The snow arrived a little earlier than normal, and this may have contributed to the reduction in Kelowna Real Estate sales numbers month.

There seem to be a lot of mixed signals at the moment for Buyers and Sellers, so I am sensing some hesitancy to enter the market from both sides.

Sellers traditionally look upon winter as not being the best time to sell, and we have seen inventory fall this month.

On the other side, Buyers have concerns about the threat of recession, rising interest rates and the volatile stock market.

Therefore it is reasonable to believe that the bulk of current Real Estate Buyers and Sellers are those needing to buy and sell, for a variety of reasons.

In its commentary on the Luxury Real Estate Market, the Institute of Luxury Homes stated-: ” Until Seller’s price expectations start to align with Buyer’s perceptions of value we will continue to see this contraction in the Market.” This seems to apply to the market as a whole right now.

Kelowna Real Estate Market Sales – November 2022

As expected Sales were down again in November 2022.

Overall sales were down 17.4% last month compared to October & 54.8% on this time last year.

Single Family sales were down 11% last month & down 55.82% on last year.

Strata Sales down 23% from the previous month and down 53.7% on this time last year.

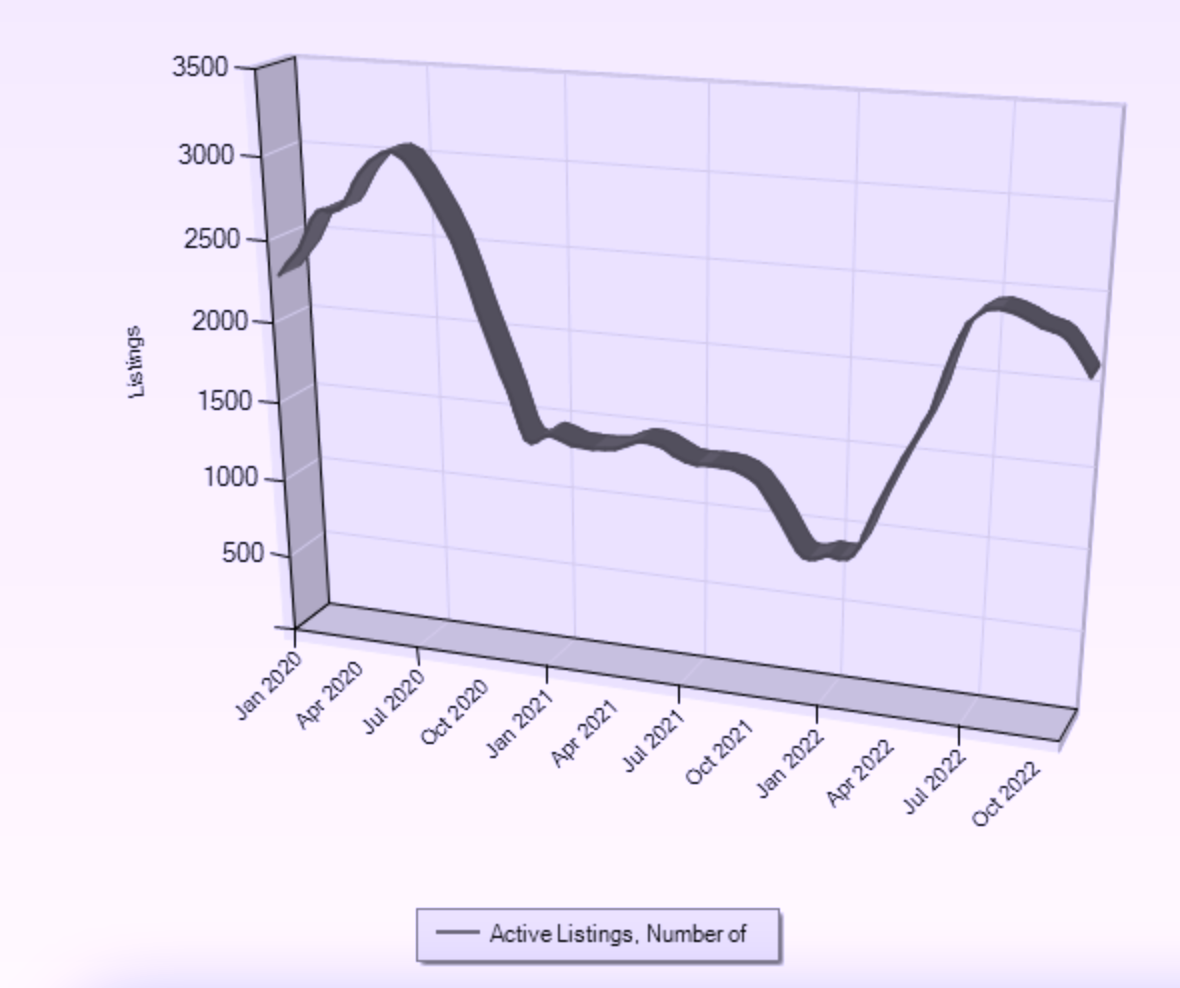

Kelowna Real Estate Inventory Levels November 2022

Single Family -: Fallen 13.9% since last month and up 134% since last year

Condos -: Fallen 3.8% since last month and 103.6% since last year.

Townhomes -: Fallen 8.1% since last month and 174.7%.

| November 2022 | October 2022 | November 2021 | |

| Total | 2118 | 2318 | 1103 |

| Single-Family | 901 | 1047 | 385 |

| Condos | 446 | 464 | 219 |

| Townhomes | 294 | 320 | 107 |

Kelowna Real Estate Median Prices November 2022

| November 2022 | October 2022 | November 2021 | |

| Single-Family | 909,000 | 922,500 | 949,900 |

| Condos | 407,500 | 470,000 | 450,050 |

| Townhomes | 744,250 | 666,150 | 653,900 |

Median Sales Prices

Single Family – Prices were down 1.5% from October, down 4.3% from November 2021 & down 21% from the Peak in March 2022 ($1,150,500)

Condos – Prices were down 13.3% from October, 9.5% from November 2021 and down 21.6% from the March 2022 peak of $520,000.

Townhomes – Prices bucked the trend and were up 11.7% from October 2022, up 13.8% from November 2021 and down 5.3% from the March 2022 peak of $786,000.

It will be interesting to watch these prices, to see if affordability issues continue to affect Buyers power to purchase single-family homes and if they switch to Townhomes, creating increased demand and potential upward pricing pressure.

Kelowna Real Estate Market – My Thoughts this month.

