Revised Edition October 3, 2024*

As October begins and the weather cools, the Kelowna Real Estate Market seems to be following a similar trend—i.e. cooler activity and lower sales numbers for September 2024.

In speaking to potential buyers at Open Houses this month, many have shared that they are keen to buy but still need to sell their current homes before moving.

It’s beginning to feel like the Kelowna Real Estate market is at an impasse. Buyers are waiting for prices to fall further, while many Sellers are unwilling to make additional price reductions. This standoff is creating a gridlock, with neither side ready to budge, leaving the market largely ‘on pause’.

Single-Family Homes: Sales Continuing to Cool & Prices Up.

In September 2024, the Kelowna single-family home market experienced a significant reduction in Sales, dropping to 122 from 163 in August, a 25.2% decline, and continuing to be a Buyer’s Market. However, the median sale price rose to $957,750, up from $940,000 last month and $900,000 in September 2023, indicating continued price appreciation.

Inventory saw a substantial year-over-year increase, up 33.2% from 1,414 homes in September 2023 to 1,883 this year. Homes are selling faster, with a median of 42 days on the market, compared to 49 last month and 44 last year.

Condos: Sales Up & Prices Improve.

In September 2024, the Kelowna Condo market continued to favour buyers, although sales were up by 6.5% to 82 units, down from 77 in August 2024. The median sale price increased to $458,000, up from $430,000 last month, but slightly down from $464,000 in September 2023.

Inventory rose significantly, up 28.1% from 544 condos in September 2023 to 697 this September. Condos are selling quicker, with the median days on the market at 38, a noticeable improvement from 53 days last month and 49 days in September 2023.

