These changes may encourage hesitant buyers to act before the spring surge, potentially stabilizing winter market activity. There was a short burst of Market activity after the last Rate cut.

4. Impact on Sellers: Sellers should prepare for renewed buyer interest, especially in condos and townhomes, as affordability measures take hold. The Buyers that are out there right now appear to be seriously looking.

Is Kelowna’s Real Estate recovery likely to take longer than the Lower Mainland or Vancouver Island?

Yes, our market will likely take longer to recover and here are some of the key factors:

- Higher Interest Rates: Kelowna’s Real Estate Market has been more sensitive to interest rate hikes, leading to a significant slowdown in sales activity. According to a 2024 Rennie Real Estate Report Kelowna’s per capita (i.e. average per person.) sales over the last decade have always been higher than Vancouver and Victoria. In 2023, there were 15.2 sales per 1,000 residents (roughly 15% more than Vancouver and Victoria) and, based on activity through the first half of 2024, the Central Okanagan has been on pace for 13.5 sales per 1,000 residents this year, roughly in line with Vancouver and Victoria. Rising interest rate rises and changes to Provincial legislation E.G Short Term Rental Regulations (that hit in Spring 2o24) have had an extra effect here.

Other Sources: Mortgage Sandbox – 5 Forces Driving BC Real Estate

- Government Policies Impacting Investors: Some recent Federal & Provincial Government regulations have targeted investors and recreational buyers. This has disproportionately affected Kelowna. These policies have led to a decline in demand from secondary buyers, such as those seeking vacation homes or short-term rentals, which are more prevalent in Kelowna, than some other areas of the Province.

- Affordability Challenges & Lower Buyer Confidence: Despite recent interest rate cuts, many potential buyers in Kelowna remain priced out of the market due to high home prices and limited purchasing power. These challenges are further intensified by lower buyer confidence in the Central Okanagan compared to other regions in the province. Factors like weaker tourism numbers this summer and some of the slowest economic growth in British Columbia have combined to dampen market sentiment. This is likely to make the Kelowna Real Estate Market recovery slower than other areas.

- Supply and Demand Imbalance: While Kelowna has seen an increase in inventory, the demand from both local and secondary buyers has not matched this growth. This imbalance will also contribute to a slower market recovery.

Well, that’s all for this month.

As always, if you have any questions about your specific home or buying needs, please feel free to contact me as I’m happy to help!

This month’s photo: Sunset by Kelowna Yacht Club November 2024.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link