Looking at the Teranet Pricing Graph for Kelowna this month it looks like the price decreases are slowing, and RBC Bank shares this view – see link below.

The main factors that are likely to affect the Kelowna Real Estate Market.

- Interest Rates – Canadian inflation is now slowing, so hopefully, this will mean the Bank of Canada will not continue with interest rate hikes, but we should expect 1 or 2 more rate ‘tweaks’ in the coming months.

- Affordability – Working Households, in particular, will have many factors affecting their spending powers over the next few months – rising Food & Gas Prices, Utility Bills, the costs of Christmas and increasing interest rates. This will leave less funds available for moving house, so I expect the more affordable sector of the market to either have more downward price pressure, or Buyers will adjust their expectations and consider Buying a Townhome or Condo, rather than a Single-Family Home.

- Seasonality – Winter is traditionally a quieter time in the Kelowna Real Estate Market, so expect fewer listings and sales in the next 3 months.

- Inventory – inventory levels have started to fall again, & still remain relatively low. So providing numbers don’t rise rapidly this should not be an additional cause of downward pricing pressure.

- Rental Rates – yet again we have seen rental rates rising in Kelowna last month with Zumper Reporting a 1 Bedroom Condo rent as $1,960 p.m. This may again provide more attractive returns for investors, but a word of caution, the City has approved a significant number of new Rental Developments recently, so the current rental crisis may start to ease in the next couple of years.

- BC Housing Supply Act Spring 2023 – The new BC Premier, David Eby, announced plans earlier this month to ease BC’ Housing Crisis – working with local Municipalities and some Age Restriction & Rental Restriction changes coming to the Strata Property Act – see link below.

Also, new on the Real Estate radar – Stratas that want to restrict short-term rentals, will still be encouraged to do so to ensure long-term rental options are available in BC. But the Province is working with municipalities to bring in further short-term rental restrictions in future legislation and we don’t know what that looks like yet.

ACCESS TO ADDITIONAL ECONOMIC REPORTS & INFORMATION

RBC Monthly Housing Update November 2022 – RBC Real Estate Market Update November 2022

Teranet National Bank House Price Index October 2022 Teranet Real Estate Report November 2022 HPI Index

Zumper Rental Report November 2022 Zumper Rental Report Nov 2022

BC Housing Supply Act coming Spring 2023 – BC Housing Supply Act more info

Morning Star Comment on Canadian House Prices December 1, 2022 – Canadian Housing Adjustment

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link