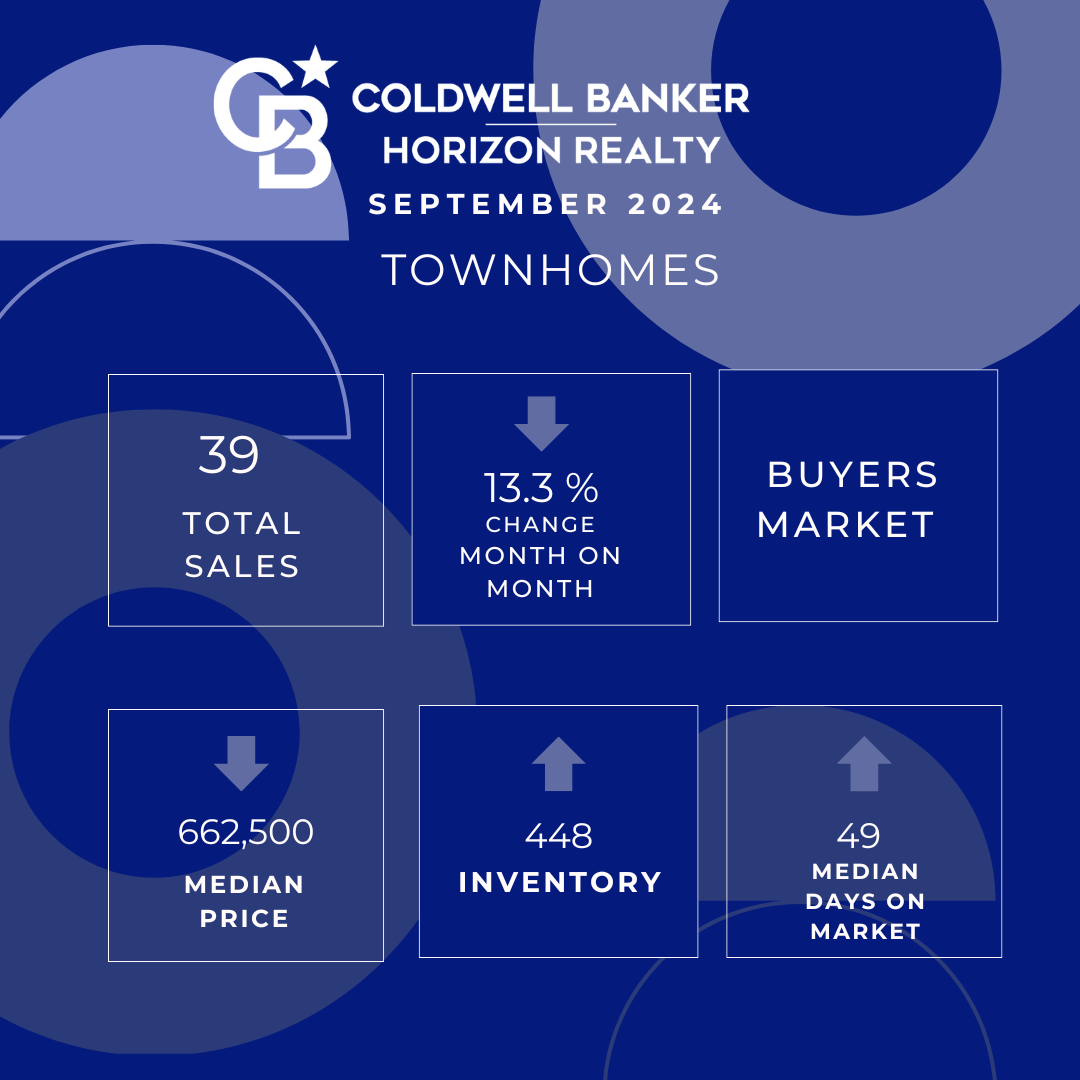

Townhomes: Lower Sales & Taking Longer to Sell.

In September 2024, the Kelowna Townhome market experienced a drop in sales, with 39 units sold compared to 45 in August, a 13.3% decline, keeping it in a buyers’ market. The median sale price decreased to $662,500, down from $704,667 last month, though still higher than the $650,000 seen in September 2023.

Inventory increased by 28.7% year-over-year, rising from 348 in September 2023 to 448 this year. Townhomes are taking longer to sell, with the median days on the market rising to 49, compared to 35 last month and 45 days in September 2023.

Factors Affecting the Kelowna Real Estate Market in September 2024

1. High Interest Rates: Higher Bank of Canada interest rates continue to keep potential buyers and investors on the sidelines. More rate cuts are in the forecast which will hopefully give Buyers the hope of improved affordability.

2. Short-Term Rental Regulations: BC’s stricter regulations on short-term rentals were designed to ease housing shortages by reducing the number of homes converted into vacation rentals. However, in Kelowna, this has had the effect of discouraging real estate investors who relied on rental income, contributing to lower investment in the market. I also read this very interesting article by the Rennie Group recently that detailed the effects these regulations have had on our Recreational Real Estate Sales.

3. Speculation and Vacancy Tax: This was implemented to combat empty homes and housing speculation, this tax was intended to increase housing availability by penalizing vacant homes. However, in Kelowna, it has led some property owners to sell their vacation properties or keep them vacant due to the financial penalties. The result is added to our market oversupply, which, coupled with high interest rates, is leading to some price stagnation and our current buyer’s market.

3. Weaker Tourism this year: Kelowna’s tourism sector, typically a major driver of the local real estate market, has underperformed this summer. Reduced tourist numbers have weakened demand from seasonal buyers and those drawn to the area after visiting.

4. High Inventory Levels: The market is currently at a 10-year peak with listings. This surplus of properties, combined with lower sales, has put more power in the hands of buyers.

5. Limited Investor Leverage: Investors are finding it difficult to achieve good returns. For example, high interest rates are making their costs higher, and tightening of Short Term Rental legislation has affected rental income, especially certain types of Condos.

6. The long-term effects of COVID-19: Kelowna experienced a spike in sales activity, during the Covid outbreak, as Buyers adopted an ‘if not now, when’ strategy to move to the area. Many Buyers brought forward their planned move to Kelowna and the Central Okanagan and we are seeing the knock-on effect of this now.

Other Real Estate Links

BC Real Estate Association September 2024 Report.

Central 1 Credit Union– Mild signs of traction in Canadian Housing Market September 2024 Report

Trish’s Real Estate Listings

This Months Photo – View of Lake Okanagan from Naramata Bench, Penticton.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link